The accompanying table shows audit status and income of the 149,897 thousand tax returns filed in 2018. The frequencies in the table are reported in thousands. Complete parts a through c below. Click the icon to view the audit status and income table. KILE a. Find the probability that a randomly selected return is in the lowest income category and is not audited. The probability is 0.9451. (Round to four decimal places as needed.) b. Given that a return is in the lowest income category, what is the probability that it was not audited? The probability is (Round to four decimal places as needed.)

The accompanying table shows audit status and income of the 149,897 thousand tax returns filed in 2018. The frequencies in the table are reported in thousands. Complete parts a through c below. Click the icon to view the audit status and income table. KILE a. Find the probability that a randomly selected return is in the lowest income category and is not audited. The probability is 0.9451. (Round to four decimal places as needed.) b. Given that a return is in the lowest income category, what is the probability that it was not audited? The probability is (Round to four decimal places as needed.)

Chapter8: Sequences, Series,and Probability

Section8.7: Probability

Problem 35E: Unemployment In 2015, there were approximately 8.3 million unemployed workers in the United States....

Related questions

Question

8.

Transcribed Image Text:K

The accompanying table shows audit status and income of the 149,897 thousand tax returns filed in 2018. The frequencies in the table are reported in thousands. Complete parts a through c below.

Click the icon to view the audit status and income table.

a. Find the probability that a randomly selected return is in the lowest income category and is not audited.

The probability is 0.9451.

(Round to four decimal places as needed.)

b. Given that a return is in the lowest income category, what is the probability that it was not audited?

The probability is

(Round to four decimal places as needed.)

Transcribed Image Text:the audit status and income table.

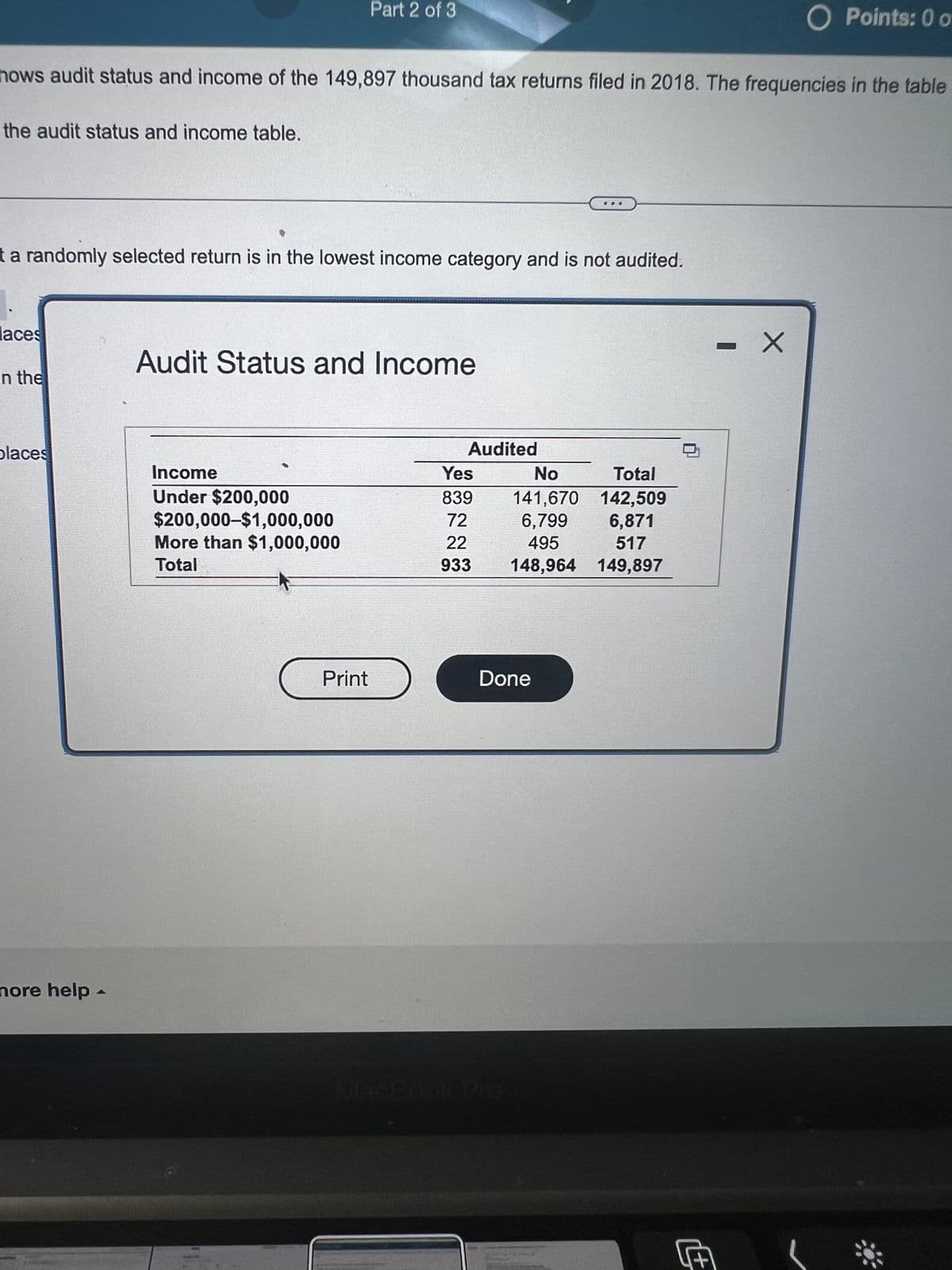

hows audit status and income of the 149,897 thousand tax returns filed in 2018. The frequencies in the table

t a randomly selected return is in the lowest income category and is not audited.

aces

in the

places

nore help -

Part 2 of 3

Audit Status and Income

Income

Under $200,000

$200,000-$1,000,000

More than $1,000,000

Total

Print

Audited

Yes

No

Total

839

141,670 142,509

72

6,799

6,871

22

517

495

933 148,964

149,897

Done

O Points: 0 o

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill