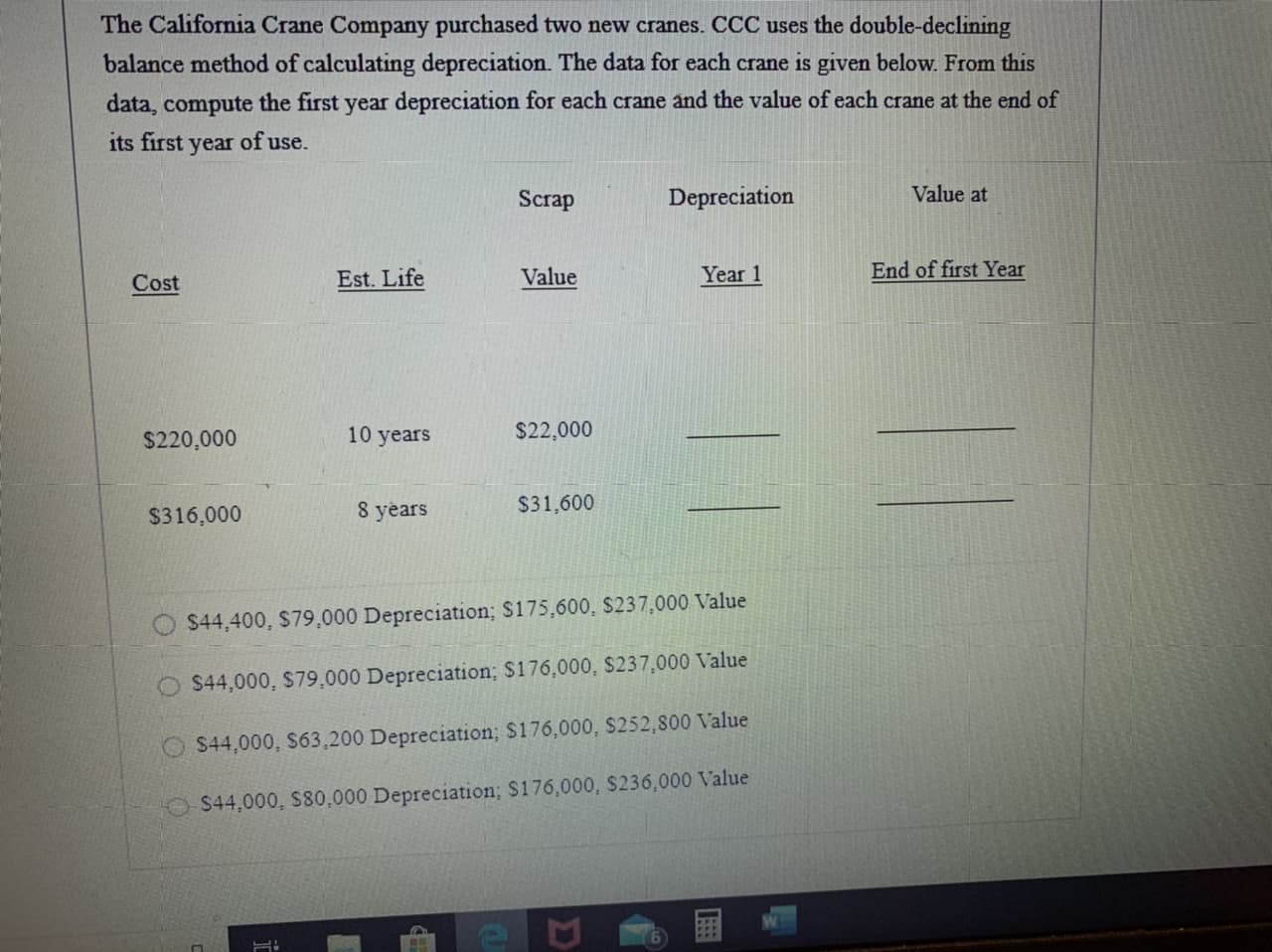

The California Crane Company purchased two new cranes. CCC uses the double-declining balance method of calculating depreciation. The data for each crane is given below. From this data, compute the first year depreciation for each crane and the value of each crane at the end of its first year of use. Scrap Depreciation Value at Cost Est. Life Value Year 1 End of first Year $220,000 10 years $22,000 $316,000 8 years $31,600 $44,400, $79,000 Depreciation; $175,600, $237,000 Value O $44,000, $79,000 Depreciation; $176,000, $237,000 Value S44,000, S63,200 Depreciation; $176,000, $252,800 Value S44,000, S80,000 Depreciation; S176,000, S236,000 Value

The California Crane Company purchased two new cranes. CCC uses the double-declining balance method of calculating depreciation. The data for each crane is given below. From this data, compute the first year depreciation for each crane and the value of each crane at the end of its first year of use. Scrap Depreciation Value at Cost Est. Life Value Year 1 End of first Year $220,000 10 years $22,000 $316,000 8 years $31,600 $44,400, $79,000 Depreciation; $175,600, $237,000 Value O $44,000, $79,000 Depreciation; $176,000, $237,000 Value S44,000, S63,200 Depreciation; $176,000, $252,800 Value S44,000, S80,000 Depreciation; S176,000, S236,000 Value

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PA: Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value...

Related questions

Question

Transcribed Image Text:The California Crane Company purchased two new cranes. CCC uses the double-declining

balance method of calculating depreciation. The data for each crane is given below. From this

data, compute the first year depreciation for each crane and the value of each crane at the end of

its first year of use.

Scrap

Depreciation

Value at

Cost

Est. Life

Value

Year 1

End of first Year

$220,000

10 years

$22,000

$316,000

8 years

$31,600

$44,400, $79,000 Depreciation; $175,600, $237,000 Value

O $44,000, $79,000 Depreciation; $176,000, $237,000 Value

S44,000, S63,200 Depreciation; $176,000, $252,800 Value

S44,000, S80,000 Depreciation; S176,000, S236,000 Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning