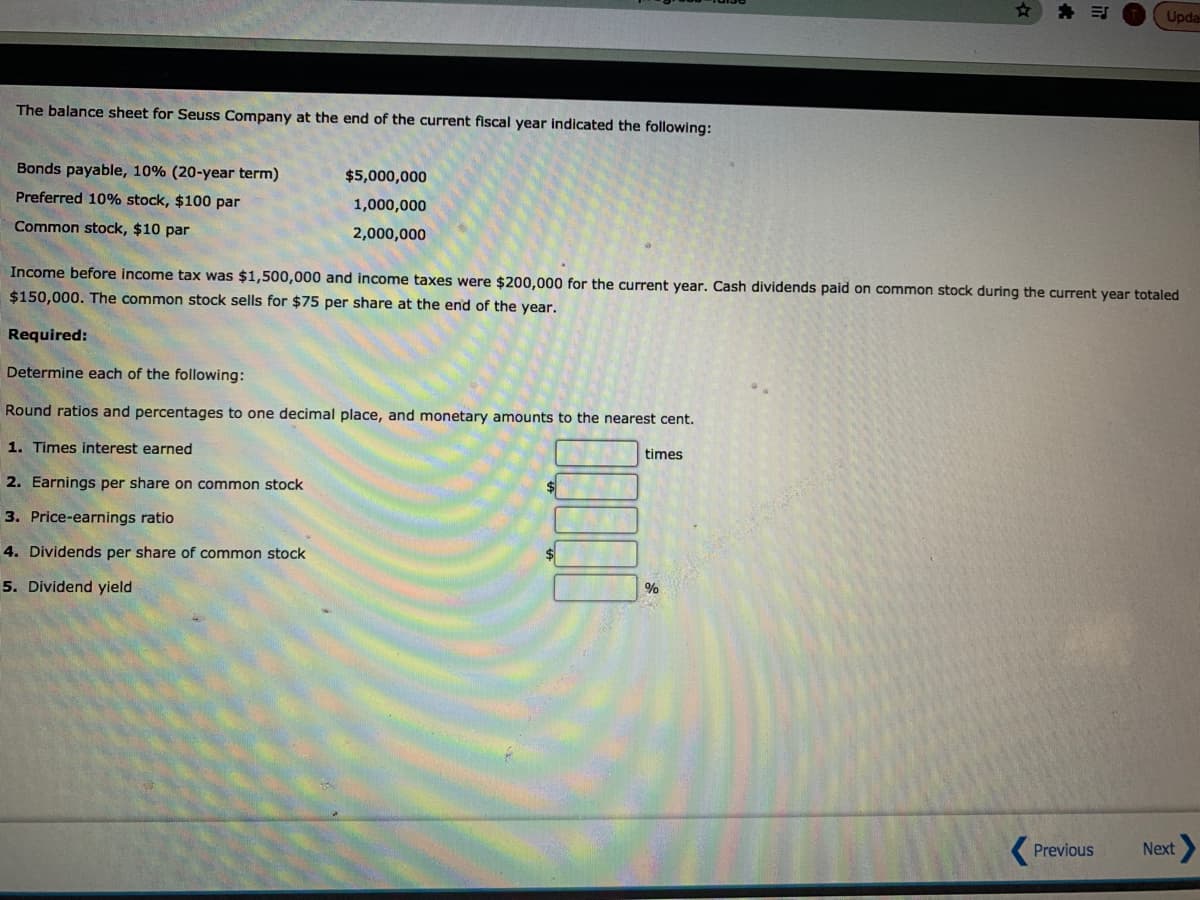

The balance sheet for Seuss Company at the end of the current fiscal year indicated the following: Bonds payable, 10% (20-year term) $5,000,000 Preferred 10% stock, $100 par 1,000,000 Common stock, $10 par 2,000,000 Income before income tax was $1,500,000 and income taxes were $200,000 for the current year. Cash dividends paid on common stock during the current year totaled $150,000. The common stock sells for $75 per share at the end of the year. Required: Determine each of the following: Round ratios and percentages to one decimal place, and monetary amounts to the nearest cent. 1. Times interest earned times 2. Earnings per share on common stock 3. Price-earnings ratio 4. Dividends per share of common stock 5. Dividend yield %

The balance sheet for Seuss Company at the end of the current fiscal year indicated the following: Bonds payable, 10% (20-year term) $5,000,000 Preferred 10% stock, $100 par 1,000,000 Common stock, $10 par 2,000,000 Income before income tax was $1,500,000 and income taxes were $200,000 for the current year. Cash dividends paid on common stock during the current year totaled $150,000. The common stock sells for $75 per share at the end of the year. Required: Determine each of the following: Round ratios and percentages to one decimal place, and monetary amounts to the nearest cent. 1. Times interest earned times 2. Earnings per share on common stock 3. Price-earnings ratio 4. Dividends per share of common stock 5. Dividend yield %

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 20E: Five measures of solvency or profitability The balance sheet for Garcon Inc. at the end of the...

Related questions

Question

Transcribed Image Text:* 司

Upda

The balance sheet for Seuss Company at the end of the current fiscal year indicated the following:

Bonds payable, 10% (20-year term)

$5,000,000

Preferred 10% stock, $100 par

1,000,000

Common stock, $10 par

2,000,000

Income before income tax was $1,500,000 and income taxes were $200,000 for the current year. Cash dividends paid on common stock during the current year totaled

$150,000. The common stock sells for $75 per share at the end of the year.

Required:

Determine each of the following:

Round ratios and percentages to one decimal place, and monetary amounts to the nearest cent.

1. Times interest earned

times

2. Earnings per share on common stock

3. Price-earnings ratio

4. Dividends per share of common stock

5. Dividend yield

%

( Previous

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,