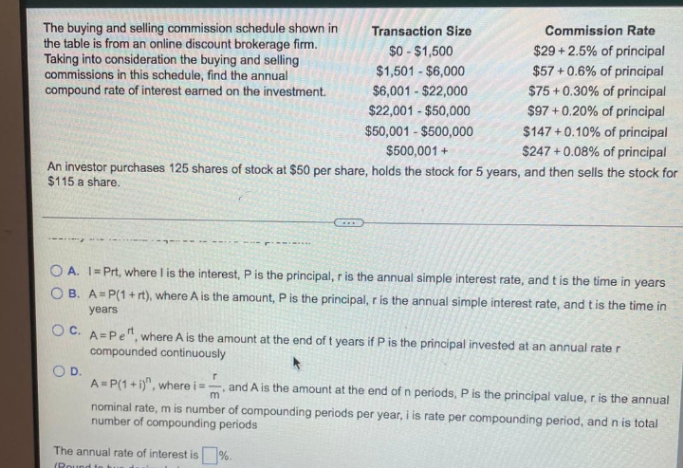

The buying and selling commission schedule shown in the table is from an online discount brokerage firm. Taking into consideration the buying and selling commissions in this schedule, find the annual compound rate of interest earned on the investment. Transaction Size Commission Rate $0 - $1,500 $1,501 - $6,000 $29 + 2.5% of principal $57 + 0.6% of principal $6,001 - $22,000 $75 + 0.30% of principal $97 +0.20% of principal $147 +0.10% of principal $247 + 0.08% of principal An investor purchases 125 shares of stock at $50 per share, holds the stock for 5 years, and then sells the stock for $22,001 - $50,000 $50,001 - $500,000 $500,001 + $115 a share. क O A. I-Prt, where I is the interest, Pis the principal, r is the annual simple interest rate, and t is the time in years OB. A-P(1+ rt), where A is the amount, Pis the principal, r is the annual simple interest rate, and tis the time in years O C. A-Pe" where A is the amount at the end of t years if P is the principal invested at an annual rate r compounded continuously OD. A P(1+)", where i- nominal rate, m is number of compounding periods per year, i is rate per compounding period, and n is total number of compounding periods and A is the amount at the end of n periods, P is the principal value, r is the annual The annual rate of interest is%.

The buying and selling commission schedule shown in the table is from an online discount brokerage firm. Taking into consideration the buying and selling commissions in this schedule, find the annual compound rate of interest earned on the investment. Transaction Size Commission Rate $0 - $1,500 $1,501 - $6,000 $29 + 2.5% of principal $57 + 0.6% of principal $6,001 - $22,000 $75 + 0.30% of principal $97 +0.20% of principal $147 +0.10% of principal $247 + 0.08% of principal An investor purchases 125 shares of stock at $50 per share, holds the stock for 5 years, and then sells the stock for $22,001 - $50,000 $50,001 - $500,000 $500,001 + $115 a share. क O A. I-Prt, where I is the interest, Pis the principal, r is the annual simple interest rate, and t is the time in years OB. A-P(1+ rt), where A is the amount, Pis the principal, r is the annual simple interest rate, and tis the time in years O C. A-Pe" where A is the amount at the end of t years if P is the principal invested at an annual rate r compounded continuously OD. A P(1+)", where i- nominal rate, m is number of compounding periods per year, i is rate per compounding period, and n is total number of compounding periods and A is the amount at the end of n periods, P is the principal value, r is the annual The annual rate of interest is%.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.6E

Related questions

Question

Transcribed Image Text:The buying and selling commission schedule shown in

the table is from an online discount brokerage firm.

Taking into consideration the buying and selling

commissions in this schedule, find the annual

compound rate of interest earned on the investment.

Transaction Size

Commission Rate

$0 - $1,500

$29 +2.5% of principal

$57 + 0.6% of principal

$1,501 - $6,000

$6,001 - $22,000

$75 + 0.30% of principal

$97 + 0.20% of principal

$147 +0.10% of principal

$247 + 0.08% of principal

An investor purchases 125 shares of stock at $50 per share, holds the stock for 5 years, and then sells the stock for

$22,001 - $50,000

$50,001 - $500,000

$500,001 +

$115 a share.

O A. I= Prt, where I is the interest, P is the principal, r is the annual simple interest rate, and t is the time in years

O B. A=P(1+ rt), where A is the amount, P is the principal, r is the annual simple interest rate, and t is the time in

years

OC. A=Pe", where A is the amount at the end of t years if P is the principal invested at an annual rate r

compounded continuously

OD.

A= P(1 + i)", where is

-, and A is the amount at the end of n periods, P is the principal value, r is the annual

nominal rate, m is number of compounding periods per year, i is rate per compounding period, and n is total

number of compounding periods

The annual rate of interest is %.

(Round

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning