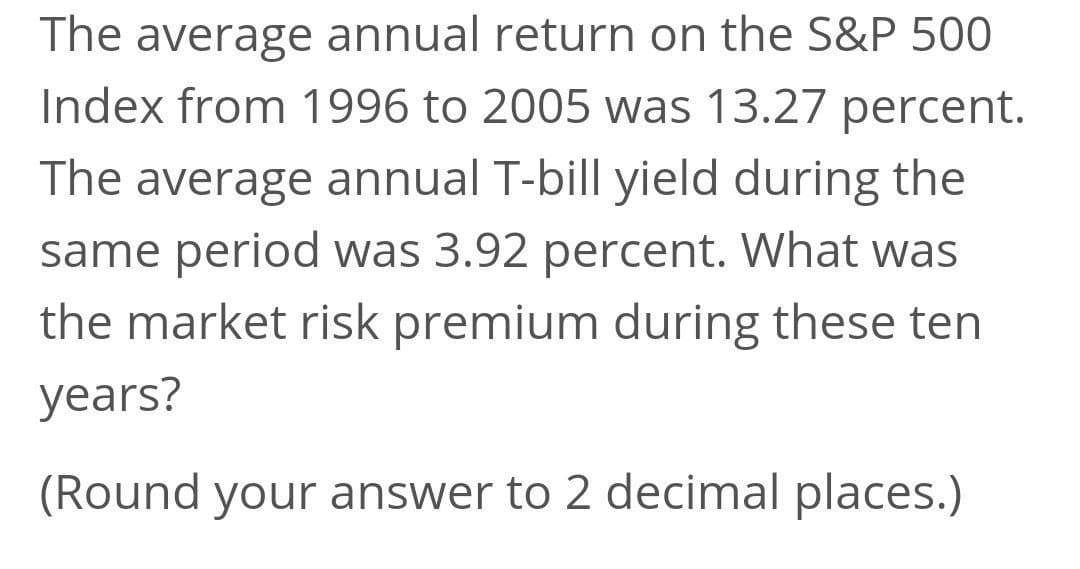

The average annual return on the S&P 500 Index from 1996 to 2005 was 13.27 percent. The average annual T-bill yield during the same period was 3.92 percent. What was the market risk premium during these ten years?

Q: Suppose that expectations about the S&P 500 index and the T-bill rate are the same as they were in…

A: Treasury bills yield a lower return.

Q: The analysts at FNB forecasted that the return on DJIA index portfolio over the coming year will be…

A: The degree of risk aversion of the average investors can be denoted as Beta. Variance of returns…

Q: Over a certain period, large-company stocks had an average return of 12.54 percent, the average…

A: Given: Risk free rate = 2.57% Small company stock return = 17.41%

Q: Assume the ASX 200 forward earnings yield is 6 percent and the 10-year T-note yield is 5.6 percent.…

A: Forward earnings yield = 6% 10 year Treasury note yield = 5.6%

Q: You've observed the following returns on Crash-n-Burn Computer's stock over the past five years: 12…

A: Average Nominal Return = (12% -9% +20% +17% +10%) / 5 Average Nominal Return = 50%/5 Average…

Q: Risk Premium If the annual return on the S&P 500 Index was 10.70 percent. The annual T-bill yield…

A: Market Risk Premium = Market Rate of Return – Risk Free Return

Q: The Treasury bill rate at the time of estimation is 15% with a beta of 2.0 and the expected return…

A: The Capital Asset Pricing Model (CAPM): A Capital Asset Pricing Model is the technique of…

Q: what is inflation if the real risk-free rate is 7%?

A: Inflation refers to the state in which the prices of the goods and services increases as compare to…

Q: A)The following are monthly percentage price changes for four market indexes. Month…

A: “Since you have posted multiple sub-parts, we will solve the first three sub-parts for you. To get…

Q: Suppose that the rate of return for a particular stock during the past two years was 10% and 20%.…

A: Geometric Rate of return= [(1+r1)*(1+r2)......(1+r3)1/n-1 r1= .10 r2=.20 n=2 years

Q: Assume that the average annual historical return for shares that comprise the Australian All…

A: Calculation of 95% confidence interval:

Q: A stock has a current price of 100. The stock price in two years is either 120 or 100 with equal…

A: The standard deviation is the variability between the annual returns of the stocks. It indicates the…

Q: Over the past four years, large-company stocks and U.S. Treasury bills have produced the returns…

A: Here,

Q: The rate of return on General Electric common stock over the coming year is normally distributed…

A: To find the Probability of Negative return Firstly one has to find the z Value.

Q: Consider a stock currently trading at $10, with expected annual return of 15% and annual volatility…

A: Current Stock price is $10 Expected annual return is 15% Annual Volatility is 0.2 To Find:…

Q: The Wall Street Journal reported that the yield on common stocks is about 2 percent, whereas a study…

A: Measures of Investment : When an investor invests his money into…

Q: Assume these were the inflation rates and U.S. stock market and Treasury bill returns between 1929…

A: NOTE: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: The average annual return on the S&P 500 Index from 1996 to 2005 was 13.27 percent. The average…

A: Calculation of market risk premium:Answer:The average market premium in these ten years is 9.35%

Q: A stock’s returns for the past 3 years were 10%, 215%, and 35%.What is the historical average…

A: Working note:

Q: Consider a stock with an initial price of $40, an expected return of 16% per annum, and a volatility…

A: Initial price = $40 Expected return =16% per annum Volatility = 20% per annum

Q: geometric

A: Introduction: The term geometric mean refers to investment's average growth. In other words it is…

Q: Assume that over the last several decades, the annual returns on large-company common stocks…

A: Excess return earned by long-term government bonds = (long-term government bonds -U.S. T-bills)…

Q: You've observed the following returns on Yamauchi Corporation's stock over the past five years:…

A:

Q: Over a certain period, large-company stocks had an average return of 12.19 percent, the average…

A: Risk free rate = 2.50% Return on small-company stocks = 17.13%

Q: Assume these are the stock market and Treasury bill returns for a 5-year period: Stock Market T-Bill…

A: Year Stock Market Return T-Bill Return 2013 35.40% 0.19% 2014 14.80% 0.19% 2015 -4.70% 0.19%…

Q: Consider the following realized annual returns for the Index HG200: Year End Index Realized Return…

A: Here, To Find: Part a. Average Annual Return =? Part b. Standard Deviation =?

Q: Over a certain period, large-company stocks had an average return of 12.79 percent, the average…

A: Given, Risk-free rate = 2.62% Return on given stock = 17.61% Risk premium = Return on given stock -…

Q: Assume these are the stock market and Treasury bill returns for a 5-year period: Stock Market T-Bill…

A: Risk premium is the difference between the market rate of return and risk free rate.

Q: Two common stocks, Consolidated Edison and Apple, have the following expected return and standard…

A: Given:

Q: A portfolio of stocks generates a −9% return in 2016, a 23% return in 2017, and a 17% return in…

A: YEAR RETURNS 2016 -9% 2017 23% 2018 17%

Q: You’ve observed the following returns on Crash-n-Burn Computer’s stock over the past five years: 14…

A: Inflation rate=3.5%T-bill rate=4.2%

Q: Suppose that you want to use the 10-year historical average return on the Index to forecast the…

A: 95% confidence interval can be calculated using the below formula: Standard error is: Standard…

Q: A stock's initial value was $ 15 and the value after two years is $25. a. Find out the holding…

A: Given: Initial Value = $15 Value after 2 years = $25 Number of period = 2 Holding period return…

Q: Assume the return on large-company stocks is currently 11.5 percent. The risk premium on…

A: Return means get something form the investment. Return is directly (positively) relates with the…

Q: What is the price of the stock today?

A: Share price: It represents the current worth to the sellers and buyers of stock and can be…

Q: What is the required rate of return on a preferred stock with a $50 par value,a stated annual…

A: The computation of dividend as follows:

Q: Treasury bill yield is 10%, ABC company’s expected return for the next year is 18%, beta of ABC…

A: Thee market return can be calculated with the help of CAPM equation

Q: What was the average real risk-free rate over this time period? (Do not round intermediate…

A: Given information: Average inflation rate = 3.25% Average risk free rate = 4.30% Return on stock for…

Q: Assume that the stock market index is trading at a level of 4,500. You can interpret this index…

A: Stock market index level = 4500 Risk Free Rate = 1.3% Aggregate earnings = 132 Payout Ratio = 45%…

Q: 3. The following table gives actual data on the U.S. CPI and the S&P 500 total return index (SPTRI).…

A: These are two different questions, so according to our guidelines, we will answer the first one.…

Q: Assume that the stock market index is trading at a level of 4,500. You can interpret this index…

A: Stock Market Index Level = 4500 Long Term Risk Free Rate = 1.3% Aggregate Earnings Expected Next…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The average annual return on the S&P SOO Index from 1988 to 1995 was 15.8 percent The average annual T-bill yield during the same period was 5.8 percent What was the market risk premium during these ten years?The average annual return on the S&P 500 Index from 1996 to 2005 was 13.27 percent. The average annual T-bill yield during the same period was 3.92 percent.What was the market risk premium during these ten years? (Round your answer to 2 decimal places.) Average Market Risk Premium: ___.__%The average annual return on the S&P 500 Index from 1986 to 1995 was10.75 percent. The average annual T-bill yield during the same period was 3.85 percent. What was the market risk premium during these ten years? (Round your answer to 2 decimal places.) Average market risk premium %

- The level of the Syldavian market index is 23,000 at the start of the year and 27,500 at the end. The dividend yield on the index is 5.5%. What is the return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) If the interest rate is 8%, what is the risk premium over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) If the inflation rate is 9%, what is the real return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)Suppose 1-year T-bills currently yield 7.00% and the future inflation rate is expected to be constant at 2.00% per year. What is the real risk-free rate of return, r*? The cross-product term should be considered , i.e., if averaging is required, use the geometric average. (Round your final answer to 2 decimal places.)An investment had a nominal return of 11.8 percent last year. If the real return on the investment was only 8.7 percent, what was the inflation rate for the year?

- Risk Premium If the annual return on the S&P 500 Index was 10.70 percent. The annual T-bill yield during the same period was 4.65 percent. What was the market risk premium during that year?The level of the Syldavian market index is 21,600 at the start of the year and 26,100 at the end. The dividend yield on the index is 4.3%. a. What is the return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) b. If the interest rate is 5%, what is the risk premium over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. If the inflation rate is 7%, what is the real return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)The level of the Syldavia market index is 21,900 at the start of the year and 26,400 at the end. The dividend yield on the index is 4.7%. What is the return on the index over the year? If the interest rate is 6%, what is the risk premium over the year? If the inflation rate is 8%, what is the real return on the index over the year? Note: For all requirements, do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places.

- Consider a long position of USD100 million in a par 10-year note. Payments are annual. Interest rates are at 6% and the volatility of changes in interest rates is 0.25% over the next month. Assuming normal distributions for yields, what is the monthly 99% yield changes? Calculate the VaR of the position.Using the Treasury yield information in part c, calculate the following rates using geometric averages (round your answers to three decimal places): The 1-year rate, 1 year from now The 5-year rate, 5 years from now The 10-year rate, 10 years from now The 10-year rate, 20 years from nowSuppose that the 9-month and 12-month LIBOR rates are 4% and 4.2%, respectively. What is the value of an FRA where 5% is received and LIBOR is paid on £1 million for the quarterly period? All rates are quarterly compounded and expressed as per annum. Assume that LIBOR is used as the risk-free discount rate. Select one: a. £478.115 b. £422.870 c. £479.062 d. £426.132