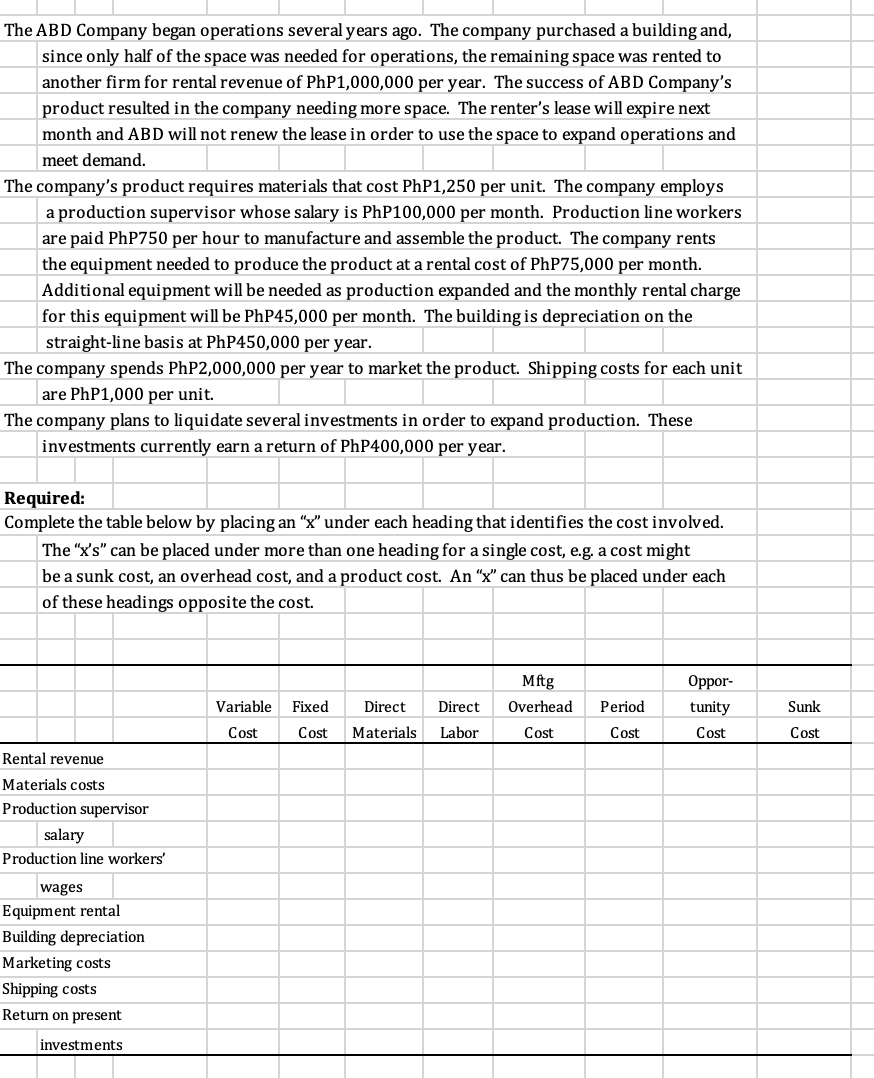

The ABD Company began operations several years ago. The company purchased a building and, since only half of the space was needed for operations, the remaining space was rented to another firm for rental revenue of PhP1,000,000 per year. The success of ABD Company's product resulted in the company needing more space. The renter's lease will expire next month and ABD will not renew the lease in order to use the space to expand operations and meet demand. The company's product requires materials that cost PhP1,250 per unit. The company employs a production supervisor whose salary is PhP100,000 per month. Production line workers are paid PHP750 per hour to manufacture and assemble the product. The company rents the equipment needed to produce the product at a rental cost of PhP75,000 per month. Additional equipment will be needed as production expanded and the monthly rental charge for this equipment will be PhP45,000 per month. The building is depreciation on the straight-line basis at PhP450,000 per year. The company spends PhP2,000,000 per year to market the product. Shipping costs for each unit are PhP1,000 per unit. The company plans to liquidate several investments in order to expand production. These investments currently earn a return of PhP400,000 per year. Required: Complete the table below by placing an "x" under each heading that identifies the cost involved. The "x's" can be placed under more than one heading for a single cost, e.g. a cost might be a sunk cost, an overhead cost, and a product cost. An "x" can thus be placed under each of these headings opposite the cost. Mftg Oppor- Variable Fixed Direct Direct Overhead Period tunity Sunk Cost Cost Materials Labor Cost Cost Cost Cost Rental revenue Materials costs Production supervisor salary Production line workers' wages Equipment rental Building depreciation Marketing costs Shipping costs Return on present investments

The ABD Company began operations several years ago. The company purchased a building and, since only half of the space was needed for operations, the remaining space was rented to another firm for rental revenue of PhP1,000,000 per year. The success of ABD Company's product resulted in the company needing more space. The renter's lease will expire next month and ABD will not renew the lease in order to use the space to expand operations and meet demand. The company's product requires materials that cost PhP1,250 per unit. The company employs a production supervisor whose salary is PhP100,000 per month. Production line workers are paid PHP750 per hour to manufacture and assemble the product. The company rents the equipment needed to produce the product at a rental cost of PhP75,000 per month. Additional equipment will be needed as production expanded and the monthly rental charge for this equipment will be PhP45,000 per month. The building is depreciation on the straight-line basis at PhP450,000 per year. The company spends PhP2,000,000 per year to market the product. Shipping costs for each unit are PhP1,000 per unit. The company plans to liquidate several investments in order to expand production. These investments currently earn a return of PhP400,000 per year. Required: Complete the table below by placing an "x" under each heading that identifies the cost involved. The "x's" can be placed under more than one heading for a single cost, e.g. a cost might be a sunk cost, an overhead cost, and a product cost. An "x" can thus be placed under each of these headings opposite the cost. Mftg Oppor- Variable Fixed Direct Direct Overhead Period tunity Sunk Cost Cost Materials Labor Cost Cost Cost Cost Rental revenue Materials costs Production supervisor salary Production line workers' wages Equipment rental Building depreciation Marketing costs Shipping costs Return on present investments

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 7EA: Alfredo Company purchased a new 3-D printer for $900,000. Although this printer is expected to last...

Related questions

Question

Transcribed Image Text:The ABD Company began operations several years ago. The company purchased a building and,

since only half of the space was needed for operations, the remaining space was rented to

another firm for rental revenue of PhP1,000,000 per year. The success of ABD Company's

product resulted in the company needing more space. The renter's lease will expire next

month and ABD will not renew the lease in order to use the space to expand operations and

meet demand.

The company's product requires materials that cost PhP1,250 per unit. The company employs

a production supervisor whose salary is PhP100,000 per month. Production line workers

are paid PHP750 per hour to manufacture and assemble the product. The company rents

the equipment needed to produce the product at a rental cost of PhP75,000 per month.

Additional equipment will be needed as production expanded and the monthly rental charge

for this equipment will be PhP45,000 per month. The building is depreciation on the

straight-line basis at PhP450,000 per year.

The company spends PHP2,000,000 per year to market the product. Shipping costs for each unit

are PhP1,000 per unit.

The company plans to liquidate several investments in order to expand production. These

investments currently earn a return of PhP400,000 per year.

Required:

Complete the table below by placing an "x" under each heading that identifies the cost involved.

The "x's" can be placed under more than one heading for a single cost, e.g. a cost might

be a sunk cost, an overhead cost, and a product cost. An "x" can thus be placed under each

of these headings opposite the cost.

Mftg

Оppor-

Variable

Fixed

Direct

Direct

Overhead

Period

tunity

Sunk

Cost

Cost

Materials

Labor

Cost

Cost

Cost

Cost

Rental revenue

Materials costs

Production supervisor

salary

Production line workers'

wages

Equipment rental

Building depreciation

Marketing costs

Shipping costs

Return on present

investments

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College