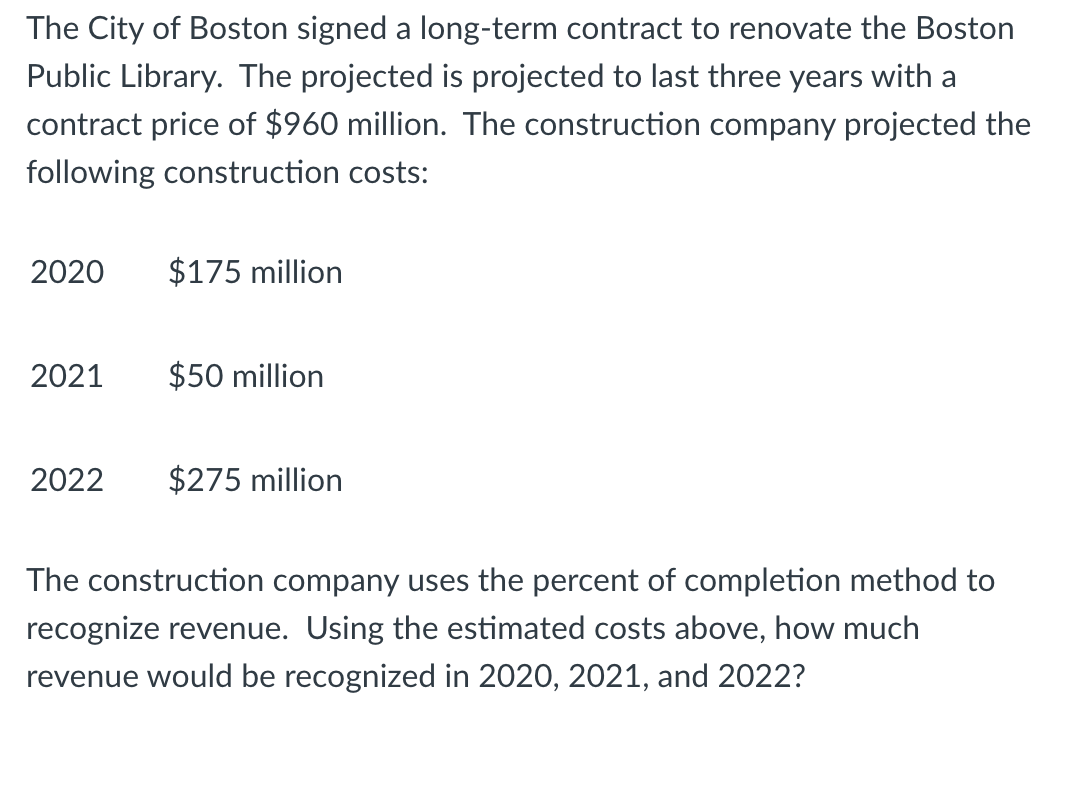

The City of Boston signed a long-term contract to renovate the Boston Public Library. The projected is projected to last three years with a contract price of $960 million. The construction company projected the following construction costs: 2020 2021 2022 $175 million $50 million $275 million The construction company uses the percent of completion method to recognize revenue. Using the estimated costs above, how much revenue would be recognized in 2020, 2021, and 2022?

The City of Boston signed a long-term contract to renovate the Boston Public Library. The projected is projected to last three years with a contract price of $960 million. The construction company projected the following construction costs: 2020 2021 2022 $175 million $50 million $275 million The construction company uses the percent of completion method to recognize revenue. Using the estimated costs above, how much revenue would be recognized in 2020, 2021, and 2022?

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 28CE

Related questions

Question

Please help me

Transcribed Image Text:The City of Boston signed a long-term contract to renovate the Boston

Public Library. The projected is projected to last three years with a

contract price of $960 million. The construction company projected the

following construction costs:

2020

2021

$175 million

$50 million

2022 $275 million

The construction company uses the percent of completion method to

recognize revenue. Using the estimated costs above, how much

revenue would be recognized in 2020, 2021, and 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT