28/9 Paid wages to shop assistant by cheque, $1,200. REQUIRED: Prepare a Three-column Cash Book, balancing it at 30 September 2021. Bring down the balances to 1 October 2021.

28/9 Paid wages to shop assistant by cheque, $1,200. REQUIRED: Prepare a Three-column Cash Book, balancing it at 30 September 2021. Bring down the balances to 1 October 2021.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 2SEQ

Related questions

Question

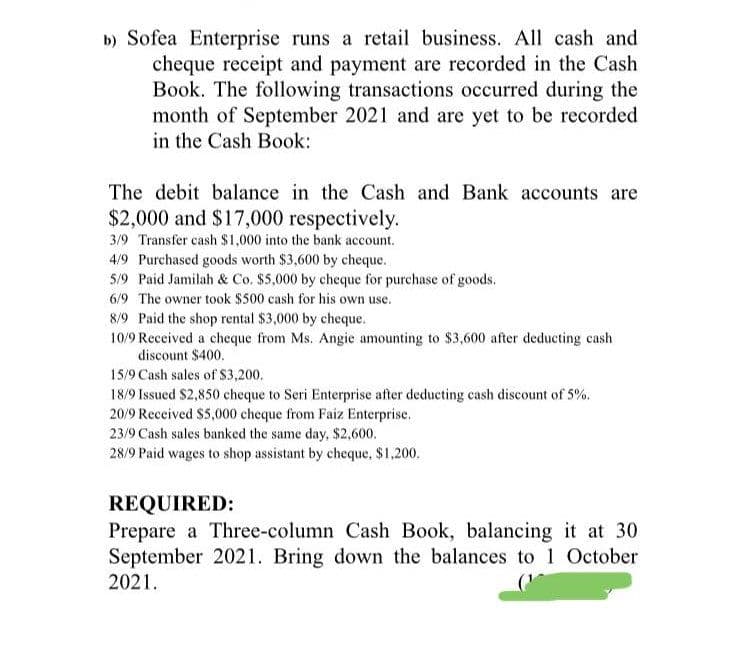

Transcribed Image Text:b) Sofea Enterprise runs a retail business. All cash and

cheque receipt and payment are recorded in the Cash

Book. The following transactions occurred during the

month of September 2021 and are yet to be recorded

in the Cash Book:

The debit balance in the Cash and Bank accounts are

$2,000 and $17,000 respectively.

3/9 Transfer cash $1,000 into the bank account.

4/9 Purchased goods worth $3,600 by cheque.

5/9 Paid Jamilah & Co. $5,000 by cheque for purchase of goods.

6/9 The owner took $500 cash for his own use.

8/9 Paid the shop rental $3,000 by cheque.

10/9 Received a cheque from Ms. Angie amounting to $3,600 after deducting cash

discount $400.

15/9 Cash sales of $3,200.

18/9 Issued $2,850 cheque to Seri Enterprise after deducting cash discount of 5%.

20/9 Received $5,000 cheque from Faiz Enterprise.

23/9 Cash sales banked the same day, $2,600.

28/9 Paid wages to shop assistant by cheque, $1,200.

REQUIRED:

Prepare a Three-column Cash Book, balancing it at 30

September 2021. Bring down the balances to 1 October

2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub