The average return on the Market is 12% while the market risk premium is 7%. What is the require rate of return of the portfolio? (In percentage)

Q: The Treasury bill rate is 4%, and the expected return on the market portfolio is 12%. Using the…

A: Risk free rate = 4% Market return = 12% Beta of stock X = 1.5

Q: Suppose the risk-free rate is 5.1 percent and the market portfolio has an expected return of 11.8…

A: Standard deviation of market portfolio and portfolio Z is calculated. Then covariance and beta of…

Q: Suppose the risk-free return is 4% and the market portfolio has an expected return of 10% and a…

A: Calculation of 3M's beta with respect to market: Beta of 3M is determined by multiplying the…

Q: a. What is the expected return on a portfolio that is equally invested in the two assets? b. If a…

A: Information Provided: Stock beta = 1.35 Expected return = 16% Risk-free asset return = 4.8%…

Q: Assume the riskless rate of interest is 2% per year, and the expected rate of return on the market…

A: The expected return is the profit margin or loss that an investment may anticipate by the investor.…

Q: what is the Sharpe ratio of this portfolio?

A: Information Provided: Return = 25.30% Standard deviation = 31% T-bills = 5%

Q: Asset P has a beta of 0.9. The risk-free rate of return is 8 percent, while the return on the market…

A: The asset required rate of return can be calculated with the help of CAPM equation

Q: A portfolio consists of 70% of investment A and 30% of investment B. The expected return on…

A: The Expected portfolio or overall rate of return of the portfolio is the total return that is…

Q: If the risk free rate is 6 %, the expected return on the market portfolio is 12% and the beta of…

A: The Capital Asset Pricing Model (CAPM) is the model which shows the relationship between the…

Q: A portfolio that combines the risk-free asset and the market portfolio has an expected return of 7…

A: A portfolio is a combination or group of financial instruments and securities that are held by an…

Q: Beta and required rate of return A stock has a required return of 11 percent; the risk-free rate is…

A: In the given question we require to compute the beta of stock from below details : Required return =…

Q: A portfolio has a beta of 1.2 and an actual return of 14.1 percent. The risk-free rate is 3.5…

A: Given: Beta = 1.2 Actual return = 14.1% Risk free rate = 3.5% Market risk premium = 7.4%

Q: A portfolio has an average return of 14.4 percent, a standard deviation of 18.5 percent, and a beta…

A: The Sharpe ratio: The Sharpe ratio is one of the most commonly used measures to assess the…

Q: If the T Bill rate is 1.1% and the market risk premium is 10.8%, what is the CAPM-implied expected…

A: Portfolio is a bunch of various assets or investments. Investors invest their funds in various…

Q: Suppose the expected return on the tangent portfolio is 10% and its volatility is 40%. The risk-free…

A: Portfolio refers to basket of different financial assets in which investment is made by single…

Q: A portfolio is invested 27 percent in Stock G, 42 percent in Stock J, and 31 percent in Stock K. The…

A: The expected return of a portfolio refers to the sum of proportionate returns from each element of…

Q: If the risk free rate is 2 %, the expected return on the market portfolio is 12% and the beta of…

A: Financial management consists of directing, planning, organizing and controlling of financial…

Q: the returns on Magee companys stock have a standard deviation of 30% and a correlation with the…

A: A model that represents the relationship of the required return and beta of a particular asset is…

Q: Security F has an expected return of 10 percent and a standard deviation of 43 percent per year.…

A: The expected return of the company is the return of security adjusted with the volatility with…

Q: If the expected return on the market is 16%, then using the historical risk premium on large stocks…

A: In the given problem we require to calculate the risk free rate from following details: Expected…

Q: Suppose the assumption behind that the CAPM hold. The risk free rate is 2% and the expected return…

A:

Q: Equity has a beta of 1.35 and an expected return of 16 percent. A risk-free asset currently earns…

A: Beta = 1.35 Expected Return = 16% Return Risk-free asset = 4.8% Part a: Weight of asset = 50%…

Q: Consider a portfolio exhibiting an expected return of 6% in an economy where the riskless interest…

A: Given, Expected return = 6% Risk less interest rate = 1% Expected return on market portfolio = 10%…

Q: The Treasury bill rate is 4.9%, and the expected return on the market portfolio Is 11.1%. Use the…

A: According to the rule, we will answer the first three subparts, for the remaining subparts, kindly…

Q: Currently the risk-free return is 3 percent and the market risk premium is 8 percent. What is the…

A: Risk-free rate = 3% Market risk premium = 8% According to CAPM: Required return = Risk-free rate +…

Q: Suppose the expected return for the market portfolio and risk-free rate are 13 percent and 3 percent…

A: Treynor ratio = (Expected return - Risk free rate) / BetaTreynor ratio of the market = (Expected…

Q: A portfolio that combines the risk-free asset and the market portfolio has an expected return of 7…

A: An expected return is defined as the profit / loss, where an investors used to anticipate on their…

Q: According to the tangency portfolio allocation, stock A contributes 10%, stock B contributes 40%,…

A: Expected return of portfolio 10%-0.5*2%=11%

Q: Security F has an expected return of 10 percent and a standard deviation of 43 percent per year.…

A: Solution- (A)-The expected return of the portfolio is the sum of the weight of each asset timesthe…

Q: A portfolio has a correlation of 0.40 with the overall market and produces a Sharpe Ratio of 0.2. If…

A: There are different measures which are used for the estimation of portfolio performance. One such…

Q: the required return on portfolio is 18% risk free rate is 6% and the market return is 14% calculate…

A: Given: Rp = 18% (required return on portfolio) Rf = 6% (risk free rate of portfolio) Rm = 14%…

Q: If the risk-free rate is 7 percent, the expected return on the market is 10 percent, and the…

A: Given that;Risk free rate is 7%Expected return on the market is 10%Expected return on the security…

Q: The Treasury bill rate is 4.9%, and the expected return on the market portfolio is 11.1%. Use the…

A: 1. Risk premium =expected return on the market - Treasury bill rate Risk premium = 11.1% - 4.9%…

Q: If the risk free rate is 4 9%, the expected return on the market portfolio is 1296 and the beta of…

A: Financial management consists of directing, planning, organizing and controlling of financial…

Q: A portfolio is invested 25 percent in Stock G, 65 percent in Stock J, and 10 percent in Stock K. The…

A: portfolio return =∑n rn×wnwhere,rn=return of stock wn=weights of stockn=number of stocks in…

Q: The risk-free rate is 2%, the market risk premium is 8.00%, and portfolio A has a beta of 2. What is…

A: Given: Risk free rate = 2% Market risk premium = 8% Beta of portfolio = 2 Computation of required…

Q: If the risk free rate is 2 96, the expected retun on the market portfolio is 129% and the beta of…

A: Financial statements are statements which states the business activities performed by the company .…

Q: Consider two types of assets: market portfolio (M) and stock A. The expected return is 8% and…

A: Given: Market rate = 8% Risk free rate = 2% Standard deviation of market portfolio = 15% Standard…

Q: Stock M has a relevant risk equals 1.75, and unsystematic risk equals 2. If the real risk-free rate…

A: RRR adjusted for inflation = [(1+RRR)/(1-i)] - 1 where RRR is Required Rate of Return = Risk Free…

Q: Security F has an expected return of 10 percent and a standard deviation of 43 percent per year.…

A: given, rf=10%σf=43%rg=15%σg=62%wf=0.3wg=0.7

Q: Your portfolio has a beta of 1.73, a standard deviation of 29 percent, and an expected return of…

A: Treynor ratio = Portfolio Return - Risk Free ReturnPortfolio Beta

Q: Suppose the next month rate of return on a portfolio (worth $1M) is distributed as follows. Return…

A: Using excel

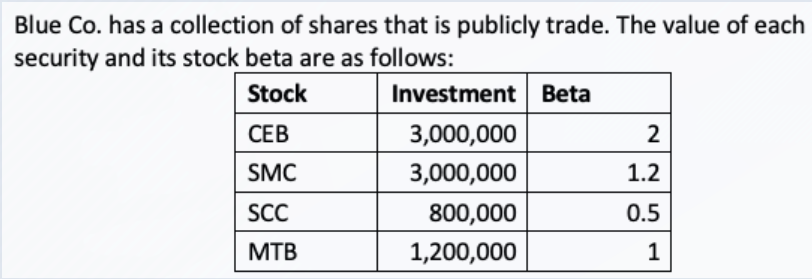

The average return on the Market is 12% while the market risk premium is 7%.

What is the require

Step by step

Solved in 2 steps

- Alert Companys shareholders equity prior to any of the following events is as follows: The company is considering the following alternative items: 1. An 8% stock dividend on the common stock when it is selling for 30 per share. 2. A 30% stock dividend on the common stock when it is selling for 32 per share. 3. A special stock dividend to common shareholders consisting of 1 share of preferred stock for every 100 shares of common stock. The preferred stock and common stock are selling for 123 and 31 per share, respectively. 4. A 2-for-1 stock split on the common stock, reducing the par value to 5 per share (assume the same date for declaration and issuance). The market price is 30 per share on the common stock. 5. A property dividend to common shareholders consisting of 100 bonds issued by West Company. These bonds are carried on the Alert Company books as an available-for sale investment at a fair value of 48,000 (which is also its cost); it has a current value of 54,000. 6. A cash dividend, consisting of a normal dividend and a liquidating dividend, on both the preferred and the common stock. The 10% preferred dividend includes a 2% liquidating dividend, and the 2.30 per share common dividend includes a 0.30 per share liquidating dividend (separate liquidating dividend contra accounts should be used). Required: For each of the preceding alternative items: 1. Record (a) the journal entry at the date of declaration and (b) the journal entry at the date of issuance. 2. Compute the balances in the shareholders equity accounts immediately after the issuance (any gains or losses are to be reflected in the retained earnings balance; ignore income taxes).We have those information available to make a calculation. Number of shares: 2.000.000 Nominal value of each share: 1.000 TL Market price declared by the Stock Exchange: 12 TL Stock Exchange declares the price of a 1 lot of shares and 1 lot denotes 1000 TL nominal value of shares. What is the market value of the shares we have?You have been provided with the following information for the year ended 30 June 2022 for ABCLtd:RNet profit for the year -R1 800 000Weighted average number of shares (WANOS) outstanding during the year-R 120 000Average fair value per share -R30.00Weighted average number of shares (WANOS) under option during the year -R25 000Exercise price for shares under option during the year -R28.00REQUIRED:Q.2.1 Explain the purpose and objective of disclosing diluted earnings per share.

- a. What is the average selling price of the stock that had been issued as of december 31, 2021? b. The par value of the outstanding shares of ordinary shares as of December 31, 20X2 is shown as P403 million. This is actually a rounded amount. What is the exact par value of the common stock outstanding as of that date? c. How many shares of common stock were issued during 20X2? d. How many shares would Excelsior be allowed to issue during 20X2? pls answer all and i'll give u a good rateWe have those information available to make a calculation. Number of shares: 200 Nominal value of each share: 100 TL Market price declared by the Stock Exchange: 5,00 TL Stock Exchange declaration: 1 lot denotes 100 shares. What is the market value of the shares we have.Garnet Trust has the following classes of stock: Data table Preferred Stock—5%, $15 Par Value; 9,000 shares authorized, 7,500 shares issued and outstanding Common Stock—$0.15 Par Value; 2,250,000 shares authorized, 1,750,000 shares issued and outstanding Requirements 1. Garnet declares cash dividends of $22,000 for 2024. How much of the dividends goes to preferred stockholders? How much goes to common stockholders? 2. Assume the preferred stock is cumulative and Garnet passed the preferred dividend in 2022 and 2023. In 2024, the company declares cash dividends of $28,000. How much of the dividend goes to preferred stockholders? How much goes to common stockholders? 3. Assume the preferred stock is noncumulative and Garnet passed the preferred dividend in 2022 and 2023. In 2024, the company declares cash dividends of $28,000. How much of the dividend goes to preferred stockholders? How much goes to common stockholders? Requirement…

- From page 10-1 of the VLN, when a company sells shares of stock, those shares of stock are said to be: Group of answer choices A. Authorized shares B. Issued shares C. Outstanding shares D. Treasury sharesRequired: Determine the following items based on Eldon's balance sheet. Round all calculations except per-share amounts to the nearest whole number; round per-share amounts to the nearest cent. 1. The number of shares of preferred stock issued ? shares 2. The number of shares of preferred stock outstanding ? shares 3. The average per-share sales price of the preferred stock when issued $? per share 4. The par value of the common stock $? per shareThe following question is based on the following information about the stocks of Whitestone REIT, HCC Insurance Holdings, Inc., and SanDisk Corporation.† Price($) Dividend Yield(%) WSR(WSR Whitestone REIT) 16 7 HCC(HCC Insurance Holdings, Inc.) 56 2 SNDK(SanDisk Corporation) 80 2 You invested a total of $12,400 in shares of the three stocks at the given prices, and expected to earn $328 in annual dividends. If you purchased a total of 250 shares, how many shares of each stock did you purchase? WSR shares = HCC shares = SNDK shares =

- Analyse the information given in the table below and answer the questions below:Details Company A Company BShare price R60 R90Number of ordinary shares issued 10 000 000 10 000 000Market capitalisation 600 000 000 900 000 000Annual earnings R90 000 000 R120 000 000Earnings per share A BPrice/ Earnings (P/ E) Ratio C DREQUIRED:Please note that all theoretical answers should be in your own words and not directly from yourtextbook or any other source. Remember to add a list of resources (correctly referencedaccording to the Harvard method) at the end of your assignment. Calculate the missing amounts for A ‐ D.Round off your answers to 2 decimal places.You are given the following information: Stockholders’ equity !$3.75 billion, price/earnings ratio ! 3.5, common shares outstanding ! 50 million, and market/book ratio ! 1.9. Calculate the price of a share of the company’s common stockFrom page 10-2 of the VLN, the common stock account amount is determined Group of answer choices A. Par value x issued shares B. Par value x outstanding shares C. Par value x authorized shares D. Par value x unissued shares