Allocate overhead using a single plantwide rate, multiple department rates, and activity-based costing Downhill Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows: Indirect labor Cutting Department Finishing Department Total The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Activity Production control Materials handling Total Snowboards Skis Budgeted Activity Cost Total The activity-base usage quantities and units produced for the two products follow: $90,000 270,000 $360,000 Number of Production Runs 450 50 $360,000 250,000 560,000 $1,170,000 500 Activity Base Number of production runs Number of moves Number of Moves 5,000 2,500 7,500 Direct Labor Hours- Cutting 2,000 3,000 5,000 Direct Labor Hours- Finishing 4,000 3,000 7,000 Units Produced 5,000 5,000 10,000

Allocate overhead using a single plantwide rate, multiple department rates, and activity-based costing Downhill Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows: Indirect labor Cutting Department Finishing Department Total The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Activity Production control Materials handling Total Snowboards Skis Budgeted Activity Cost Total The activity-base usage quantities and units produced for the two products follow: $90,000 270,000 $360,000 Number of Production Runs 450 50 $360,000 250,000 560,000 $1,170,000 500 Activity Base Number of production runs Number of moves Number of Moves 5,000 2,500 7,500 Direct Labor Hours- Cutting 2,000 3,000 5,000 Direct Labor Hours- Finishing 4,000 3,000 7,000 Units Produced 5,000 5,000 10,000

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 3PA: Activity-based and department rate product costing and product cost distortions Black and Blue...

Related questions

Question

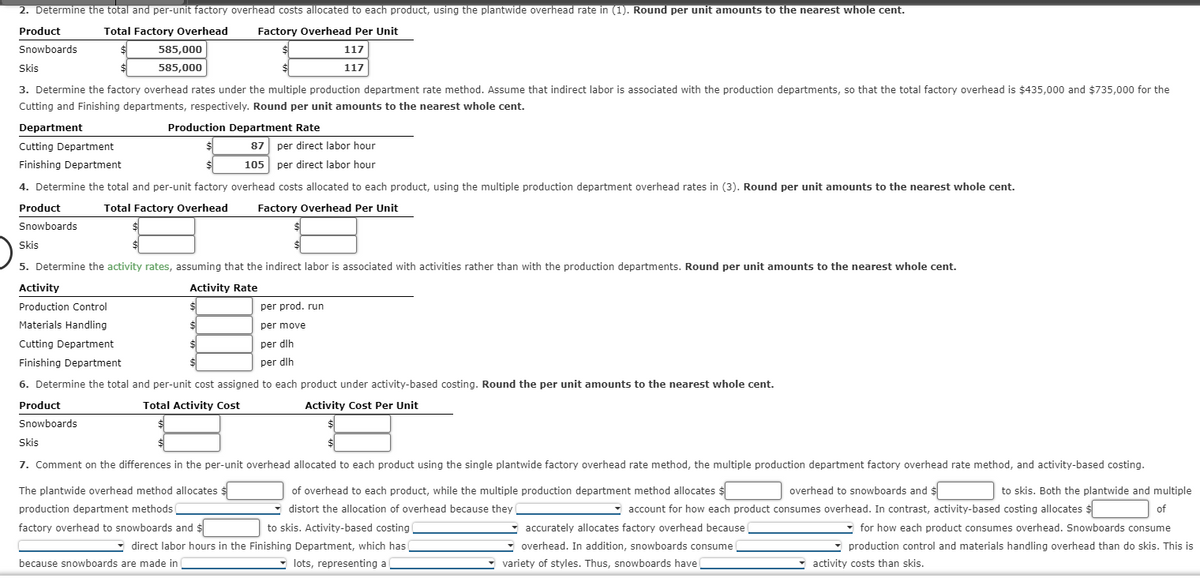

Transcribed Image Text:2. Determine the total and per-unit factory overhead costs allocated to each product, using the plantwide overhead rate in (1). Round per unit amounts to the nearest whole cent.

Product

Snowboards

Total Factory Overhead Factory Overhead Per Unit

585,000

585,000

Skis

$

3. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is $435,000 and $735,000 for the

Cutting and Finishing departments, respectively. Round per unit amounts to the nearest whole cent.

Department

Cutting Department

87 per direct labor hour

105 per direct labor hour

Finishing Department

4. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (3). Round per unit amounts to the nearest whole cent.

Product

Total Factory Overhead Factory Overhead Per Unit

Snowboards

Activity

Production Control

Materials Handling

Cutting Department

Finishing Department

Production Department Rate

Skis

5. Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. Round per unit amounts to the nearest whole cent.

Activity Rate

Product

Snowboards

$

$

$

117

117

6. Determine the total and per-unit cost assigned to each product under activity-based costing. Round the per unit amounts to the nearest whole cent.

Total Activity Cost

Activity Cost Per Unit

per prod. run

per move

per dlh

per dlh

factory overhead to snowboards and $

because snowboards are made in

Skis

7. Comment on the differences in the per-unit overhead allocated to each product using the single plantwide factory overhead rate method, the multiple production department factory overhead rate method, and activity-based costing.

The plantwide overhead method allocates $

of overhead to each product, while the multiple production department method allocates $

distort the allocation of overhead because they

overhead to snowboards and $

production department methods

to skis. Activity-based costing

direct labor hours in the Finishing Department, which has (

lots, representing a

to skis. Both the plantwide and multiple

account for how each product consumes overhead. In contrast, activity-based costing allocates $

of

for how each product consumes overhead. Snowboards consume

production control and materials handling overhead than do skis. This is

activity costs than skis.

accurately allocates factory overhead because

overhead. In addition, snowboards consume

variety of styles. Thus, snowboards have

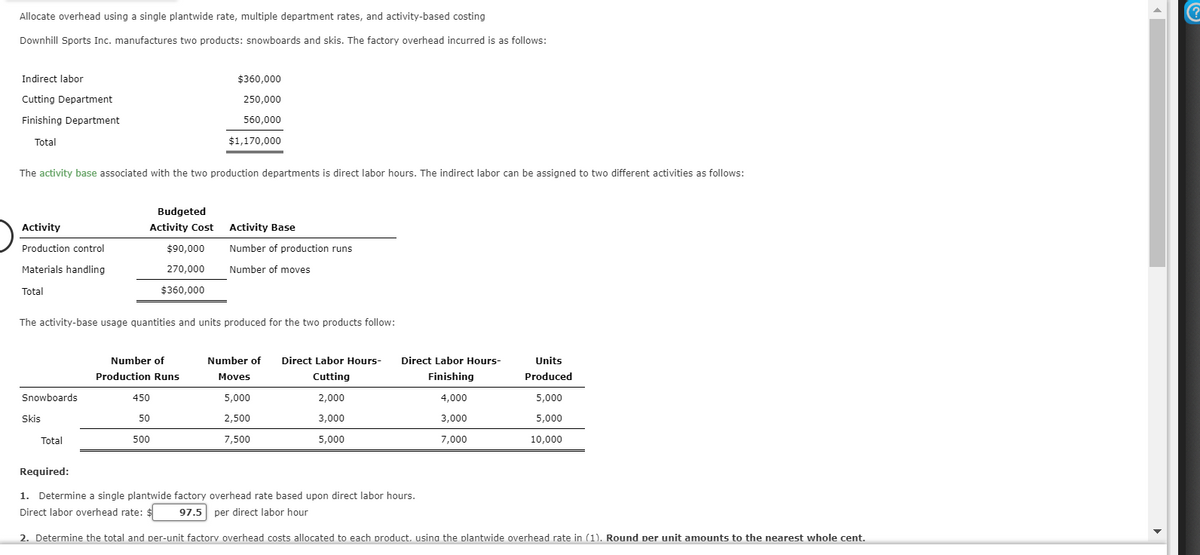

Transcribed Image Text:Allocate overhead using a single plantwide rate, multiple department rates, and activity-based costing

Downhill Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows:

Indirect labor

Cutting Department

Finishing Department

Total

The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows:

Activity

Production control

Materials handling

Total

Snowboards

Skis

Total

Budgeted

Activity Cost

The activity-base usage quantities and units produced for the two products follow:

Required:

Number of

Production Runs

450

$90,000

270,000

$360,000

50

$360,000

250,000

560,000

$1,170,000

500

Activity Base

Number of production runs

Number of moves

Number of Direct Labor Hours-

Moves

Cutting

2,000

3,000

5,000

5,000

2,500

7,500

Direct Labor Hours-

Finishing

4,000

3,000

7,000

1. Determine a single plantwide factory overhead rate based upon direct labor hours.

Direct labor overhead rate: $ 97.5 per direct labor hour

Units

Produced

5,000

5,000

10,000

2. Determine the total and per-unit factory overhead costs allocated to each product, using the plantwide overhead rate in (1). Round per unit amounts to the nearest whole cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College