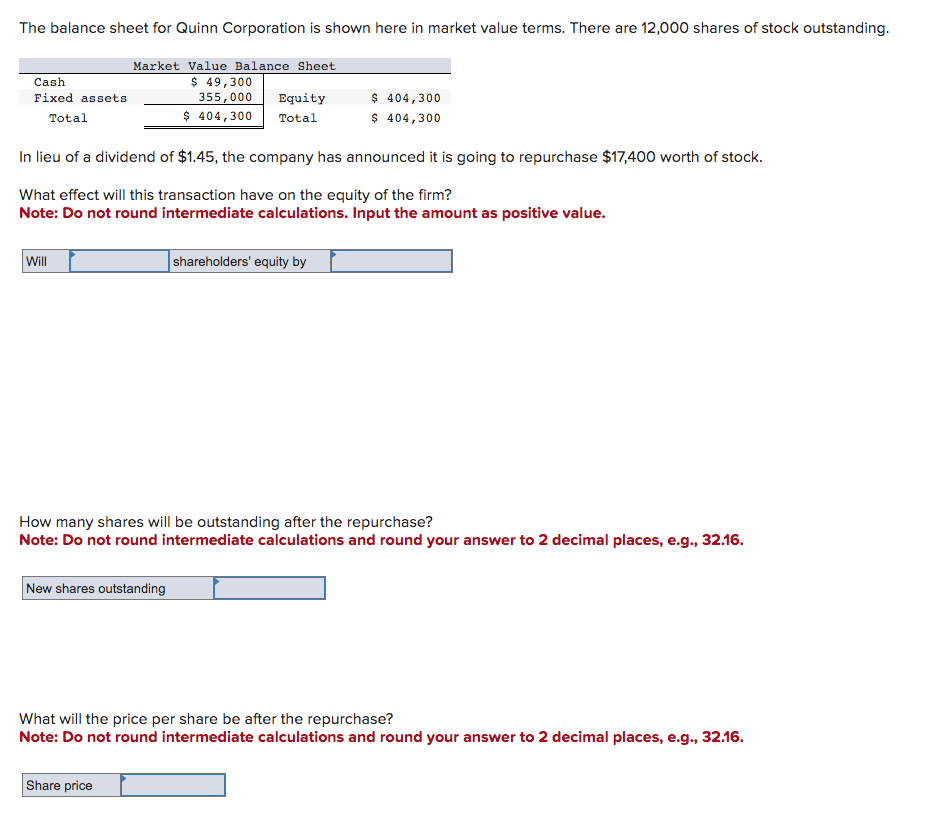

The balance sheet for Quinn Corporation is shown here in market value terms. There are 12,000 shares of stock outstanding. Cash Fixed assets Total Market Value Balance Sheet $ 49,300 355,000 Equity Total $ 404,300 $ 404,300 $ 404,300

The balance sheet for Quinn Corporation is shown here in market value terms. There are 12,000 shares of stock outstanding. Cash Fixed assets Total Market Value Balance Sheet $ 49,300 355,000 Equity Total $ 404,300 $ 404,300 $ 404,300

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 55E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

Transcribed Image Text:The balance sheet for Quinn Corporation is shown here in market value terms. There are 12,000 shares of stock outstanding.

Cash

Fixed assets

Total

Will

Market Value Balance Sheet

$ 49,300

355,000 Equity

$ 404,300 Total

In lieu of a dividend of $1.45, the company has announced it is going to repurchase $17,400 worth of stock.

What effect will this transaction have on the equity of the firm?

Note: Do not round intermediate calculations. Input the amount as positive value.

New shares outstanding

$ 404,300

$ 404,300

shareholders' equity by

How many shares will be outstanding after the repurchase?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

Share price

What will the price per share be after the repurchase?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning