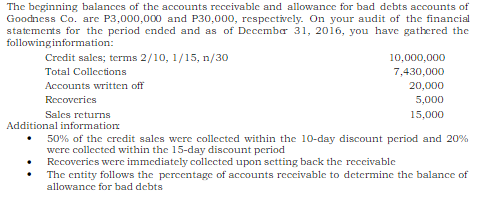

The beginning balances of the accounts reccivable and allowance for bad debts accounts of Goodness Co. are P3,000,000 and P30,000, respectively. On your audit of the financial statements for the period ended and as of December 31, 2016, you have gathered the followinginformation: Credit sales; terms 2/10, 1/15, n/30 10,000,000 Total Collections 7,430,000 Accounts written off 20,000 Recoveries 5,000 Sales returns 15,000 Additional information 50% of the credit sales were collected within the 10-day discount period and 20% were collected within the 15-day discount pcriod Recoveries were immediately collected upon setting back the reccivable The entity follows the percentage of accounts reccivable to determine the balance of allowance for bad debts

The beginning balances of the accounts reccivable and allowance for bad debts accounts of Goodness Co. are P3,000,000 and P30,000, respectively. On your audit of the financial statements for the period ended and as of December 31, 2016, you have gathered the followinginformation: Credit sales; terms 2/10, 1/15, n/30 10,000,000 Total Collections 7,430,000 Accounts written off 20,000 Recoveries 5,000 Sales returns 15,000 Additional information 50% of the credit sales were collected within the 10-day discount period and 20% were collected within the 15-day discount pcriod Recoveries were immediately collected upon setting back the reccivable The entity follows the percentage of accounts reccivable to determine the balance of allowance for bad debts

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.1AP: Allowance Method for Accounting for Bad Debts At the beginning of 2016, Miyazaki Companys Accounts...

Related questions

Question

What is the adjusted balance of the Allowance for

Transcribed Image Text:The beginning balances of the accounts reccivable and allowance for bad debts accounts of

Goodness Co. are P3,000,000 and P30,000, respectively. On your audit of the financial

statements for the period ended and as of Decembar 31, 2016, you have gathered the

followinginformation:

Credit salcs; terms 2/10, 1/15, n/30

Total Collections

10,000,000

7,430,000

Accounts written off

20,000

Recoveries

5,000

Sales returns

15,000

Additional information

50% of the credit sales were collected within the 10-day discount period and 20%

were collected within the 15-day discount period

Recoveries were immediately collected upon setting back the reccivable

The entity follows the percentage of accounts receivable to determine the balance of

allowance for bad debts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning