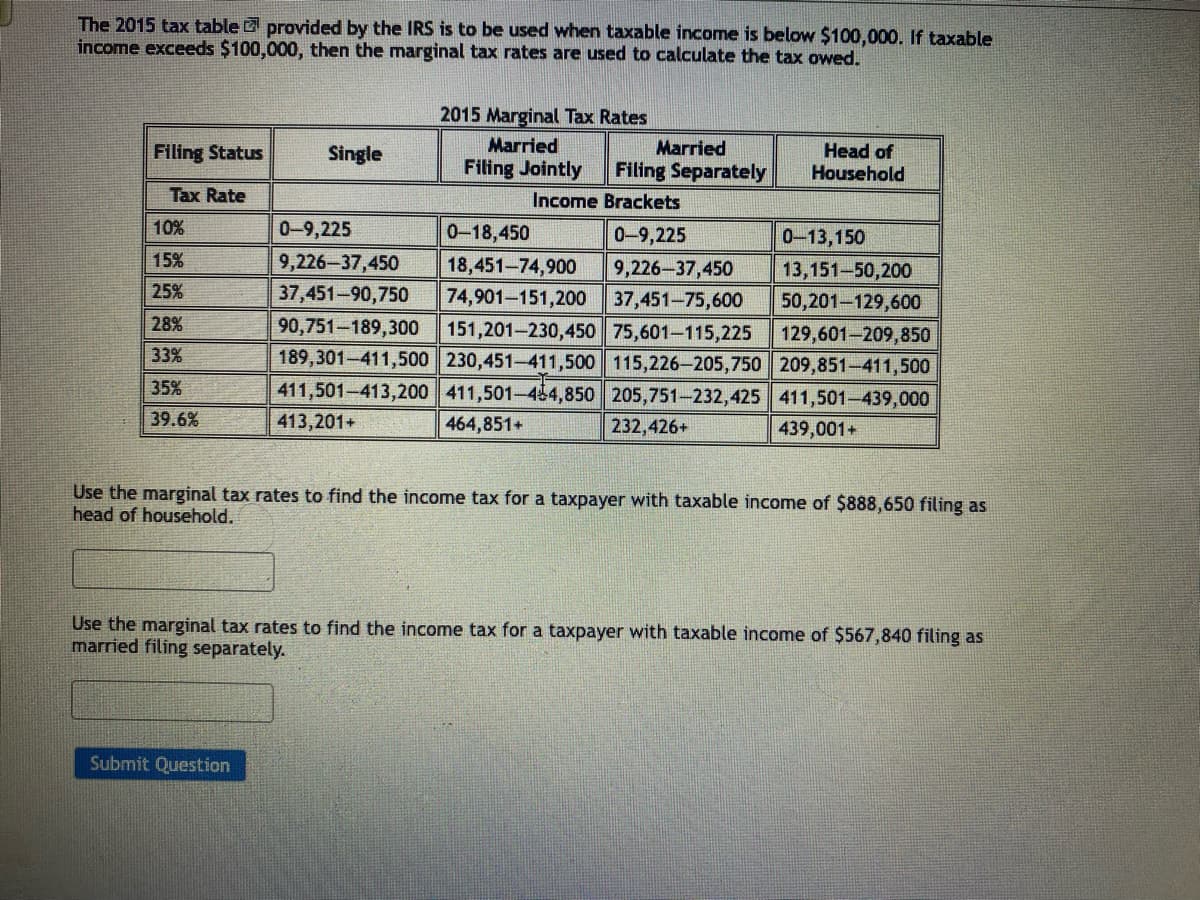

The 2015 tax table provided by the IRS is to be used when taxable income is below $100,000. If taxable income exceeds $100,000, then the marginal tax rates are used to calculate the tax owed. Filing Status Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Single 2015 Marginal Tax Rates Married Married Filing Jointly Filing Separately Income Brackets 0-9,225 Head of Household 0-9,225 0-18,450 0-13,150 9,226-37,450 18,451-74,900 9,226-37,450 13,151-50,200 37,451-90,750 74,901-151,200 37,451-75,600 50,201-129,600 129,601-209,850 90,751-189,300 151,201-230,450 75,601-115,225 189,301-411,500 230,451-411,500 115,226-205,750 209,851-411,500 411,501-413,200 411,501-44,850 205,751-232,425 411,501-439,000 413,201+ 464,851+ 439,001+ 232,426+ Use the marginal tax rates to find the income tax for a taxpayer with taxable income of $888,650 filing as head of household. Use the marginal tax rates to find the income tax for a taxpayer with taxable income of $567,840 filing as married filing separately.

The 2015 tax table provided by the IRS is to be used when taxable income is below $100,000. If taxable income exceeds $100,000, then the marginal tax rates are used to calculate the tax owed. Filing Status Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Single 2015 Marginal Tax Rates Married Married Filing Jointly Filing Separately Income Brackets 0-9,225 Head of Household 0-9,225 0-18,450 0-13,150 9,226-37,450 18,451-74,900 9,226-37,450 13,151-50,200 37,451-90,750 74,901-151,200 37,451-75,600 50,201-129,600 129,601-209,850 90,751-189,300 151,201-230,450 75,601-115,225 189,301-411,500 230,451-411,500 115,226-205,750 209,851-411,500 411,501-413,200 411,501-44,850 205,751-232,425 411,501-439,000 413,201+ 464,851+ 439,001+ 232,426+ Use the marginal tax rates to find the income tax for a taxpayer with taxable income of $888,650 filing as head of household. Use the marginal tax rates to find the income tax for a taxpayer with taxable income of $567,840 filing as married filing separately.

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 43P

Related questions

Question

??

Transcribed Image Text:The 2015 tax table provided by the IRS is to be used when taxable income is below $100,000. If taxable

income exceeds $100,000, then the marginal tax rates are used to calculate the tax owed.

Filing Status

Tax Rate

10%

15%

25%

28%

33%

35%

39.6%

Single

Submit Question

2015 Marginal Tax Rates

Married

413,201+

Married

Filing Jointly Filing Separately

Income Brackets

0-9,225

0-9,225

0-18,450

9,226-37,450

18,451-74,900 9,226-37,450

37,451-90,750 74,901-151,200 37,451-75,600

90,751-189,300 151,201-230,450 75,601-115,225

189,301-411,500 230,451-411,500 115,226-205,750

411,501-413,200 411,501-44,850 205,751-232,425

464,851+

232,426+

Head of

Household

0-13,150

13,151-50,200

50,201-129,600

129,601-209,850

209,851-411,500

411,501-439,000

439,001+

Use the marginal tax rates to find the income tax for a taxpayer with taxable income of $888,650 filing as

head of household.

Use the marginal tax rates to find the income tax for a taxpayer with taxable income of $567,840 filing as

married filing separately.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT