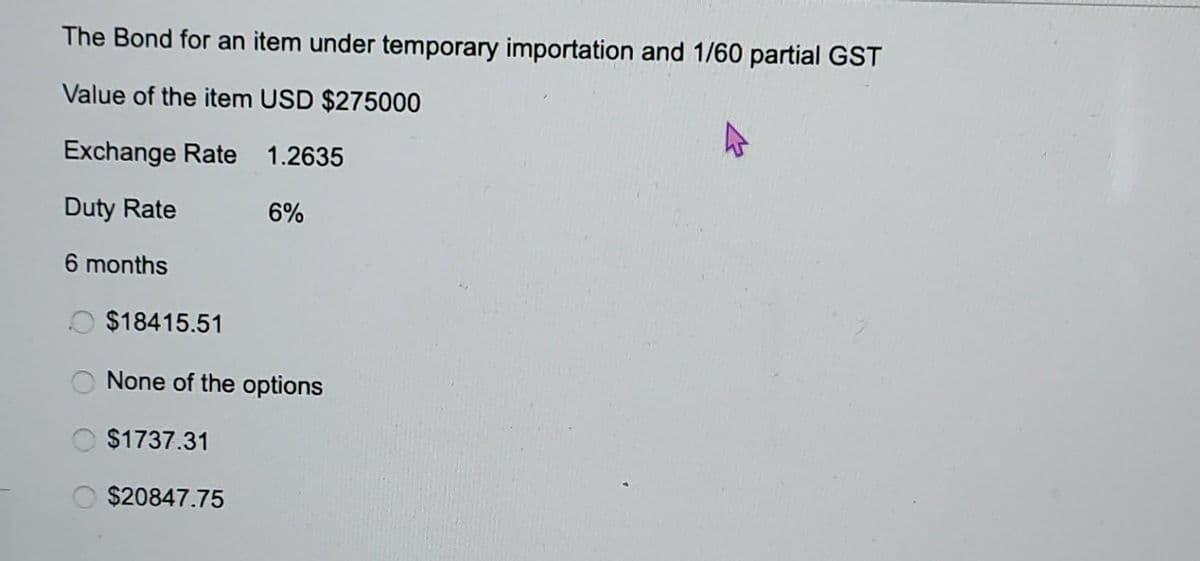

The Bond for an item under temporary importation and 1/60 partial GST Value of the item USD $275000 Exchange Rate 1.2635 Duty Rate 6 months 6%

Q: A Company produces items to order and had the following budgeted overheads for the year on normal…

A: Lets understand the basics. Overhead absorption rate is a rate based on which overhead gets…

Q: The debits and credits from four related transactions, (1) through (4), are presented in the…

A: Note: 1/10, n/30: Here, 1 represent the discount rate if payment is made within ten days. And if…

Q: Assuming that Sales Discounts is treated as a contra-revenue, compute net sales for the two months…

A: Sales discount is the discount which has been given by the corporation to the customers which has…

Q: The following shows the time in hours between towns in Jamaica: Alexandria - Brown's Town…

A: Shortest time: It is the time the alexndria takes to reach guy's hill. To calculate shortest time we…

Q: Delta Company manufactures drills and sells them to distributors. In its first year of operations,…

A: Cost of Goods Sold is calculated by adding the value of inventory at the beginning of the year with…

Q: Calculate William's maximum depreciation deduction for 2021, assuming he uses the automobile 100…

A: answer: First of all let us understand MARCS method, The full form of MACRS is a modified…

Q: On 1 July 2020, Big Ltd acquired all the issued share capital of Small Ltd for cash for an amount of…

A: In case one company overtake the assets and liabilities of another company , then accounting for…

Q: Sophia invests $100 at the end of each year for 9 years at an annual effective interest rate of 4%.…

A: SOLUTION:- Sophia Year Investment New Value Interest @ 4% Accumulated…

Q: Question 5 Bee-In-The-Bonnet Company purchased office supplies costing $8,000 and debited Supplies…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Budgeted Income Statement and Balance Sheet As a preliminary to requesting budget estimates of…

A: Budgeted Income Statement A planned financial statements, also known as a budgeted income statement,…

Q: The A and B Partnership was formed on January 2, 2022. Under the partnership agreement, each partner…

A: Under Bonus Method, the amount pf Bonus shall be computed as follows, Amount of Bonus = Total…

Q: E3-7 Recording Journal Entries LO3-4 Sysco Corporation, formed in 1969, is the largest global…

A: Journal entry: It implies to the process of accounting company's financial transactions in it's…

Q: 4.1 Calculate the combined value of the proposed acquisition. 4.2 Calculate the total number of…

A: SOLUTION:- 4.1 Combined value of the proposed acquisition will be: Value of Watford Refiners +…

Q: QUESTION 2 Alyna owns a sole trading business that sells kids clothing. She purchased stocks from…

A:

Q: The following cash budget is for the third quarter of this year. Solve for the missing numbers on…

A: A cash budget has several advantages, including : 1. It forces the business to think about and…

Q: A and B enter into a partnership agreement contributing their respective business' assets at fair…

A:

Q: understand

A: Sales Discount refers to reduced price offered by a company for sale of product in the market.…

Q: Determine the correct inventory amount. E6.1 (LO 1), AN Umatilla Bank and Trust is considering…

A: Ending inventory is the pricing of the goods still in stock at the end of a reporting period. The…

Q: hat are 3 publicly traded corporations. For each corporation you need to provide URL link for…

A: Publicly traded corporations are those corporations, whose shares are available for general public.…

Q: XYZ Inc is preparing the October month-end Bank Reconciliation. The balance in the cash ledger on…

A: Bank reconciliation statement is the one which is prepared in order to reconcile the errors in…

Q: Prepare: Journal Entry T Account (Ledger Account) 2020 Details of Transactions Jan- 01…

A: Journal Entry : It is a record of every business transaction in day-to-day operations of the…

Q: The balance in the supplies account before adjustment at the end of the year is $766. The proper…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Need help with the balance sheet liabilities part and to make sure the assets are correct

A: Balance Sheet An organization's properties, obligations, and capital employed are listed on a…

Q: For the given corporate bond, whose annual simple interest rate is provided, find the semiannual…

A: BOND Bond are Shown Under Non Current Liabilities in the Balance sheet Of the Company. Bond is…

Q: Kim is a furniture retailer. She can buy a dining table for a list price of $1,600 with a 25% trade…

A: Discount allowed is the amount that is allowed by a supplier to its customer on account of the bulk…

Q: A Trinidad Bauxite Corporation, Sparrow, acquired mineral rights for $58,500,000. The mineral…

A: The question is based on the concept of Financial Accounting. The terms "depletion" and…

Q: Prepare the appropriate journal entries for Macy Company to record each of the May transactions.…

A: Perpetual Inventory System is one of the method of Inventory keeping. It maintain running balances…

Q: Happy Citrus started selling franchise locations in April 2026. The franchisee pays continuing fees…

A: Introduction to the IFRS 15 International Financial reporting standards (IFRS) 15 - This standard…

Q: Jerry and Sherry own and operate a partnership. Jerry’s capital balance is $50,000 and Sherry’s is…

A: A partnership is an association of businesses in which more than one person invests money, engages…

Q: A, B, C are new lawyers and are decided to form a partnership. . A is to contribute cash of P50,000…

A: Journal entries refers to the entries which are passed by the companies at the end of the accounting…

Q: The following information is for Acme Auto Supplies: Trademark Land Buildings Less Accum.…

A: Current assets: Current assets are those assets that are expected to be sold,collected or used…

Q: Question 2 On September 1, 2022, Alpha Co borrowed $10,000,000 for a term of 1 year at an interest…

A: Borrowing cost means where the assets like building , take substantial time to build , then interest…

Q: The following selected transactions were completed by Betz Company during July of the current year.…

A: Every organization, big or small, must record its financial transactions in its books. The first…

Q: Question 3 At the end of the year, a deductible temporary difference of $40 million has been…

A: When there is a difference in amounts of tax base and accounting base of assets and liabilities it…

Q: inden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: 28/9 Paid wages to shop assistant by cheque, $1,200. REQUIRED: Prepare a Three-column Cash Book,…

A: Cash Book (Triple Coloum) The most thorough type of cash book has triple currency columns on both…

Q: Pressure Pumps Corporation, a manufacturer of industrial pumps, reports the following results for…

A: Retained Earnings Statement is a statement showing the opening retained earnings, net income earned…

Q: Based on the background example of this assignment, kindly provide answer/working of this assignment…

A: Liquidity, acid test, and debt ratios are some of the most important ratios. These ratios help the…

Q: er Company entered into the following transactions involving short-term liabilities. (Use 360 days a…

A: Interest expense refers to the expense born by an entity in order to take loan or get the loan…

Q: On January 1, 2022, A, B and C formed ABC Partnership with agreed capital of P1,200,000 or P400,000…

A: Lets understand the basics. Partnership is an agreement between two or more person who works…

Q: BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its…

A: The calculation related to FUTA and SUTA are made in the excel sheet and the calculation work is…

Q: The supplies account had a balance of $1,443 at the beginning of the year and was debited during the…

A: Supplies account refers to the account which has a normal debit balance and is used to record the…

Q: Number of Units Cost per unit Opening inventory, May 1…

A: Every organization has some inventory for the purpose of sale. The company should determine the flow…

Q: a) Diana started her business on 1 July 2021. transactions during July 2021 were as follows: Date…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: 2. Journalize the necessary entries (a.) that increase cash and (b.) that decrease cash. The…

A: A journal is a detailed account that records all the financial transactions of a business, to be…

Q: Mr. Josh Kho, the operations manager of Achos Merchandising Corp. Is worried about the result of its…

A: Since you have posted a question with multiple sub-parts, we are allowed to do only first three…

Q: Explain the presentation of a multiple-step income statement,

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Find the payment necessary to amortize a 8% loan of $800 compounded quarterly, with 9 quarterly…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: 2. Sales Invoice #121 Dated: July 4, 2025 To FIX IT, $900 plus $117 HST for

A: The sale of welding a trailer for a cattle farmer should be recorded as revenue in the company's…

Q: Host nations have adopted competition policy and anti-dumping law. a. Why do multinational…

A: Host nations have adopted competition policy and anti-dumping law. In addition, the host countries…

6.

Step by step

Solved in 2 steps

- Brief Exercise (Appendix 9A) Bond Issue Price On January 1, 2020, Ruby Inc. issued 3,000 $1,000 par value bonds with a staled rate of6% and a 10-year maturity. Interest is payable semiannually on June 30 and December 31. Required: What is the issue price if the bonds are sold to yield 8%? {Note: Round to nearest dollar.)Wilbury Corporation issued 1 million of 13.5% bonds for 985,071.68. The bonds are dated and issued October 1, 2019, are due September 30, 2020, and pay interest semiannually on March 31 and September 30. Assume an effective yield rate of 14%. Required: 1. Prepare a bond interest expense and discount amortization schedule using the straight-line method. 2. Prepare a bond interest expense and discount amortization schedule using the effective interest method. 3. Prepare adjusting entries for the end of the fiscal year December 31, 2019, using the: a. straight-line method of amortization b. effective interest method of amortization 4. If income before interest and income taxes of 30% in 2020 is 500,000, compute net income under each alternative. 5. Assume the company retired the bonds on June 30, 2020, at 98 plus accrued interest. Prepare the journal entries to record the bond retirement using the: a. straight line method of amortization b. effective interest method of amortization 6. Compute the companys times interest earned (pretax operating income divided by interest expense) for 2020 under each alternative.Date of purchase: January 1, 2021 Purchase price: P4,200,000 Principal amount: P4,000,000 Cash interest: 5% per annum, payable on December 31 Effective interest: 3.8806% per annum Maturity date: December 31, 2025 Fair value of the bond: December 31, 2021 P4,894,000 December 31, 2022 P4,560,000 The bond was sold on December 31, 2022 at its fair value. If the bonds are held for collection of contractual cash flow and for sale of financial asset, what amount to be recognized in 2022 in the Profit or Loss?

- Tony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has projected the following amortization schedule from issuance until maturity: Date Cash Paid InterestExpense Increase inCarrying Value CarryingValue 01/01/2021 331,652 06/30/2021 10,500 13,266 2,766 334,418 12/31/2021 10,500 13,377 2,877 337,295 06/30/2022 10,500 13,492 2,992 340,287 12/31/2022 10,500 13,611 3,111 343,398 06/30/2023 10,500 13,736 3,236 346,634 12/31/2023 10,500 13,866 3,366 350,000 What is the annual market interest rate on the bonds? (Hint: Be sure to provide the annual rate rather than the six-month rate.) (Do not round your intermediate calculations.) Multiple Choice 6%. 3%. 7%. 8%.Tony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has projected the following amortization schedule from issuance until maturity: Date Cash Paid InterestExpense Increase inCarrying Value CarryingValue 01/01/2021 332,789 06/30/2021 17,500 19,967 2,467 335,256 12/31/2021 17,500 20,115 2,615 337,871 06/30/2022 17,500 20,272 2,772 340,643 12/31/2022 17,500 20,439 2,939 343,582 06/30/2023 17,500 20,615 3,115 346,697 12/31/2023 17,500 20,803 3,303 350,000 THA issued the bonds for: Multiple Choice $350,000. $332,789. $455,000. Cannot be determined from the given information.6. [HW] $100,000 bond redeemable at par on October 1, 2038, is purchased on January 15, 2017. Interest is 5.9% payable semi-annually and the yield is 9% compounded semi-annually. a) What is the cash price of the bond? b) What is the accrued interest? c) What is the purchase price? SDT = CPN = RDT = RV = ACT 2/Y YLD = PRI = AI = a) $70,634.65 b) $1718.13 c) 72,352.78

- Tony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has projected the following amortization schedule from issuance until maturity: Date Cash Paid InterestExpense Increase inCarrying Value Carrying value 01/01/2021 $341,728 06/30/2021 $14,400 $17,086 $2,686 344,414 12/31/2021 14,400 17,221 2,821 347,235 06/30/2022 14,400 17,362 2,962 350,197 12/31/2022 14,400 17,510 3,110 353,307 06/30/2023 14,400 17,665 3,265 356,572 12/31/2023 14,400 17,828 3,428 360,000 THA buys back the bonds for $345,005 immediately after the interest payment on 12/31/2021 and retires them. What gain or loss, if any, would THA record on this date? Multiple Choice $3,277 loss. $2,230 gain. $14,995 gain. No gain or loss.An investor invested in a 4-years, 4 percent EuroLBP bond sells at par. A comparable risk 4 years, 5.5 percent LBP/dollar dual currency bond pays $666.66 at maturity per LBP1,000,000 of face value. It sells for 1,200,000. Required: Calculate the implied LBP/$ exchange rate at maturity.On 1 January 20X3, XYZ bought a $200,000 5% bond at nominal value. Interest is received in arrears. The bond will be redeemed at a premium of $26,225 over nominal value on 31 December 20X5. The effective rate of interest is 9%. The fair value of the bond was as follows: 31 Dec 20X3: $212,000 31 Dec 20X4: $215,000 Required: Show your calculations how the bond will be accounted for at the years ended 31 December 20X3 and 20X4 if: a) XYZ's business model is to trade bonds in the short term. Assume that XYZ sold this bond for its fair value of on 1 January 20X4. b) XYZ’s business model is to hold bonds until the redemption date. c) XYZ's business model is to hold bonds until redemption but also to sell them if investments with higher returns become available.

- The current US 10-year Tresury Note is quoted at a bid-offer spread of 100-16 to 100-17^+. A bond dealer is asked to sell $100m of these Treasury Notes is most likely to show a price offer of:A. 100.546875B. 100.1650C. 100.500 Please show work!!!Lopez Plastics Co. (LPC) issued callable bonds on January 1, 2021. LPC's accountant has projected the following amortization schedule from issuance until maturity: Date Cashinterest Effectiveinterest Decrease inbalance Outstandingbalance 1/1/2021 $ 207,020 6/30/2021 $ 7,000 $ 6,211 $ 789 206,230 12/31/2021 7,000 6,187 813 205,417 6/30/2022 7,000 6,163 837 204,580 12/31/2022 7,000 6,137 863 203,717 6/30/2023 7,000 6,112 888 202,829 12/31/2023 7,000 6,085 915 201,913 6/30/2024 7,000 6,057 943 200,971 12/31/2024 7,000 6,029 971 200,000 What is the annual effective interest rate on the bonds?Bond Premium and Discount Markway Inc. is contemplating selling bonds. The issue is to be composed of 750 bonds, each with a face amount of $800. 4. Calculate how much Markway is able to borrow if each bond is sold at 103% of par.$fill in the blank 23f1fdf81fe3f91_4 5. Assume that the bonds are sold for $625 each. Prepare the entry to recognize the sale of the 750 bonds. Cash fill in the blank 2552a6f29fa5030_2 fill in the blank 2552a6f29fa5030_3 Discount on Bonds Payable fill in the blank 2552a6f29fa5030_5 fill in the blank 2552a6f29fa5030_6 Bonds Payable fill in the blank 2552a6f29fa5030_8 fill in the blank 2552a6f29fa5030_9 Record issuance of bonds at discount 6. Assume that the bonds are sold for $900 each. Prepare the entry to recognize the sale of the 750 bonds. Cash fill in the blank 1d87ca07df94044_2 fill in the blank 1d87ca07df94044_3 Premium on Bonds Payable fill in the blank 1d87ca07df94044_5 fill in the blank…