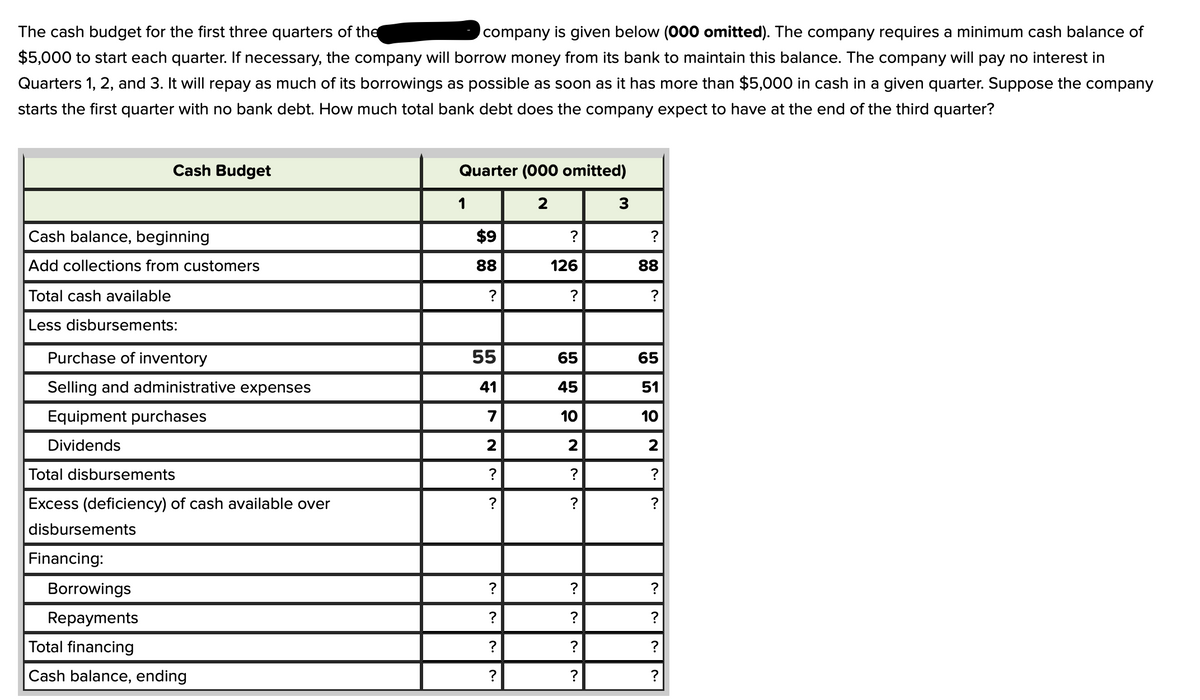

The cash budget for the first three quarters of the company is given below (000 omitted). The company requires a minimum cash balance of $5,000 to start each quarter. If necessary, the company will borrow money from its bank to maintain this balance. The company will pay no interest in Quarters 1, 2, and 3. It will repay as much of its borrowings as possible as soon as it has more than $5,000 in cash in a given quarter. Suppose the company starts the first quarter with no bank debt. How much total bank debt does the company expect to have at the end of the third quarter? Cash Budget Quarter (000 omitted) 1 2 3 Cash balance, beginning $9 ? Add collections from customers 88 126 Total cash available ? ? Less disbursements: Purchase of inventory 55 Selling and administrative expenses 41 Equipment purchases 7 Dividends 2 Total disbursements ? ? Excess (deficiency) of cash available over disbursements Financing: ? Borrowings ? Repayments Total financing ? Cash balance, ending ? 65 45 10 2 ? ? ? ? ? ? ? 88 ? 65 51 10 2 ? ? ? ? ? ?

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps