The Chapter 7 Form worksheet is to be used to create your own worksheet version of the Review Problem for Activity Based Costing found in the text (include a link of the problem). 2. Assume that OfficeMart places orders more frequently, but everything else remains the same. On your worksheet increase the number of orders from 4 to 9. (a) What is the customer margin under activity-based costing when the number of orders increases to 9? (Enter a loss as a negative amount.) (b) What is the product margin under the traditional costing system when the number of orders increases to 9? (Enter a loss as a negative amount.) (c) Which of the following statements are true? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) check all that apply 1 If a customer orders more frequently, but orders the same total number of units over the course of a year, the customer margin under activity based costing will decrease. If a customer orders more frequently, but orders the same total number of units over the course of a year, the product margin under a traditional costing system will decrease. If a customer orders more frequently, but orders the same total number of units over the course of a year, the customer margin under activity based costing will be unaffected. If a customer orders more frequently, but orders the same total number of units over the course of a year, the product margin under a traditional costing system will be unaffected.

Process Costing

Process costing is a sort of operation costing which is employed to determine the value of a product at each process or stage of producing process, applicable where goods produced from a series of continuous operations or procedure.

Job Costing

Job costing is adhesive costs of each and every job involved in the production processes. It is an accounting measure. It is a method which determines the cost of specific jobs, which are performed according to the consumer’s specifications. Job costing is possible only in businesses where the production is done as per the customer’s requirement. For example, some customers order to manufacture furniture as per their needs.

ABC Costing

Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production. Cost accounting is generally used by the management so as to ensure better decision-making. In comparison to financial accounting, cost accounting has to follow a set standard ad can be used flexibly by the management as per their needs. The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

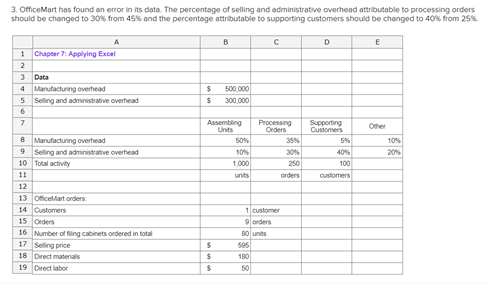

The Chapter 7 Form worksheet is to be used to create your own worksheet version of the Review Problem for Activity Based Costing found in the text (include a link of the problem).

2. Assume that OfficeMart places orders more frequently, but everything else remains the same. On your worksheet increase the number of orders from 4 to 9.

(a) What is the customer margin under activity-based costing when the number of orders increases to 9? (Enter a loss as a negative amount.)

(b) What is the product margin under the traditional costing system when the number of orders increases to 9? (Enter a loss as a negative amount.)

(c) Which of the following statements are true? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.)

check all that apply 1

- If a customer orders more frequently, but orders the same total number of units over the course of a year, the customer margin under activity based costing will decrease.

- If a customer orders more frequently, but orders the same total number of units over the course of a year, the product margin under a traditional costing system will decrease.

- If a customer orders more frequently, but orders the same total number of units over the course of a year, the customer margin under activity based costing will be unaffected.

- If a customer orders more frequently, but orders the same total number of units over the course of a year, the product margin under a traditional costing system will be unaffected.

3. OfficeMart has found an error in its data. The percentage of selling and administrative

(a) Based on new number of orders in Requirement 2, what is the customer margin under activity-based costing when the data are corrected? (Enter a loss as a negative amount.)

(b) Based on new number of orders in Requirement 2, what is the product margin under the traditional costing system when the data are corrected? (Enter a loss as a negative amount.)

(c) Which of the following statements are true about what happens when the percentage of selling and administrative overhead attributable to processing orders declines and the percentage of selling and administrative overhead attributable to supporting customers increases by the same amount? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.)

check all that apply 2

- When the percentage of selling and administrative overhead attributable to processing orders declines and the percentage of selling and administrative overhead attributable to supporting customers increases by the same amount, costs are shifted from the

processing orders cost pool to the supporting customers cost pool. - When the percentage of selling and administrative overhead attributable to processing orders declines and the percentage of selling and administrative overhead attributable to supporting customers increases by the same amount, costs will be shifted from customers who order more frequently to those who order less frequently.

- When the percentage of selling and administrative overhead attributable to processing orders declines and the percentage of selling and administrative overhead attributable to supporting customers increases by the same amount, the customer margins of those who order more frequently will increase relative to the customer margins of those who order less frequently.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps