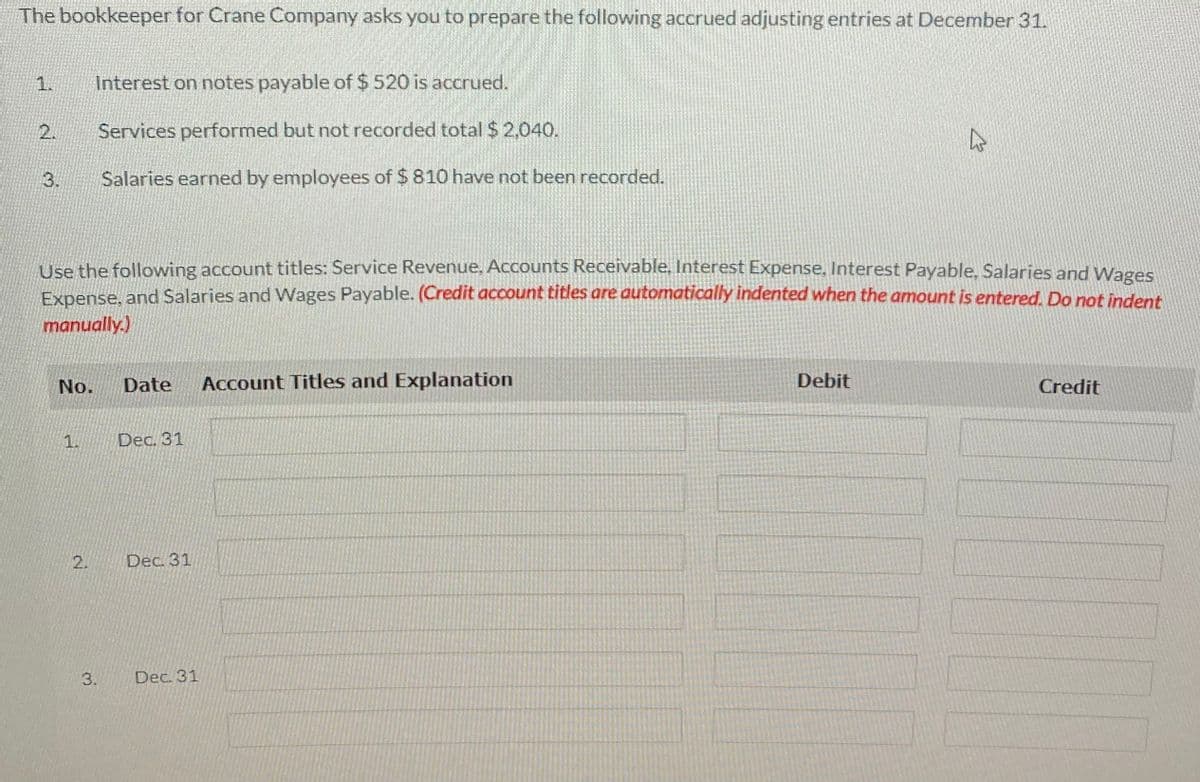

The bookkeeper for Crane Company asks you to prepare the following accrued adjusting entries at December 31. 1. Interest on notes payable of $ 520 is accrued. 2. Services performed but not recorded total $ 2,040. 3. Salaries earned by employees of $ 810 have not been recorded. Use the following account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Was Expense, and Salaries and Wages Payable. (Credit account titles are automatically indented when the amount is entered. Do not ind manually.) No. Date Account Titles and Explanation Debit Credit

The bookkeeper for Crane Company asks you to prepare the following accrued adjusting entries at December 31. 1. Interest on notes payable of $ 520 is accrued. 2. Services performed but not recorded total $ 2,040. 3. Salaries earned by employees of $ 810 have not been recorded. Use the following account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Was Expense, and Salaries and Wages Payable. (Credit account titles are automatically indented when the amount is entered. Do not ind manually.) No. Date Account Titles and Explanation Debit Credit

Chapter5: Completing The Accounting Cycle

Section: Chapter Questions

Problem 3EB: For each of the following accounts, identify whether it would be closed at year-end (yes or no) and...

Related questions

Question

Transcribed Image Text:The bookkeeper for Crane Company asks you to prepare the following accrued adjusting entries at December 31.

1.

Interest on notes payable of $ 520 is accrued.

2.

Services performed but not recorded total $ 2,040.

3.

Salaries earned by employees of $810 have not been recorded.

Use the following account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Wages

Expense, and Salaries and Wages Payable. (Credit account titles are automatically indented when the amount is entered, Do not indent

manually.)

No.

Date

Account Titles and Explanation

Debit

Credit

1.

Dec. 31

2.

Dec. 31

3.

Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning