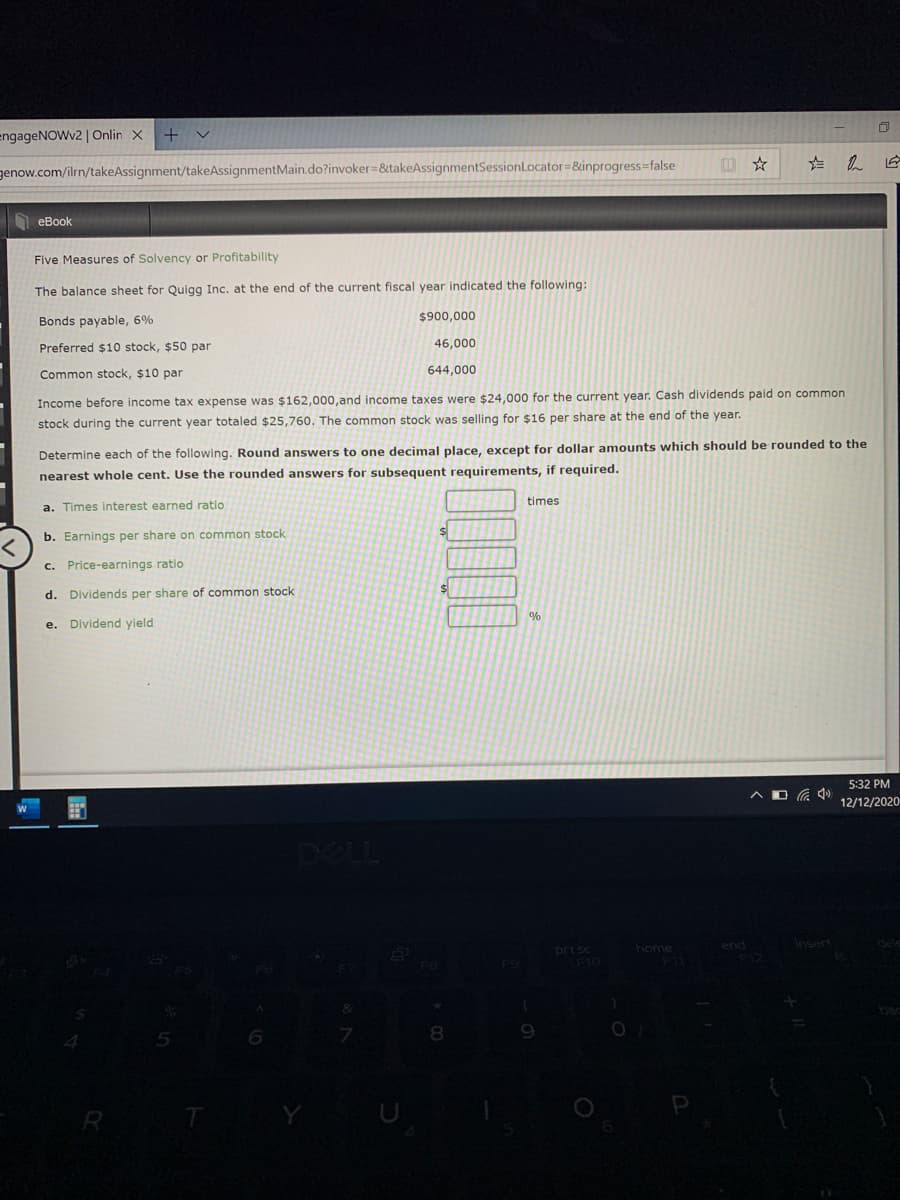

Five Measures of Solvency or Profitability The balance sheet for Quigg Inc. at the end of the current fiscal year indicated the following: Bonds payable, 6% $900,000 Preferred $10 stock, $50 par 46,000 Common stock, $10 par 644,000 Income before income tax expense was $162,000,and income taxes were $24,000 for the current year. Cash dividends paid on common stock during the current year totaled $25,760. The common stock was selling for $16 per share at the end of the year. Determine each of the following. Round answers to one decimal place, except for dollar amounts which should be rounded to the nearest whole cent. Use the rounded answers for subsequent requirements, if required. times a. Times interest earned ratio b. Earnings per share on common stock c. Price-earnings ratio d. Dividends per share of common stock e. Dividend yield

Five Measures of Solvency or Profitability The balance sheet for Quigg Inc. at the end of the current fiscal year indicated the following: Bonds payable, 6% $900,000 Preferred $10 stock, $50 par 46,000 Common stock, $10 par 644,000 Income before income tax expense was $162,000,and income taxes were $24,000 for the current year. Cash dividends paid on common stock during the current year totaled $25,760. The common stock was selling for $16 per share at the end of the year. Determine each of the following. Round answers to one decimal place, except for dollar amounts which should be rounded to the nearest whole cent. Use the rounded answers for subsequent requirements, if required. times a. Times interest earned ratio b. Earnings per share on common stock c. Price-earnings ratio d. Dividends per share of common stock e. Dividend yield

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PB

Related questions

Question

Transcribed Image Text:engageNOWv2 | Onlin X

genow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker &takeAssignmentSessionLocator=&inprogress=false

еВook

Five Measures of Solvency or Profitability

The balance sheet for Quigg Inc. at the end of the current fiscal year indicated the following:

Bonds payable, 6%

$900,000

Preferred $10 stock, $50 par

46,000

Common stock, $10 par

644,000

Income before income tax expense was $162,000,and income taxes were $24,000 for the current year. Cash dividends paid on common

stock during the current year totaled $25,760. The common stock was selling for $16 per share at the end of the year.

Determine each of the following. Round answers to one decimal place, except for dollar amounts which should be rounded to the

nearest whole cent. Use the rounded answers for subsequent requirements, if required.

a. Times interest earned ratio

times

b. Earnings per share on common stock

c. Price-earnings ratio

d. Dividends per share of common stock

e. Dividend yield

5:32 PM

12/12/2020

insert

prt sc

F10

home

end

F12

8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning