The city of Segovia is analyzing the possibility of building a second airport to alleviat analyzing two potential locations, X and Y. Hard Rock Hotels would like to buy land to bu land has been rising in anticipation of the decision and is expected to skyrocket when th For this reason, Hard Rock would like to buy the land now. Hard Rock will sell the land there. Hard Rock has four options: (1) buy land in X, (2) buy land in Y, (3) buy land in compiled the following data (in millions of euros): Hard Rock estimates that there a 45 percent chance that the airnort wi11 be huilt

The city of Segovia is analyzing the possibility of building a second airport to alleviat analyzing two potential locations, X and Y. Hard Rock Hotels would like to buy land to bu land has been rising in anticipation of the decision and is expected to skyrocket when th For this reason, Hard Rock would like to buy the land now. Hard Rock will sell the land there. Hard Rock has four options: (1) buy land in X, (2) buy land in Y, (3) buy land in compiled the following data (in millions of euros): Hard Rock estimates that there a 45 percent chance that the airnort wi11 be huilt

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 35P

Related questions

Question

resolver el ejercicio

Transcribed Image Text:Location X

Location Y

current purchase price

27

15

Obenefits if the airport and hotel are built

here

45

30

sale price if the airport is not built

6

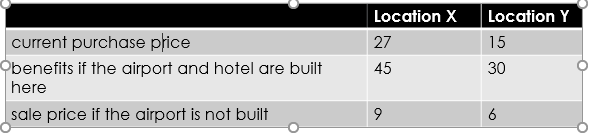

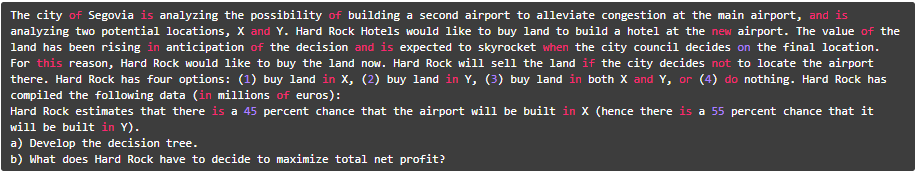

Transcribed Image Text:The city of Segovia is analyzing the possibility of building a second airport to alleviate congestion at the main airport, and is

analyzing two potential locations, X and Y. Hard Rock Hotels would like to buy land to build a hotel at the new airport. The value of the

land has been rising in anticipation of the decision and is expected to skyrocket when the city council decides on the final location.

For this reason, Hard Rock would like to buy the land now. Hard Rock will sell the land if the city decides not to locate the airport

there. Hard Rock has four options: (1) buy land in X, (2) buy land in Y, (3) buy land in both X and Y, or (4) do nothing. Hard Rock has

compiled the following data (in millions of euros):

Hard Rock estimates that there is a 45 percent chance that the airport will be built in X (hence there is a 55 percent chance that it

will be built in Y).

a) Develop the decision tree.

b) What does Hard Rock have to decide to maximize total net profit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,