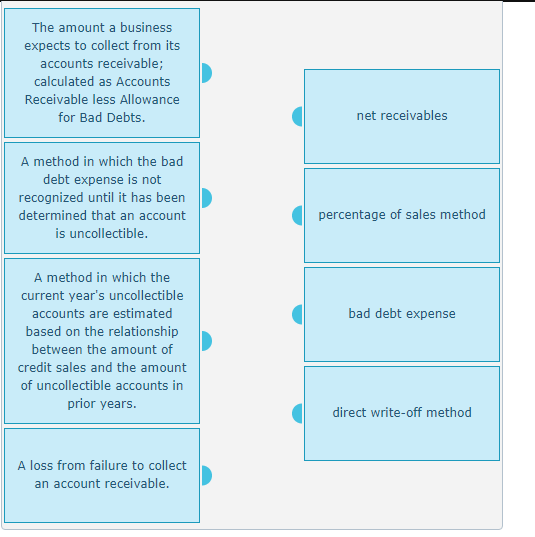

The amount a business expects to collect from its accounts receivable; calculated as Accounts Receivable less Allowance for Bad Debts. net receivables A method in which the bad debt expense is not recognized until it has been determined that an account is uncollectible. percentage of sales method A method in which the current year's uncollectible accounts are estimated based on the relationship bad debt expense between the amount of credit sales and the amount of uncollectible accounts in prior years. direct write-off method A loss from failure to collect an account receivable.

The amount a business expects to collect from its accounts receivable; calculated as Accounts Receivable less Allowance for Bad Debts. net receivables A method in which the bad debt expense is not recognized until it has been determined that an account is uncollectible. percentage of sales method A method in which the current year's uncollectible accounts are estimated based on the relationship bad debt expense between the amount of credit sales and the amount of uncollectible accounts in prior years. direct write-off method A loss from failure to collect an account receivable.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 65E: Average Uncollectible Account Losses and Bad Debt Expense The accountant for Porile Company prepared...

Related questions

Question

Match the terms with the definitions.

Transcribed Image Text:The amount a business

expects to collect from its

accounts receivable;

calculated as Accounts

Receivable less Allowance

for Bad Debts.

net receivables

A method in which the bad

debt expense is not

recognized until it has been

determined that an account

percentage of sales method

is uncollectible.

A method in which the

current year's uncollectible

accounts are estimated

bad debt expense

based on the relationship

between the amount of

credit sales and the amount

of uncollectible accounts in

prior years.

direct write-off method

A loss from failure to collect

an account receivable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning