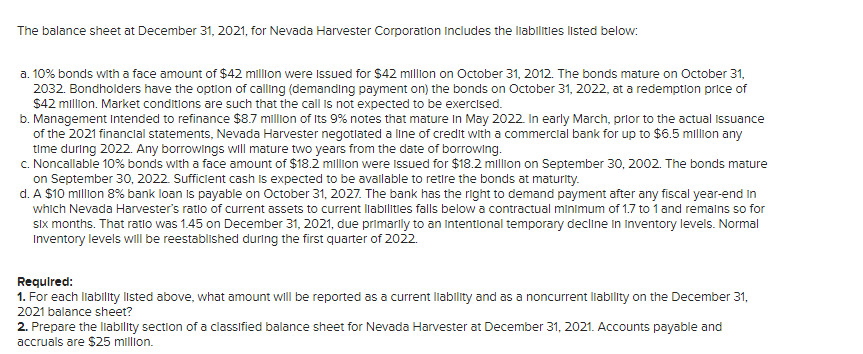

The balance sheet at December 31, 2021, for Nevada Harvester Corporation Includes the liabilitiles listed below: a. 10% bonds with a face amount of $42 million were Issued for $42 million on October 31, 2012. The bonds mature on October 31, 2032. Bondholders have the optlon of calling (demanding payment on) the bonds on October 31, 2022, at a redemption price of $42 million. Market conditions are such that the call is not expected to be exercised. b. Management Intended to refinance $8.7 million of Its 9% notes that mature In May 2022. In early March, prior to the actual Issuance of the 2021 financial statements, Nevada Harvester negotlated a line of credit with a commercial bank for up to $6.5 million any time during 2022. Any borrowings wll mature two years from the date of borrowing. C. Noncallable 10% bonds with a face amount of $18.2 million were Issued for $18.2 million on September 30, 2002. The bonds mature on September 30, 2022 Sufficlent cash Is expected to be avallable to retire the bonds at maturity. d. A $10 million 8% bank loan Is payable on October 31, 2027. The bank has the right to demand payment after any fiscal year-end in which Nevada Harvester's ratlo of current assets to current llabilitles falls below a contractual minimum of 1.7 to 1 and remalns so for Six months. That ratio was 1.45 on December 31, 2021, due primarily to an Intentional temporary decline in Inventory levels. Normal Inventory levels will be reestablished during the first quarter of 2022. Requlred: 1. For each liability listed above, what amount will be reported as a current liability and as a noncurrent liability on the December 31, 2021 balance sheet? 2. Prepare the lability section of a classified balance sheet for Nevada Harvester at December 31, 2021. Accounts payable and accruals are $25 million.

The balance sheet at December 31, 2021, for Nevada Harvester Corporation Includes the liabilitiles listed below: a. 10% bonds with a face amount of $42 million were Issued for $42 million on October 31, 2012. The bonds mature on October 31, 2032. Bondholders have the optlon of calling (demanding payment on) the bonds on October 31, 2022, at a redemption price of $42 million. Market conditions are such that the call is not expected to be exercised. b. Management Intended to refinance $8.7 million of Its 9% notes that mature In May 2022. In early March, prior to the actual Issuance of the 2021 financial statements, Nevada Harvester negotlated a line of credit with a commercial bank for up to $6.5 million any time during 2022. Any borrowings wll mature two years from the date of borrowing. C. Noncallable 10% bonds with a face amount of $18.2 million were Issued for $18.2 million on September 30, 2002. The bonds mature on September 30, 2022 Sufficlent cash Is expected to be avallable to retire the bonds at maturity. d. A $10 million 8% bank loan Is payable on October 31, 2027. The bank has the right to demand payment after any fiscal year-end in which Nevada Harvester's ratlo of current assets to current llabilitles falls below a contractual minimum of 1.7 to 1 and remalns so for Six months. That ratio was 1.45 on December 31, 2021, due primarily to an Intentional temporary decline in Inventory levels. Normal Inventory levels will be reestablished during the first quarter of 2022. Requlred: 1. For each liability listed above, what amount will be reported as a current liability and as a noncurrent liability on the December 31, 2021 balance sheet? 2. Prepare the lability section of a classified balance sheet for Nevada Harvester at December 31, 2021. Accounts payable and accruals are $25 million.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:The balance sheet at December 31, 2021, for Nevada Harvester Corporation Includes the liabilitles listed below:

a. 10% bonds with a face amount of $42 million were Issued for $42 million on October 31, 2012. The bonds mature on October 31,

2032. Bondholders have the option of calling (demanding payment on) the bonds on October 31, 2022, at a redemption price of

$42 million. Market conditions are such that the call is not expected to be exercised.

b. Management Intended to refinance $8.7 million of Its 9% notes that mature In May 2022. In early March, prior to the actual issuance

of the 2021 financial statements, Nevada Harvester negotlated a line of credit with a commercial bank for up to $6.5 million any

time during 2022. Any borrowings wll mature two years from the date of borrowing.

C. Noncallable 10% bonds with a face amount of $18.2 million were issued for $18.2 million on September 30, 2002. The bonds mature

on September 30, 2022. Sufficient cash is expected to be avallable to retire the bonds at maturity.

d. A $10 million 8% bank loan Is payable on October 31, 2027. The bank has the right to demand payment after any fiscal year-end In

which Nevada Harvester's ratio of current assets to current llabilities falls below a contractual minimum of 1.7 to 1 and remalns so for

Six months. That ratio was 1.45 on December 31, 2021, due primarly to an Intentional temporary decline in Inventory levels. Normal

Inventory levels will be reestablished during the first quarter of 2022.

Requlred:

1. For each liability listed above, what amount will be reported as a current liability and as a noncurrent liability on the December 31,

2021 balance sheet?

2. Prepare the Iliability section of a classified balance sheet for Nevada Harvester at December 31, 2021. Accounts payable and

accruals are $25 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College