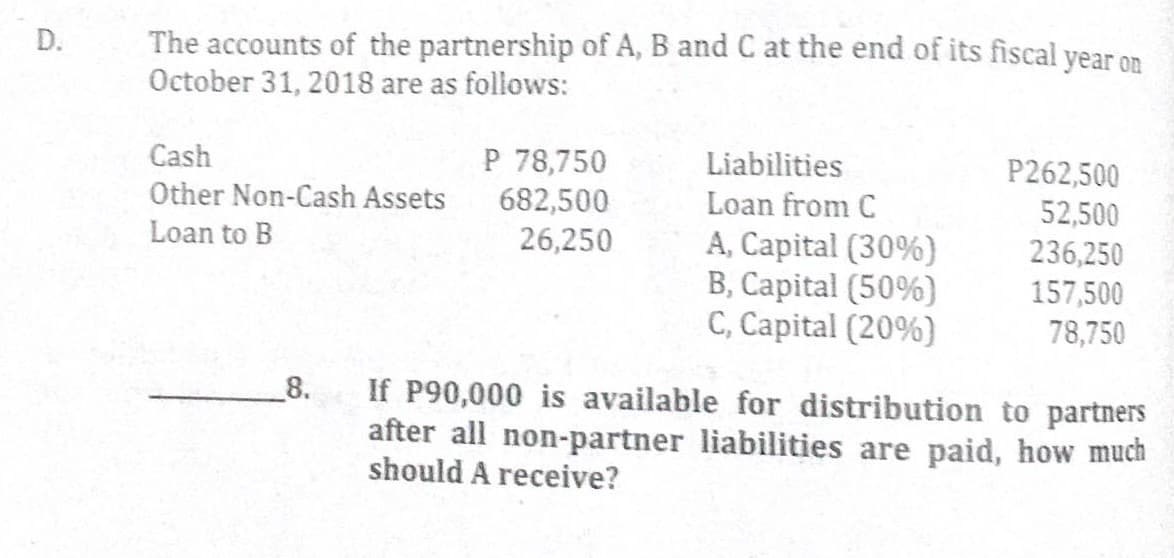

The accounts of the partnership of A, B and C at the end of its fiscal year on October 31, 2018 are as follows: D.

The accounts of the partnership of A, B and C at the end of its fiscal year on October 31, 2018 are as follows: D.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 3EA: The partnership of Tasha and Bill shares profits and losses in a 50:50 ratio, and the partners have...

Related questions

Question

Transcribed Image Text:The accounts of the partnership of A, B and C at the end of its fiscal year on

October 31, 2018 are as follows:

P 78,750

Liabilities

Loan from C

Cash

P262,500

Other Non-Cash Assets

682,500

26,250

52,500

Loan to B

A, Capital (30%)

B, Capital (50%)

C, Capital (20%)

236,250

157,500

78,750

If P90,000 is available for distribution to partners

after all non-partner liabilities are paid, how much

should A receive?

_8.

D.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,