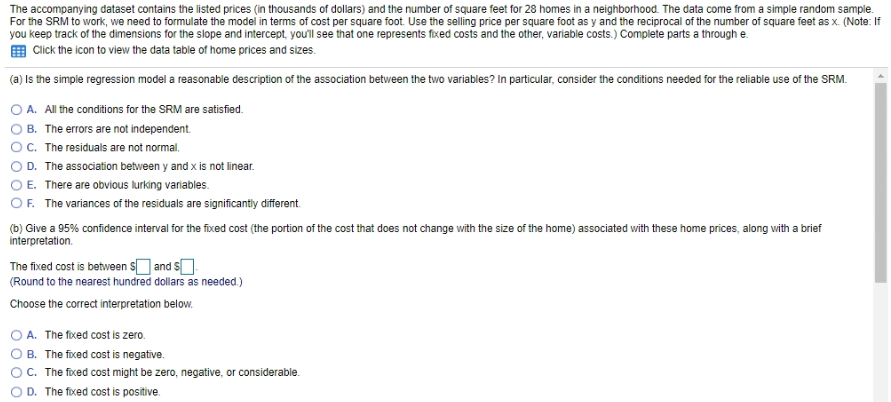

The accompanying dataset contains the listed prices (in thousands of dollars) and the number of square feet for 28 homes in a neighborhood. The data come from a simple random sample. For the SRM to work, we need to formulate the model in terms of cost per square foot. Use the selling price per square foot as y and the reciprocal of the number of square feet as x. (Note: If you keep track of the dimensions for the slope and intercept, you'll see that one represents fixed costs and the other, variable costs.) Complete parts a through e. Click the icon to view the data table of home prices and sizes. (a) Is the simple regression model a reasonable description of the association between the two variables? In particular, consider the conditions needed for the reliable use of the SRM. ○ A. All the conditions for the SRM are satisfied. OB. The errors are not independent. OC. The residuals are not normal. OD. The association between y and x is not linear. O E. There are obvious lurking variables. OF. The variances of the residuals are significantly different. (b) Give a 95% confidence interval for the fixed cost (the portion of the cost that does not change with the size of the home) associated with these home prices, along with a brief interpretation. The fixed cost is between $☐ and S☐ (Round to the nearest hundred dollars as needed.) Choose the correct interpretation below. OA. The fixed cost is zero. OB. The fixed cost is negative. OC. The fixed cost might be zero, negative, or considerable. OD. The fixed cost is positive.

The accompanying dataset contains the listed prices (in thousands of dollars) and the number of square feet for 28 homes in a neighborhood. The data come from a simple random sample. For the SRM to work, we need to formulate the model in terms of cost per square foot. Use the selling price per square foot as y and the reciprocal of the number of square feet as x. (Note: If you keep track of the dimensions for the slope and intercept, you'll see that one represents fixed costs and the other, variable costs.) Complete parts a through e. Click the icon to view the data table of home prices and sizes. (a) Is the simple regression model a reasonable description of the association between the two variables? In particular, consider the conditions needed for the reliable use of the SRM. ○ A. All the conditions for the SRM are satisfied. OB. The errors are not independent. OC. The residuals are not normal. OD. The association between y and x is not linear. O E. There are obvious lurking variables. OF. The variances of the residuals are significantly different. (b) Give a 95% confidence interval for the fixed cost (the portion of the cost that does not change with the size of the home) associated with these home prices, along with a brief interpretation. The fixed cost is between $☐ and S☐ (Round to the nearest hundred dollars as needed.) Choose the correct interpretation below. OA. The fixed cost is zero. OB. The fixed cost is negative. OC. The fixed cost might be zero, negative, or considerable. OD. The fixed cost is positive.

Big Ideas Math A Bridge To Success Algebra 1: Student Edition 2015

1st Edition

ISBN:9781680331141

Author:HOUGHTON MIFFLIN HARCOURT

Publisher:HOUGHTON MIFFLIN HARCOURT

Chapter11: Data Analysis And Displays

Section: Chapter Questions

Problem 2CT

Related questions

Question

help

Transcribed Image Text:The accompanying dataset contains the listed prices (in thousands of dollars) and the number of square feet for 28 homes in a neighborhood. The data come from a simple random sample.

For the SRM to work, we need to formulate the model in terms of cost per square foot. Use the selling price per square foot as y and the reciprocal of the number of square feet as x. (Note: If

you keep track of the dimensions for the slope and intercept, youl see that one represents fixed costs and the other, variable costs.) Complete parts a through e.

Click the icon to view the data table of home prices and sizes.

(a) Is the simple regression model a reasonable description of the association between the two variables? In particular, consider the conditions needed for the reliable use of the SRM.

O A. All the conditions for the SRM are satisfied.

B. The errors are not independent.

OC. The residuals are not normal.

O D. The association between y and x is not linear.

E. There are obvious lurking variables.

OF. The variances of the residuals are significantiy different.

(b) Give a 95% confidence interval for the fixed cost (the portion of the cost that does not change with the size of the home) associated with these home prices, along with a brief

interpretation.

The fixed cost is between s and s.

(Round to the nearest hundred dollars as needed.)

Choose the correct interpretation below.

A. The fixed cost is zero.

B. The ficed cost is negative.

C. The fixed cost might be zero, negative, or considerable.

O D. The fixed cost is positive.

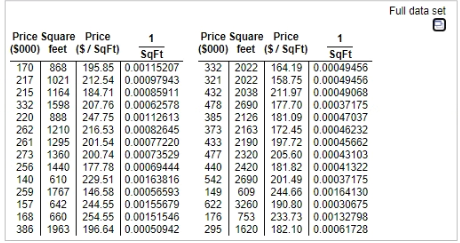

Transcribed Image Text:Full data set

Price Square Price

(S000) feet ($/ Sqft)

Price Square Price

(S000) feet ($/ Sqft)

Sqft

195.85 0.00115207

SqFt

332 2022 164.19 0.00049456

321 2022 158.75 0.00049456

432 2038 211.97 0.00049068

478 2690 177.70 0.00037175

385 2126 181.09 0.00047037

373 2163 172.45 0.00046232

433 2190 197.72 0.00045662

477 2320 205.60 0.00043103

440 | 2420 | 181.82 0.00041322

542 2690 201.49 0.00037175

149

170

868

217

1021 212.540.00097943

215

1164 184.710.00085911

332

1598 207.76 0.00062578

247.75 0.00112613

220

888

262

1210 216.530.00082645

261

1295 201.54 0.00077220

273

1360 200.74 0.00073529

256

1440 177.780.00069444

140

610 229.51 0.00163816

259

1767 146.580.00056593

157

642

660

168

244.55 0.00155679

254.55 0.00151546

609 244.66 0.00164130

622 3260 190.80 0.00030675

176 753 233.73 0.00132798

295

386

1963 | 196.64 |0.00050942

1620 | 182.10 | 0.00061728

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 14 images

Recommended textbooks for you

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning