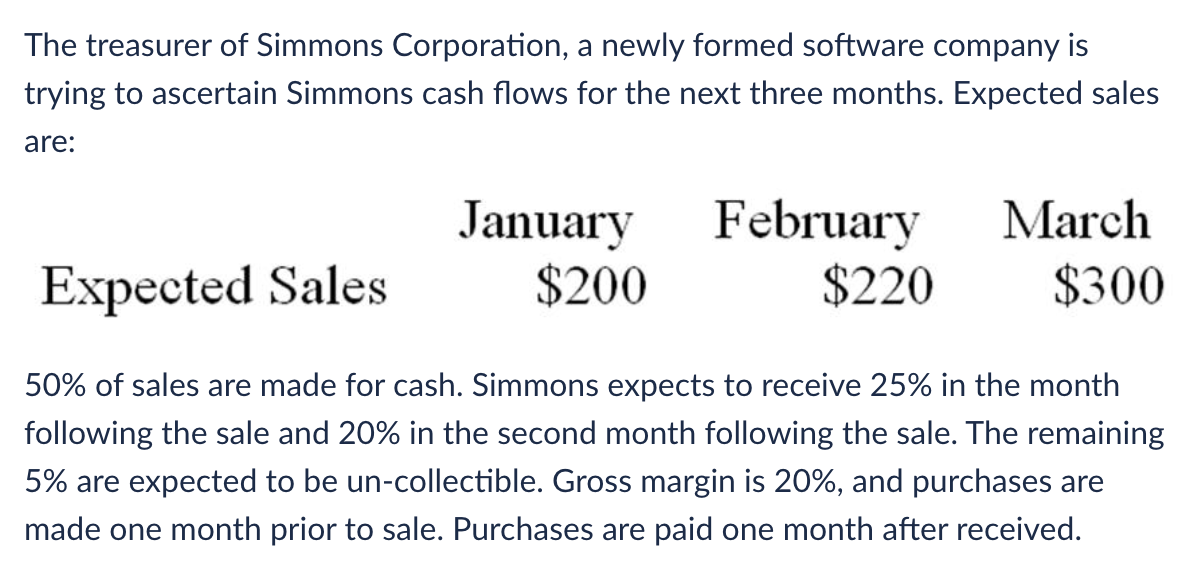

The treasurer of Simmons Corporation, a newly formed software company is trying to ascertain Simmons cash flows for the next three months. Expected sales are: January $200 February $220 March $300 Expected Sales 50% of sales are made for cash. Simmons expects to receive 25% in the month following the sale and 20% in the second month following the sale. The remaining 5% are expected to be un-collectible. Gross margin is 20%, and purchases are made one month prior to sale. Purchases are paid one month after received.

The treasurer of Simmons Corporation, a newly formed software company is trying to ascertain Simmons cash flows for the next three months. Expected sales are: January $200 February $220 March $300 Expected Sales 50% of sales are made for cash. Simmons expects to receive 25% in the month following the sale and 20% in the second month following the sale. The remaining 5% are expected to be un-collectible. Gross margin is 20%, and purchases are made one month prior to sale. Purchases are paid one month after received.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 18E

Related questions

Question

Use attachment to answer the following

The

a) $245

b) $250

c) $220

d) None of the above

Transcribed Image Text:The treasurer of Simmons Corporation, a newly formed software company is

trying to ascertain Simmons cash flows for the next three months. Expected sales

are:

January

$200

February

$220

March

$300

Expected Sales

50% of sales are made for cash. Simmons expects to receive 25% in the month

following the sale and 20% in the second month following the sale. The remaining

5% are expected to be un-collectible. Gross margin is 20%, and purchases are

made one month prior to sale. Purchases are paid one month after received.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning