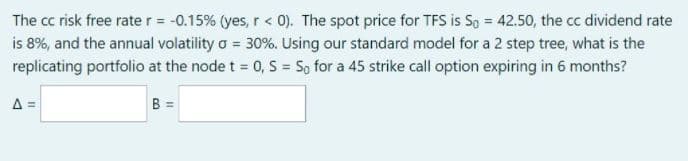

The cc risk free rate r = -0.15% (yes, r< 0). The spot price for TFS is So = 42.50, the cc dividend rate is 8%, and the annual volatility o = 30%. Using our standard model for a 2 step tree, what is the replicating portfolio at the node t = 0, S = So for a 45 strike call option expiring in 6 months? A = B =

Q: A six year note for 3500 issued on april1, 2015 with interest at 6.9percent compounded semi annually…

A: To calculate the proceeds on January 1, 2017 firstly we should calculate the future value on…

Q: #1 Matthew makes a series of payments at the beginning of each year for 20 years. The first payment…

A: Present value of a future amount With interest rate (i), period (t) and future value (FV), the…

Q: Bank Balance Sheet Assets Liabilities and Equity Reserves $20,000 Deposits $100,000 Loans 95,000…

A: When the total debt is divided by the total equity the outcome is known as the equity multiplier. It…

Q: 7. Spence Company is considering a project that has the following cash flow. What is the project's…

A: Year Cash flow 0 -1050 1 400 2 400 3 400 4 400

Q: 1. What is the value of ROR (i*) for the following equation? O= -20,000 + (29,000 - 21,000) (P/A,…

A: The rate which makes the total discounted worth of cash flows equal to zero is called IRR or…

Q: You have $10,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of…

A: Amount available to invest = $ 10000Return of X = 12.4%Return of Y = 10.1% Desired return from…

Q: The Michner Corporation is trying to choose between the following two mutually exclusive design…

A: Profitability index is the ratio of the present value of cash flow to the initial investment and…

Q: Omega company has the following capital structure as at 31st December 2020: Ordinary share…

A: We will first calculate the cost of each source of capital individually and then we will multiply it…

Q: Q3. Ricardo plans to own a 1 hectare lot after 10 years for an estimated cost of P5M. To accumulate…

A: Accumulated amount needed initially (X) = P 5000000 r = 15% n = 10 years Let A = Annual deposits…

Q: A stock currently sells for 50 and can rise by 6 or fall by 4 for each of the next two periods. The…

A: Current market price Values at the end of period one Values at the end of period two Value of call…

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery…

A: Cost of equity With current market price (P), next year dividend (D1) and constant growth rate in…

Q: P=P1,000 r= 5% t= 10 years m=4 What would be the future value of the ordinary annuity of the…

A: Given: Particulars Amount Payment(PMT) P1000 Years 10 Rate 5% Compounding 4

Q: Which maturity bond would be better for this investor, the 10 or 15-year? What would be the dollar…

A: Bond valuation refers to a method which is used to compute the current value or present value (PV)…

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery…

A: Answer 1:- The initial cash flow of the project includes the initial capital expenditure and the net…

Q: You are looking to buy a car and you have been offered a loan with an APR of 6.4%, compounded…

A: The true monthly rate of interest is simply stated as the nominal interest rate per compounding…

Q: Commercial Hydronics is considering replacing one of its larger control devices. A new unit sells…

A:

Q: You have two options to invest $1000 in: i) A $1050 face value bond with coupon rate c = 6%. ii) A…

A: Bond is the debt security that investors uses to reduce the risk and increase stable return from…

Q: Case, Part 1: Velma, a 59-year-old minority woman who works as a teacher, contacts you about getting…

A: Adjustable-rate mortgage (ARM)-is a type of mortgage that starts with a fixed interest rate (usually…

Q: 7.A man invests in a project that requires a fixed capital of P 2.5 M with no salvage, and life of…

A: With reference to capital budgeting, rate of return can be defined as an internal rate of return…

Q: You have RM9,000 that you plan to invest in a compound interest bearing instrument. Your investment…

A: Amount to be invested is RM9,000 Case -1 Interest rate is 8% Compounded semi-annually Case-2…

Q: Imagine you work for a company that uses gainsharing. Do you think you would like it? Why or why…

A: Gainsharing is a management system that encourages employees to improve their performance by…

Q: no preferred stock. The yield to at the company's WACCs 12.60% What is Pearson's cost of common…

A: Weighted average cost of capital is the cost o capital considering the weight of the different…

Q: Quèstion 12 What is the covariance of returns between stocks A and B? Expected retum of A is 30% and…

A: Data given: Expected return of A =30% Expected return of B = 23.333333% Year Return A Return B…

Q: Lamar is taking out a mortgage for $146,000 to buy a new house and is deciding between the offers…

A: The present value of loan is equal to the sum of the present value of all its future monthly…

Q: When you have a fixed investment horizon, it is important to maximize your earnings. You must…

A: Reinvestment risk refers to the possibility that an investor will not be able to reinvest the cash…

Q: Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum…

A: Present Value of bond is not given, so considering 1000 as face value of bond. So, Present Value…

Q: A stock is expected to pay dividends of $1.45 per share in Year 1 and $1.68 per share in Year 2.…

A: Shares are the company’s securities which are issued by the company to raise the funds. Value of…

Q: 16. Lancaster Corp is considering two equally risky, mutually exclusive projects, both of which have…

A: IRR of project A = 11% IRR of project B = 14% Crossover rate = 8%

Q: Identify methods for using and analysing working capital cycles

A: Working capital is the capital that a business needs and uses for the purpose of its day to day…

Q: 5. You have one asset in CCA Asset Class 12. You purchased this asset five years prior for $10.25…

A: CCA or Capital Cost Allowance- It is an annual deduction in the Canadian Tax Code. Under CCA,…

Q: Mohammed needs money in order to buy a latest Villa. The cost of building the Villa is BHD 75,000.…

A: Selling price is the price that a customer pays to purchase a product or a commodity, the price for…

Q: Sue purchased a stock for $45 a share, held it for one year, received a $2.34 dividend, and sold the…

A: Purchase price (P0) = $45 Sale price (P1) = $46.45 Dividend (D) = $2.34

Q: Company Dividend Yield Price State Street 6.66% $27.09 Use the table above for this question. What…

A: SOLUTION : GIVEN, Dividend Yield = 6.66% Price = $27.09 Now, Calculating the state street's…

Q: Benford Inc. is planning to open a new sporting goods store in a suburban mall. Benford will lease…

A: Equipment and fixtures $ 3,50,000.00 Net working capital $ 3,00,000.00 First-year sales $…

Q: You have RM9,000 that you plan to invest in a compound interest bearing instrument. Your investment…

A: Compound interest means that interest is charged on the principal amount as well as the interest…

Q: The Wright family wants to save money to travel the world. They purchase an annuity with a yearly…

A: The annuity value at end of 14 years can be calculated as future value of annuity.

Q: June 7, 2019, matures on July 1, 2039, and may be called at any time after July 1, 2029, at a price…

A: Yield to maturity refers to the total return that will be paid out from the time a bond is acquired…

Q: - Consider a firm that has EPS of $5 at the end of the first year, a dividend-payout ratio of 30%, a…

A: Discount rate is 16% Return on retained earning is 20% EPS is $5 Dividend Payout ratio is 30% To…

Q: Iceland Corporation Limited is considering investing in one of two machines – A or B. The initial…

A: ARR is the accounting rate of return which can be calculated ARR =Average annual profit/Initial…

Q: A. Which of the following is most closely associated with the cost of using assets? a. Asset…

A: A. The ratio of total sales or revenue to average assets is known as asset turnover. The asset…

Q: A quoted rate of interest is a “nominal” rate because it includes inflation expectations. a) True…

A: Answer:- True. The nominal interest rate comprises of the real interest rate and a premium for…

Q: 3. Consider assets A and B with expected returns of E(RA)=12% and E(RB)=20% and standard deviations…

A: Expected return of A=E(Ra) = 12% Expected return of B = E(Rb) = 20% Standard deviation of A = SDa =…

Q: 14.Mariah invested $10,000 in a bank certificate of deposit at a rate of 5% interest compounded…

A: Investment (PV) = $10,000 Interest rate (r) = 5% Period (n) = 3 Years

Q: Mr. Kinders has contributed $116.00 at the end of each month into an RRSP paying 6% per annum…

A: Monthly contribution (P) = $116.00 Interest rate = 6% Monthly interest rate (r) =…

Q: Solve: 3. Felix Jones, a recent engineering graduate, expects a starting salary of $35,000 per year.…

A: Salary in year 1 (S1) = $35000 Growth in salary (g) = 5% r = 5% n = 5 years

Q: 3. PHL assembles security monitors. It purchases 900 black-and-white cathode ray tubes per month at…

A: The ideal order quantity for a company to purchase to minimize inventory costs such as holding…

Q: A corporation decides to deposit fixed payment per account earning 9% interest per year in order to…

A: Amount required after 9 years 235000 Period in years 9 No of period (Quarterly) 36 Rate…

Q: 3. A mortgage balance of $18000 is renewed for the remaining amortization period of 3years at %4…

A: The current value of loan is equal to the present value of all the future monthly installments paid…

Q: Illu.1: NIT Ltd. declared dividend at 25% on its re are quoted in the market at Rs.10. You are requi…

A: Dividend is defined as the return that a shareholder gets from the company for the money invested by…

Q: Maria loaned an amount of 100,000 in payable in 15 equals installments. The first payment was made a…

A: Loan amount (L) = 100000 Number of quarterly payments (n) = 15 First payment after 1 year (4…

Step by step

Solved in 4 steps

- What is the expected return of a portfolio that has $8,000 invested in S and $2,000 invested in T? The risk-free rate is 6% and the market portfolio's return is 14%. Do you expect the investment to be a good one for the coming year if betas for the two portfolio components are 0.6 and 1.3, respectively?You want to calculate the 30 Day 95% VaR for the following portfolio. You invest $5 million in the NADAQ composite and short $4 million of Bitcoin. The NASDAQ composite has standard deviation of returns of 15% pa; Bitcoin has standard deviation of returns of 20%. The two assets have a correlation of 0.8. Assuming a 250 day year, what is the 30 day VaR? The risk free rate is 2% per annum. The market portfolio has an annual mean return of 14% and an annual return standard deviation is 26%. a.) A more cautious investor wishes to invest in another stock as he likes the low annual return standard deviation of 20%. This stock has an expected return of 7%. Construct for this investor a portfolio with the same return deviation but higher expected return, telling him what weights to employ and the return that he would expect. b.) Write down and interpret the CAPM equation that holds in this setting.

- Assume the riskless rate of interest is 2% per year, and the expected rate of return on the market portfolio is 8% per year. According to the CAPM, what is the efficient way for an investor to achieve an expected rate of return of 5% per year? If the standard deviation of the rate of return on the market portfolio is 4%, what is the standard deviation of the portfolio producing the 5% expected return? • Plot the CML and locate the foregoing portfolios on the same graph. • Plot the SML and locate the foregoing portfolios on the same graph.Based on current dividend yields and expected capital gains, the expected rates or return on portfolios A and B are 12% and 18%, respectively. The beta of A is 0.7 while that of B is 1.6. The T-bill rate is currently 4% while the expected rate of return of the S&P500 Index is 13%. The standard deviation of portfolio A is 14% annually, while that of B is 26%, and that of the index is 15%. If instead you could invest only in bills and one of these porfolios, which would you choose? Use the sharpe ratio to make your desicion.Based on current dividend yields and expected capital gains, the expected rates of return on portfolios A and B are 11% and 14%, respectively. The beta of A is 0.8 while that of B is 1.5. The T-bill rate is currently 6%, while the expected rate of return of the S&P 500 Index is 12%. The standard deviation of portfolio A is 10% annually, while that of B is 31%, and that of the index is 20%. a. If you currently hold a market-index portfolio, would you choose to add either of these portfolios to your holdings? Explain.b. If instead you could invest only in bills and one of these portfolios, which would you choose?

- Use the Black-Scholes Model to find the price for a call option with the following inputs: (1) current stock price is $30, (2) strike price is $35, (3) time toexpiration is 4 months, (4) annualized risk-free rate is 5%, and (5) varianceof stock return is 0.25.Suppose that the SP 500 index has an expected return of 7% and a standard deviation of returns of 15%. The risk-free rate is 5%. The portfolio on the Capital Allocation Line (CAL) that has an expected return of 20% invests weight 65% in the SP 500. Answer if true or false, and show all your calculations.The rate on six-month T-bills is currently 5%. Andvark Company stock has a beta 0f 1.69 and a required rate of return of 15.4%.a. According to CAPM, determine the return on the market portfolio, km. b. Is this a risky or not risky stock? Explain.

- Currently the risk-free return is 3 percent and the market risk premium is 8 percent. What is the required rate of return on the following two-stock portfolio? Amount Invested Beta $70,000 1.4 $30,000 0.4Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) =???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)Question 2. Foreign exchange marketsStatoil, the national…Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) = ???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)