The cash account for American Medical Co. at April 30 indicated a balance of $334.985. The bank statement indicated a balance of $388,600 on April 30. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: a. Checks outstanding totaled $61,280. b. A deposit of $42,500, representing receipts of April 30, had been made too late to appear on the bank statement. c. The bank collected $42,000 on a $40,000 note, including interest of $2,000. d. A check for $7,600 returned with the statement had been incorrectly recorded by American Medical Co. as $760. The check was for the payment of an obligation to Targhee Supply Co. for a purchase on account. 2. A check drawn for $240 had been erroneously charged by the bank as $420. - Bank service charges for April amounted to $145.

The cash account for American Medical Co. at April 30 indicated a balance of $334.985. The bank statement indicated a balance of $388,600 on April 30. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: a. Checks outstanding totaled $61,280. b. A deposit of $42,500, representing receipts of April 30, had been made too late to appear on the bank statement. c. The bank collected $42,000 on a $40,000 note, including interest of $2,000. d. A check for $7,600 returned with the statement had been incorrectly recorded by American Medical Co. as $760. The check was for the payment of an obligation to Targhee Supply Co. for a purchase on account. 2. A check drawn for $240 had been erroneously charged by the bank as $420. - Bank service charges for April amounted to $145.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 5EA: The bank reconciliation shows the following adjustments: Deposits in transit: $1,234 Outstanding...

Related questions

Question

I submitted this question a few moments ago and realized I didn't attach all the images. Submitting again with BOTH this time! :) Problem #PR 8-3A and excel template I'm stuck on.

Thanks!

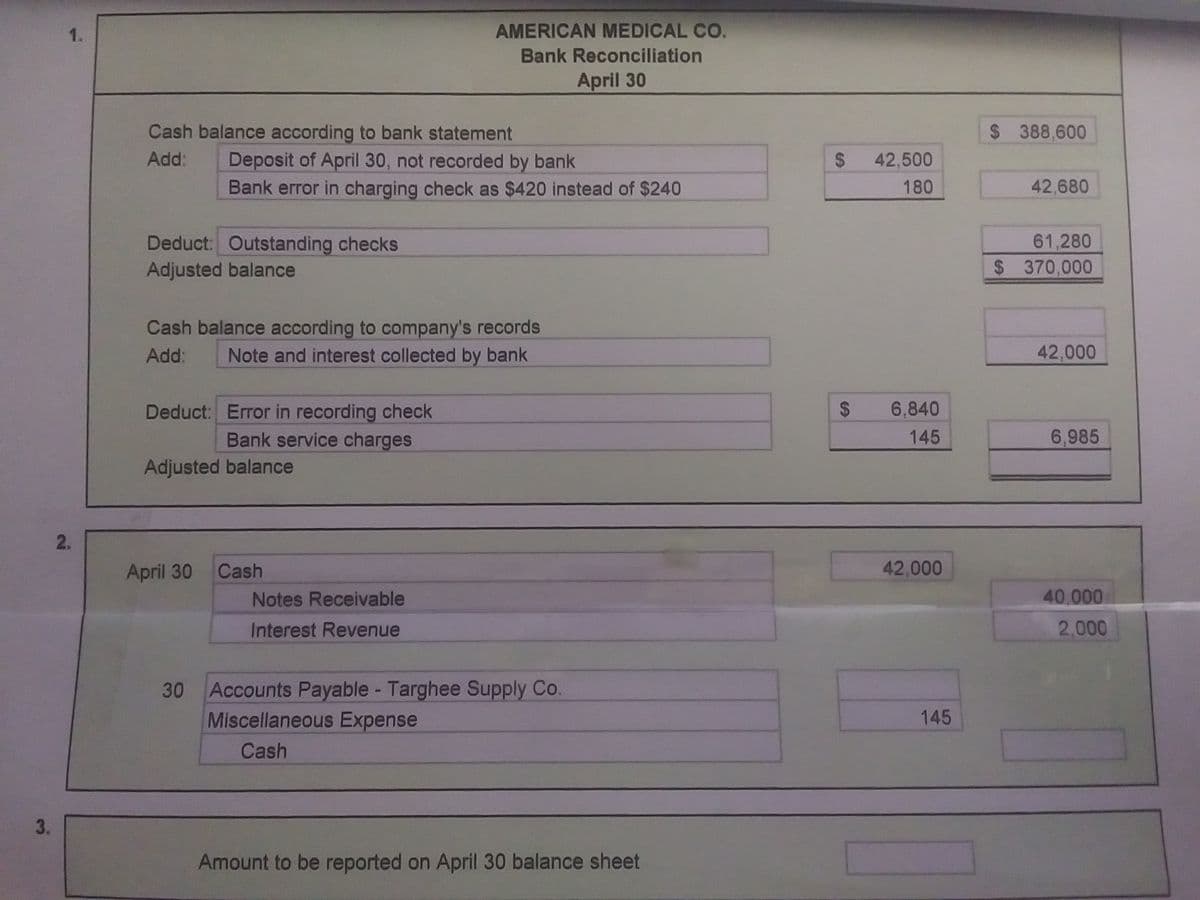

Transcribed Image Text:1.

AMERICAN MEDICAL CO.

Bank Reconciliation

April 30

Cash balance according to bank statement

$ 388,600

Add:

Deposit of April 30, not recorded by bank

Bank error in charging check as $420 instead of $240

42,500

180

42,680

Deduct: Outstanding checks

Adjusted balance

61,280

$ 370,000

Cash balance according to company's records

Note and interest collected by bank

Add:

42,000

Deduct: Error in recording check

Bank service charges

6,840

145

6,985

Adjusted balance

2.

April 30 Cash

42,000

Notes Receivable

40,000

Interest Revenue

2,000

Accounts Payable - Targhee Supply Co.

Miscellaneous Expense

30

145

Cash

3.

Amount to be reported on April 30 balance sheet

%24

%24

Transcribed Image Text:ndicate why it exists.

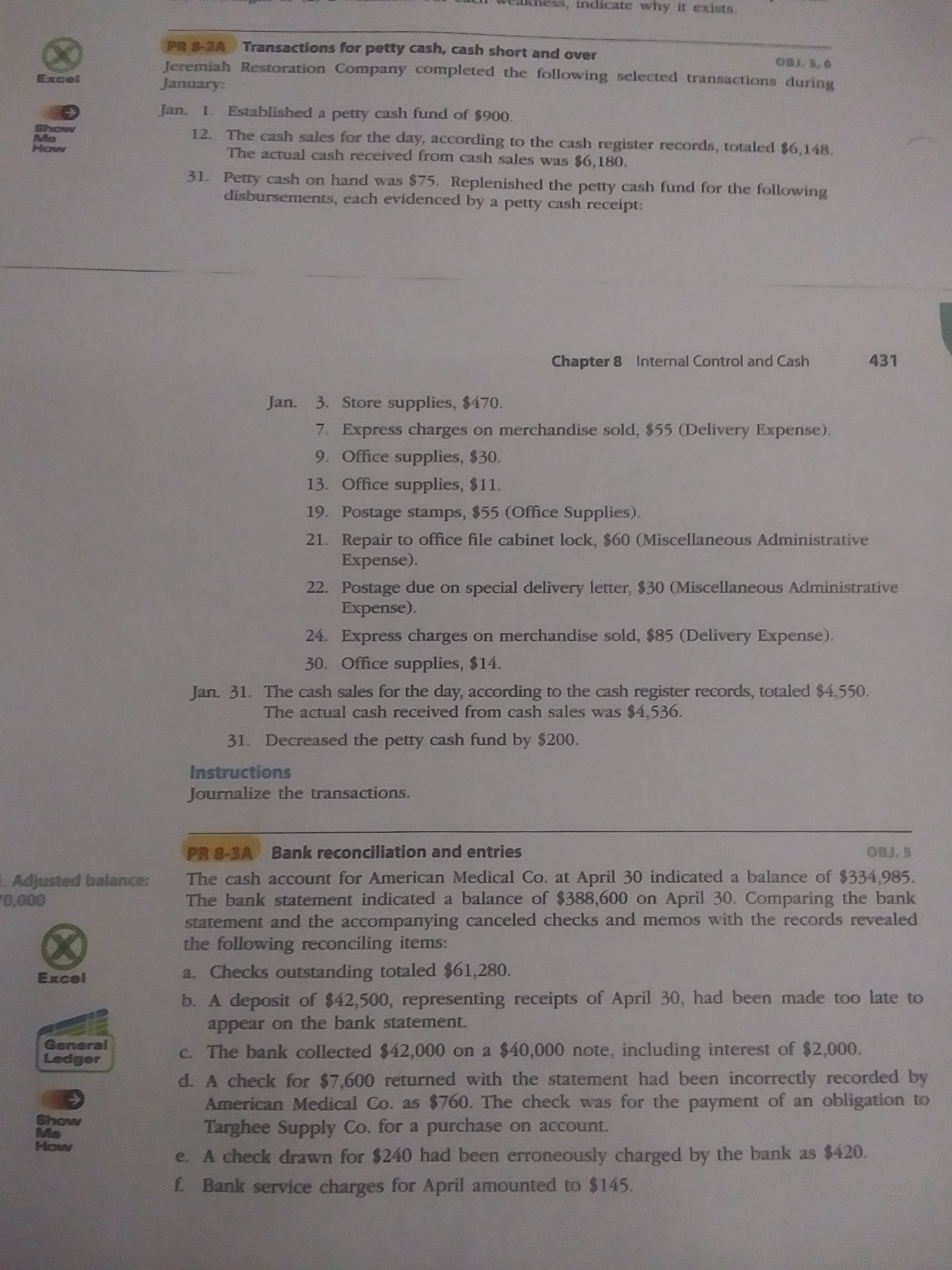

PR 8-2A Transactions for petty cash, cash short and over

Jeremiah Restoration Company completed the following selected transactions duringg

Excel

Jan. 1.

Established a petty cash fund of $900.

12. The cash sales for the day, according to the cash register records, totaled $6,148.

The actual cash received from cash sales was $6,180.

How

31. Petty cash on hand was $75. Replenished the petty cash fund for the following

disbursements, each evidenced by a petty cash receipt:

Chapter 8 Internal Control and Cash

431

Jan. 3. Store supplies, $470.

7. Express charges on merchandise sold, $55 (Delivery Expense).

9. Office supplies, $30.

13. Office supplies, $11.

19. Postage stamps, $55 (Office Supplies).

21. Repair to office file cabinet lock, $60 (Miscellaneous Administrative

Expense).

22. Postage due on special delivery letter, $30 (Miscellaneous Administrative

Expense).

24. Express charges on merchandise sold, $85 (Delivery Expense).

30. Office supplies, $14.

Jan. 31. The cash sales for the day, according to the cash register records, totaled $4,550.

The actual cash received from cash sales was $4,536.

31. Decreased the petty cash fund by $200.

Instructions

Journalize the transactions.

PR 8-3A Bank reconciliation and entries

ST80

The cash account for American Medical Co. at April 30 indicated a balance of $334,985.

The bank statement indicated a balance of $388,600 on April 30. Comparing the bank

statement and the accompanying canceled checks and memos with the records revealed

the following reconciling items:

a. Checks outstanding totaled $61,280.

Adjusted balance:

Excel

b. A deposit of $42,500, representing receipts of April 30, had been made too late to

appear on the bank statement.

General

Ledger

c. The bank collected $42,000 on a $40,000 note, including interest of $2,000.

d. A check for $7,600 returned with the statement had been incorrectly recorded by

American Medical Co. as $760. The check was for the payment of an obligation to

Targhee Supply Co. for a purchase on account.

e. A check drawn for $240 had been erroneously charged by the bank as $420.

f Bank service charges for April amounted to $145.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning