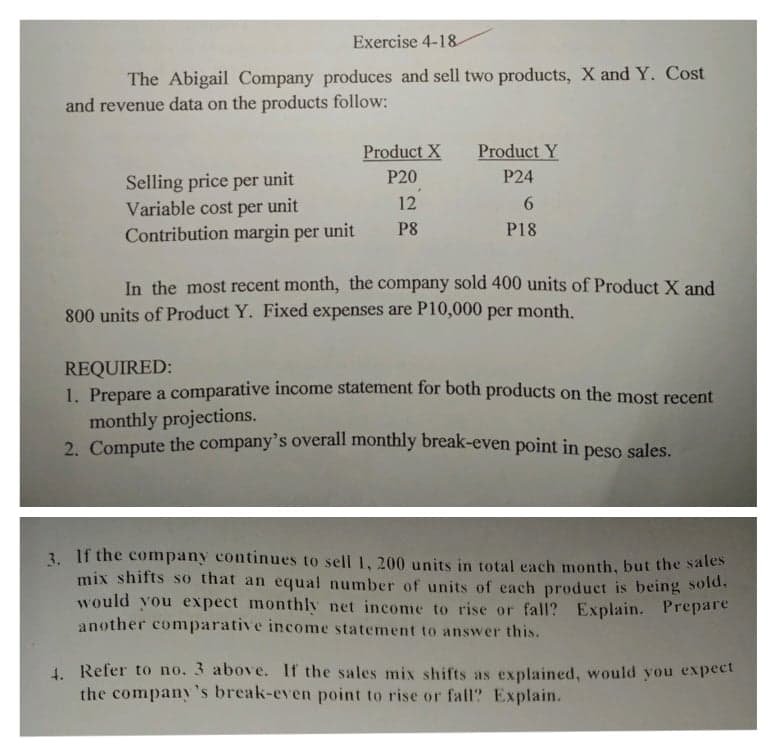

The Abigail Company produces and sell two products, X and Y. Cost and revenue data on the products follow: Product X Product Y Selling price per unit Variable cost per unit Contribution margin per unit P20 P24 12 P8 P18 In the most recent month, the company sold 400 units of Product X and 800 units of Product Y. Fixed expenses are P10,000 per month. REQUIRED: 1. Prepare a comparative income statement for both products on the most recent monthly projections. 2. Compute the company's overall monthly break-even point in peso sales.

The Abigail Company produces and sell two products, X and Y. Cost and revenue data on the products follow: Product X Product Y Selling price per unit Variable cost per unit Contribution margin per unit P20 P24 12 P8 P18 In the most recent month, the company sold 400 units of Product X and 800 units of Product Y. Fixed expenses are P10,000 per month. REQUIRED: 1. Prepare a comparative income statement for both products on the most recent monthly projections. 2. Compute the company's overall monthly break-even point in peso sales.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 11CE: Refer to Cornerstone Exercise 7.10. (Round percentages to four significant digits and cost...

Related questions

Question

Transcribed Image Text:Exercise 4-18

The Abigail Company produces and sell two products, X and Y. Cost

and revenue data on the products follow:

Product X

Product Y

Selling price per unit

Variable cost per unit

Contribution margin per unit

P20

P24

12

P8

P18

In the most recent month, the company sold 400 units of Product X and

800 units of Product Y. Fixed expenses are P10,000 per month.

REQUIRED:

1. Prepare a comparative income statement for both products on the most recent

monthly projections.

2. Compute the company's overall monthly break-even point in peso sales

3. If the company continues to sell 1, 200 units in total each month, but the sales

mix shifts so that an equal number of units of each product is being sold.

would you expect monthly net income to rise or fall? Explain. Prepare

another comparative income statement to answer this.

4. Refer to no. 3 above. If the sales mix shifts as explained, would you expect

the company's break-even point to rise or fall? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning