White & Decker Corporation's 2019 financial statements included the following information in the long-term debt disclosure note: ($ in millions) 2019 Zero-coupon subordinated debentures, due 2033: $360 The disclosure note stated the debenture bonds were issued late in 2013 and have a maturity value of $610 million. The maturity value indicates the amount that White & Decker will pay bondholders in 2033. Each individual bond has a maturity value (face amount) of $1.110. Zero-coupon bonds pay no cash interest during the term to maturity. The company is "accreting" (gradually increasing) the issue price to maturity value using the bonds' effective interest rate computed on an annual basis. (FV of $1, PV of $1, EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the effective interest rate on the bonds. 2. Determine the issue price in tate 2013 of a single, $1,110 maturity-value bond, (For all requirements, round your answers to 2 decimal places.) Eltective interest rate Issue price

White & Decker Corporation's 2019 financial statements included the following information in the long-term debt disclosure note: ($ in millions) 2019 Zero-coupon subordinated debentures, due 2033: $360 The disclosure note stated the debenture bonds were issued late in 2013 and have a maturity value of $610 million. The maturity value indicates the amount that White & Decker will pay bondholders in 2033. Each individual bond has a maturity value (face amount) of $1.110. Zero-coupon bonds pay no cash interest during the term to maturity. The company is "accreting" (gradually increasing) the issue price to maturity value using the bonds' effective interest rate computed on an annual basis. (FV of $1, PV of $1, EVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the effective interest rate on the bonds. 2. Determine the issue price in tate 2013 of a single, $1,110 maturity-value bond, (For all requirements, round your answers to 2 decimal places.) Eltective interest rate Issue price

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:Help

Save

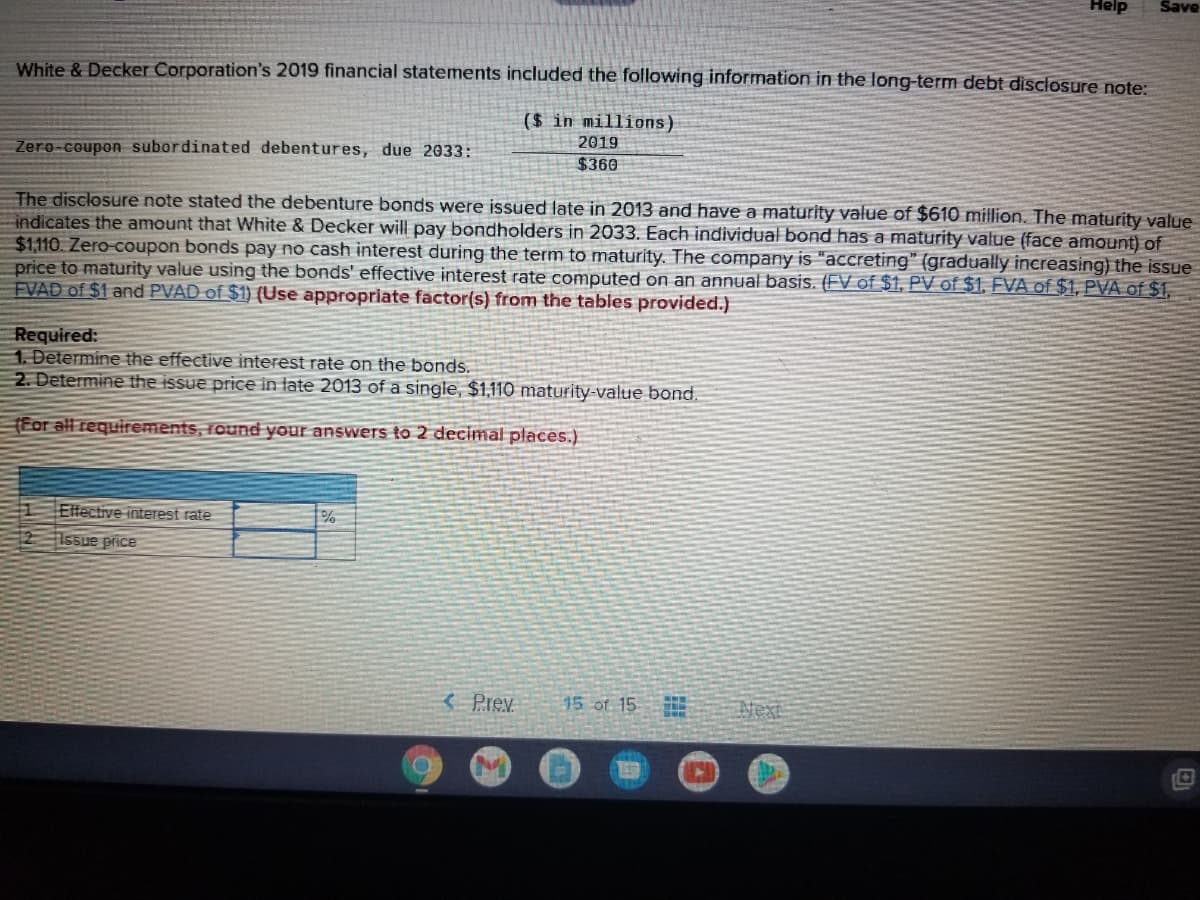

White & Decker Corporation's 2019 financial statements included the following information in the long-term debt disclosure note:

($ in millions)

2019

Zero-coupon subordinated debentures, due 2033:

$360

The disclosure note stated the debenture bonds were issued late in 2013 and have a maturity value of $610 million. The maturity value

indicates the amount that White & Decker will pay bondholders in 2033. Each individual bond has a maturity value (face amount) of

$1,110. Zero-coupon bonds pay no cash interest during the term to maturity. The company is "accreting" (gradually increasing) the issue

price to maturity value using the bonds' effective interest rate computed on an annual basis. (FV of $1, PV of $1, EVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1. Determine the effective interest rate on the bonds.

2. Determine the issue price in late 2013 of a single, $1,110 maturity-value bond.

(For all requirements, round your answers to 2 decimal places.)

Elfective interest rate

Issue price

3 Prev

15 of 15

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT