Hesham Geer Inc. has a difference in the balance as per Cash Book and bank statement as on 30h November 2020. You are advised to prepare a Bank Reconciliation statement as on that date with the following information: On November 30, 2020, the Cash Book (after all postings have been made) for Company Hesham Geer Inc shows a balance of $4,200. The bank statement, however, shows a balance of $5,000. After an examination of the bank statement, the books, and the returned checks, the accountant noted the following: Check no. 482 for $1,200 and check no. 491 for $800 are still outstanding. A check for $200 that was received from Mr. Poor has "bounce." It has been returned with the bank statement and marked "NSF," for not sufficient funds. This check was in payment for services performed by us on account for Mr. Poor. A deposit we made on November 29 for $3,000 does not appear on the bank statement. The bank charged us a $10 service fee to handle the NSF check. The bank also charged us $15 monthly checking account fee. • Check no. 474 for $85 was mistakenly charged by the bank for only $58. • The bank collected a $2,000 note for us and deposited the proceeds into our account. The checking account earned $30 interest during the month. The bank mistakenly charged us for a check of $32, which we never wrote; it was written by Company Almokhtar Inc.

Hesham Geer Inc. has a difference in the balance as per Cash Book and bank statement as on 30h November 2020. You are advised to prepare a Bank Reconciliation statement as on that date with the following information: On November 30, 2020, the Cash Book (after all postings have been made) for Company Hesham Geer Inc shows a balance of $4,200. The bank statement, however, shows a balance of $5,000. After an examination of the bank statement, the books, and the returned checks, the accountant noted the following: Check no. 482 for $1,200 and check no. 491 for $800 are still outstanding. A check for $200 that was received from Mr. Poor has "bounce." It has been returned with the bank statement and marked "NSF," for not sufficient funds. This check was in payment for services performed by us on account for Mr. Poor. A deposit we made on November 29 for $3,000 does not appear on the bank statement. The bank charged us a $10 service fee to handle the NSF check. The bank also charged us $15 monthly checking account fee. • Check no. 474 for $85 was mistakenly charged by the bank for only $58. • The bank collected a $2,000 note for us and deposited the proceeds into our account. The checking account earned $30 interest during the month. The bank mistakenly charged us for a check of $32, which we never wrote; it was written by Company Almokhtar Inc.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter5: Cash Control Systems

Section: Chapter Questions

Problem 2AP

Related questions

Question

Prepare Bank Reconciliation statement .

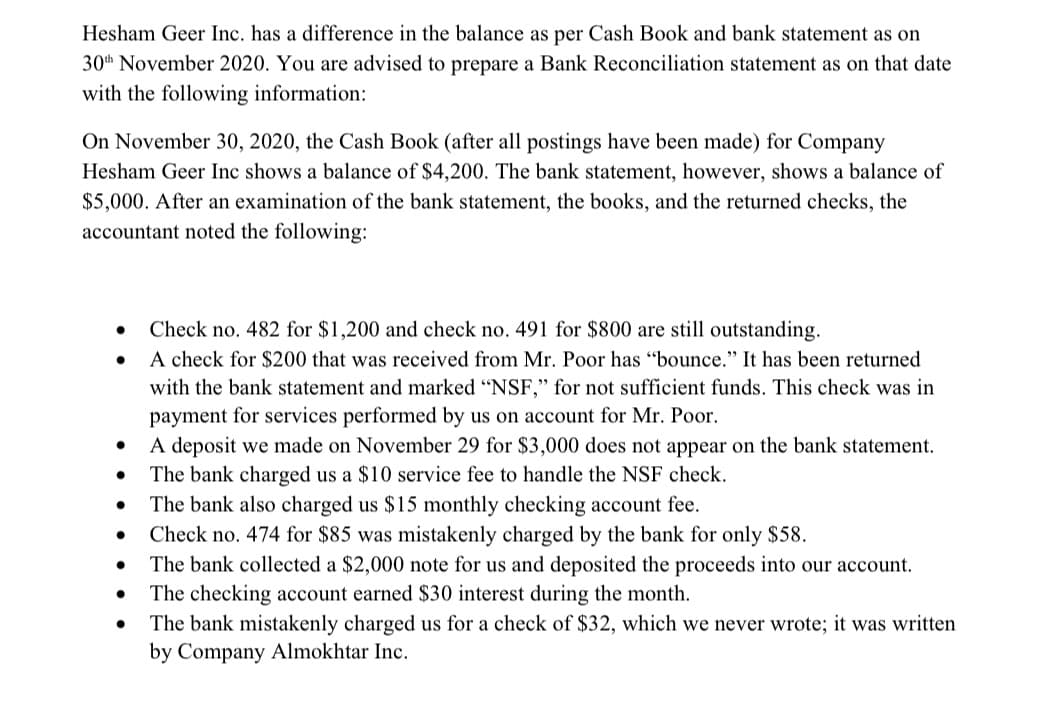

Transcribed Image Text:Hesham Geer Inc. has a difference in the balance as per Cash Book and bank statement as on

30th November 2020. You are advised to prepare a Bank Reconciliation statement as on that date

with the following information:

On November 30, 2020, the Cash Book (after all postings have been made) for Company

Hesham Geer Inc shows a balance of $4,200. The bank statement, however, shows a balance of

$5,000. After an examination of the bank statement, the books, and the returned checks, the

accountant noted the following:

Check no. 482 for $1,200 and check no. 491 for $800 are still outstanding.

A check for $200 that was received from Mr. Poor has "bounce." It has been returned

with the bank statement and marked “NSF," for not sufficient funds. This check was in

payment for services performed by us on account for Mr. Poor.

A deposit we made on November 29 for $3,000 does not appear on the bank statement.

The bank charged us a $10 service fee to handle the NSF check.

The bank also charged us $15 monthly checking account fee.

Check no. 474 for $85 was mistakenly charged by the bank for only $58.

The bank collected a $2,000 note for us and deposited the proceeds into our account.

The checking account earned $30 interest during the month.

The bank mistakenly charged us for a check of $32, which we never wrote; it was written

by Company Almokhtar Inc.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning