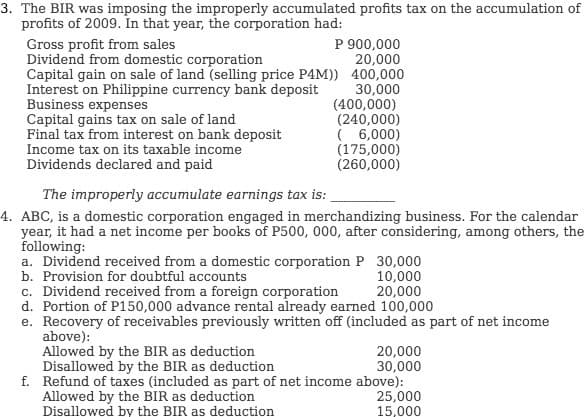

The BIR was imposing the improperly accumulated profits tax on the accumulation of profits of 2009. În that year, the corporation had: Gross profit from sales Dividend from domestic corporation Capital gain on sale of land (selling price P4M)) 400,000 Interest on Philippine currency bank deposit Business expenses Capital gains tax on sale of land Final tax from interest on bank deposit Income tax on its taxable income Dividends declared and paid P 900,000 20,000 30,000 (400,000) (240,000) ( 6,000) (175,000) (260,000) The improperly accumulate earnings tax is:

The BIR was imposing the improperly accumulated profits tax on the accumulation of profits of 2009. În that year, the corporation had: Gross profit from sales Dividend from domestic corporation Capital gain on sale of land (selling price P4M)) 400,000 Interest on Philippine currency bank deposit Business expenses Capital gains tax on sale of land Final tax from interest on bank deposit Income tax on its taxable income Dividends declared and paid P 900,000 20,000 30,000 (400,000) (240,000) ( 6,000) (175,000) (260,000) The improperly accumulate earnings tax is:

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:3. The BIR was imposing the improperly accumulated profits tax on the accumulation of

profits of 2009. In that year, the corporation had:

P 900,000

20,000

Capital gain on sale of land (selling price P4M)) 400,000

30,000

(400,000)

(240,000)

( 6,000)

(175,000)

(260,000)

Gross profit from sales

Dividend from domestic corporation

Interest on Philippine currency bank deposit

Business expenses

Capital gains tax on sale of land

Final tax from interest on bank deposit

Income tax on its taxable income

Dividends declared and paid

The improperly accumulate earnings tax is:

4. ABC, is a domestic corporation engaged in merchandizing business. For the calendar

year, it had a net income per books of P500, 000, after considering, among others, the

following:

a. Dividend received from a domestic corporation P 30,000

b. Provision for doubtful accounts

10,000

20,000

c. Dividend received from a foreign corporation

d. Portion of P150,000 advance rental already earned 100,000

e. Recovery of receivables previously written off (included as part of net income

above):

Allowed by the BIR as deduction

Disallowed by the BIR as deduction

f. Refund of taxes (included as part of net income above):

Allowed by the BIR as deduction

Disallowed by the BIR as deduction

20,000

30,000

25,000

15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you