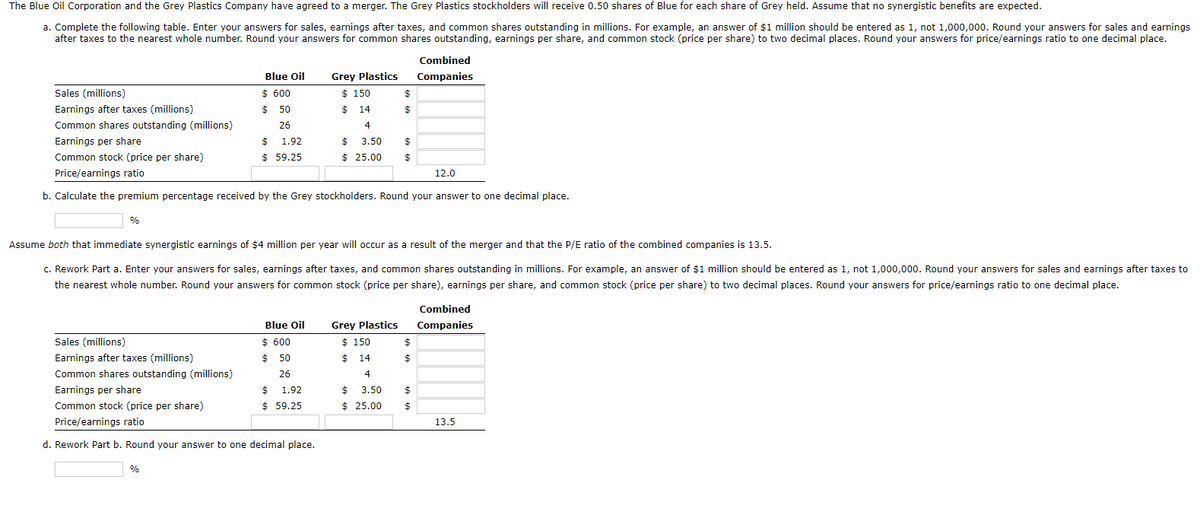

The Blue Oil Corporation and the Grey Plastics Company have agreed to a merger. The Grey Plastics stockholders will receive 0.50 shares of Blue for each share of Grey held. Assume that no synergistic benefits are expected. a. Complete the following table. Enter your answers for sales, earnings after taxes, and common shares outstanding in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers for sales and earnings after taxes to the nearest whole number. Round your answers for common shares outstanding, earnings per share, and common stock (price per share) to two decimal places. Round your answers for price/earnings ratio to one decimal place. % Blue Oil $ 600 $ 50 26 $ 1.92 $59.25 Sales (millions) Earnings after taxes (millions) Common shares outstanding (millions) Earnings per share Common stock (price per share) Price/earnings ratio b. Calculate the premium percentage received by the Grey stockholders. Round your answer to one decimal place. % Blue Oil $ 600 $ 50 26 Sales (millions) Earnings after taxes (millions) Common shares outstanding (millions) Earnings per share Common stock (price per share) Price/earnings ratio d. Rework Part b. Round your answer to one decimal place. Grey Plastics $ 150 $ 14 4 $ 3.50 $ 1.92 $ 59.25 Assume both that immediate synergistic earnings of $4 million per year will occur as a result of the merger and that the P/E ratio of the combined companies is 13.5. c. Rework Part a. Enter your answers for sales, earnings after taxes, and common shares outstanding in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers for sales and earnings after taxes to the nearest whole number. Round your answers for common stock (price per share), earnings per share, and common stock (price per share) to two decimal places. Round your answers for price/earnings ratio to one decimal place. $ $25.00 $ $ $ Grey Plastics $ 150 $14 4 $ 3.50 $ 25.00 Combined Companies $ $ $ $ 12.0 Combined Companies 13.5

The Blue Oil Corporation and the Grey Plastics Company have agreed to a merger. The Grey Plastics stockholders will receive 0.50 shares of Blue for each share of Grey held. Assume that no synergistic benefits are expected. a. Complete the following table. Enter your answers for sales, earnings after taxes, and common shares outstanding in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers for sales and earnings after taxes to the nearest whole number. Round your answers for common shares outstanding, earnings per share, and common stock (price per share) to two decimal places. Round your answers for price/earnings ratio to one decimal place. % Blue Oil $ 600 $ 50 26 $ 1.92 $59.25 Sales (millions) Earnings after taxes (millions) Common shares outstanding (millions) Earnings per share Common stock (price per share) Price/earnings ratio b. Calculate the premium percentage received by the Grey stockholders. Round your answer to one decimal place. % Blue Oil $ 600 $ 50 26 Sales (millions) Earnings after taxes (millions) Common shares outstanding (millions) Earnings per share Common stock (price per share) Price/earnings ratio d. Rework Part b. Round your answer to one decimal place. Grey Plastics $ 150 $ 14 4 $ 3.50 $ 1.92 $ 59.25 Assume both that immediate synergistic earnings of $4 million per year will occur as a result of the merger and that the P/E ratio of the combined companies is 13.5. c. Rework Part a. Enter your answers for sales, earnings after taxes, and common shares outstanding in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers for sales and earnings after taxes to the nearest whole number. Round your answers for common stock (price per share), earnings per share, and common stock (price per share) to two decimal places. Round your answers for price/earnings ratio to one decimal place. $ $25.00 $ $ $ Grey Plastics $ 150 $14 4 $ 3.50 $ 25.00 Combined Companies $ $ $ $ 12.0 Combined Companies 13.5

Chapter23: Corporate Restructuring

Section: Chapter Questions

Problem 1P

Related questions

Question

Ee 111.

Transcribed Image Text:The Blue Oil Corporation and the Grey Plastics Company have agreed to a merger. The Grey Plastics stockholders will receive 0.50 shares of Blue for each share of Grey held. Assume that no synergistic benefits are expected.

a. Complete the following table. Enter your answers for sales, earnings after taxes, and common shares outstanding in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers for sales and earnings

after taxes to the nearest whole number. Round your answers for common shares outstanding, earnings per share, and common stock (price per share) to two decimal places. Round your answers for price/earnings ratio to one decimal place.

%

Blue Oil

$ 600

$ 50

26

1.92

$59.25

Sales (millions)

Earnings after taxes (millions)

Common shares outstanding (millions)

Earnings per share

Common stock (price per share)

Price/earnings ratio

b. Calculate the premium percentage received by the Grey stockholders. Round your answer to one decimal place.

$

%

Grey Plastics

$ 150

$14

Blue Oil

$ 600

$ 50

26

$ 1.92

$59.25

Sales (millions)

Earnings after taxes (millions)

Common shares outstanding (millions)

Earnings per share

Common stock (price per share)

Price/earnings ratio

d. Rework Part b. Round your answer to one decimal place.

4

$ 3.50

$ 25.00

$

$

Assume both that immediate synergistic earnings of $4 million per year will occur as a result of the merger and that the P/E ratio of the combined companies is 13.5.

c. Rework Part a. Enter your answers for sales, earnings after taxes, and common shares outstanding in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers for sales and earnings after taxes to

the nearest whole number. Round your answers for common stock (price per share), earnings per share, and common stock (price per share) to two decimal places. Round your answers for price/earnings ratio to one decimal place.

Grey Plastics

$150

$14

4

$ 3.50

$25.00

$

$

Combined

Companies

$

$

$

$

12.0

Combined

Companies

13.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning