The City of Wolfe issues its financial statements for Year 4 (assume that the city uses a calendar year). The city's general fund is composed of two functions: (1) education and (2) parks. The city also utilizes capital projects funds for ongoing construction and an enterprise fund to account for an art museum. The city also has one discretely presented component unit. The government-wide financial statements indicate the following Year 4 totals. Education had net expenses of $614,000. Parks had net expenses of $108,000. Art museum had net revenues of $71,750. General revenues were $855,250. The overall increase in net position for the city was $205,000. The fund financial statements for Year 4 indicate the following: The general fund had an increase of $41,250 in its fund balance. The capital projects fund had an increase of $52,750 in its fund balance. The enterprise fund had an increase of $72,500 in its net position balance. Officials for the City of Wolfe define "available" as current financial resources to be paid or collected within 60 days. The city maintains a landfill and records it within its parks. The landfill generates program revenues of $10,000 in Year 4 and cash expenses of $37,600. It also pays $7,600 cash for a piece of land. These transactions were recorded as would have been anticipated, but no other recording was made this year. The city assumes that it will have to pay $370,000 to clean up the landfill when it is closed in several years. The landfill was 17 percent filled at the end of Year 3 and is 25 percent filled at the end of Year 4. No payments will be necessary for several more years. For convenience, assume that the entries in all previous years were correctly handled regardless of the situation.

The City of Wolfe issues its financial statements for Year 4 (assume that the city uses a calendar year). The city's general fund is composed of two functions: (1) education and (2) parks. The city also utilizes capital projects funds for ongoing construction and an enterprise fund to account for an art museum. The city also has one discretely presented component unit. The government-wide financial statements indicate the following Year 4 totals. Education had net expenses of $614,000. Parks had net expenses of $108,000. Art museum had net revenues of $71,750. General revenues were $855,250. The overall increase in net position for the city was $205,000. The fund financial statements for Year 4 indicate the following: The general fund had an increase of $41,250 in its fund balance. The capital projects fund had an increase of $52,750 in its fund balance. The enterprise fund had an increase of $72,500 in its net position balance. Officials for the City of Wolfe define "available" as current financial resources to be paid or collected within 60 days. The city maintains a landfill and records it within its parks. The landfill generates program revenues of $10,000 in Year 4 and cash expenses of $37,600. It also pays $7,600 cash for a piece of land. These transactions were recorded as would have been anticipated, but no other recording was made this year. The city assumes that it will have to pay $370,000 to clean up the landfill when it is closed in several years. The landfill was 17 percent filled at the end of Year 3 and is 25 percent filled at the end of Year 4. No payments will be necessary for several more years. For convenience, assume that the entries in all previous years were correctly handled regardless of the situation.

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 39P

Related questions

Question

help please

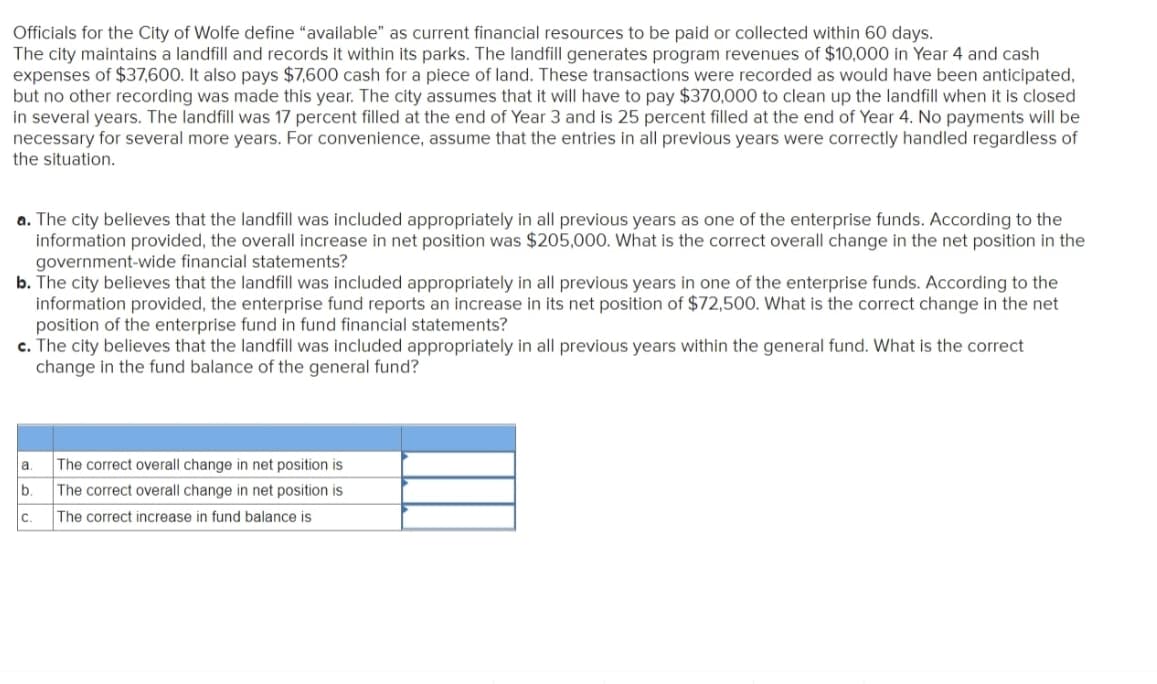

Transcribed Image Text:Officials for the City of Wolfe define "available" as current financial resources to be paid or collected within 60 days.

The city maintains a landfill and records it within its parks. The landfill generates program revenues of $10,000 in Year 4 and cash

expenses of $37,600. It also pays $7,600 cash for a piece of land. These transactions were recorded as would have been anticipated,

but no other recording was made this year. The city assumes that it will have to pay $370,000 to clean up the landfill when it is closed

in several years. The landfill was 17 percent filled at the end of Year 3 and is 25 percent filled at the end of Year 4. No payments will be

necessary for several more years. For convenience, assume that the entries in all previous years were correctly handled regardless of

the situation.

a. The city believes that the landfill was included appropriately in all previous years as one of the enterprise funds. According to the

information provided, the overall increase in net position was $205,000. What is the correct overall change in the net position in the

government-wide financial statements?

b. The city believes that the landfill was included appropriately in all previous years in one of the enterprise funds. According to the

information provided, the enterprise fund reports an increase in its net position of $72,500. What is the correct change in the net

position of the enterprise fund in fund financial statements?

c. The city believes that the landfill was included appropriately in all previous years within the general fund. What is the correct

change in the fund balance of the general fund?

a.

The correct overall change in net position is

b

The correct overall change in net position is

C.

The correct increase in fund balance is

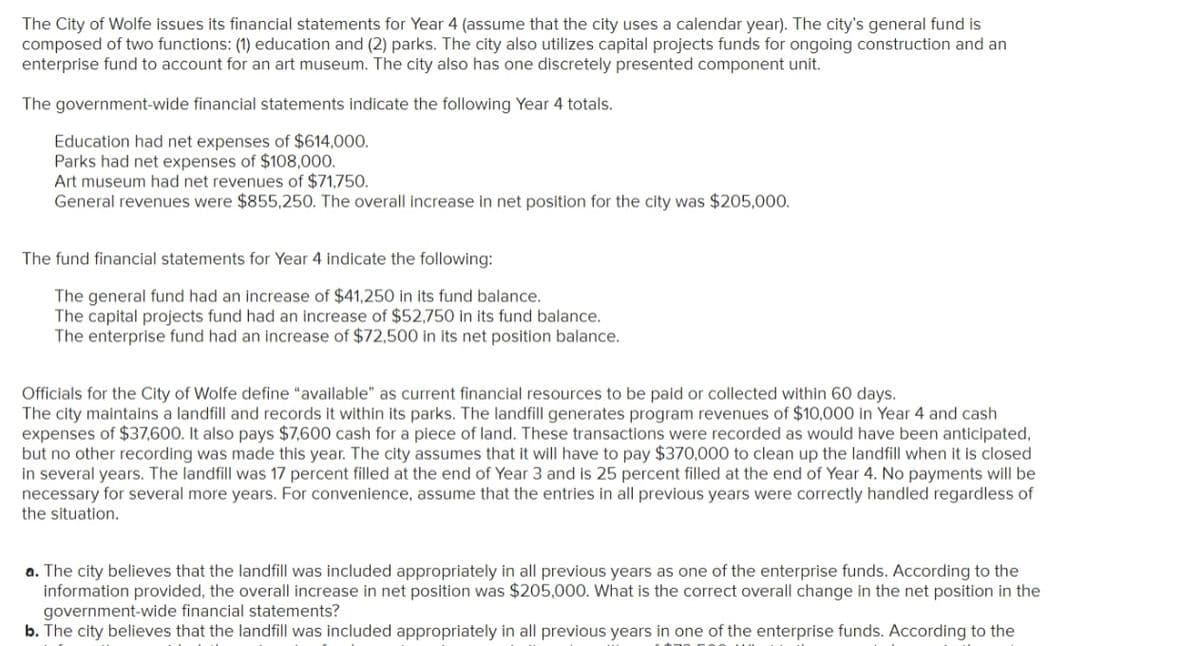

Transcribed Image Text:The City of Wolfe issues its financial statements for Year 4 (assume that the city uses a calendar year). The city's general fund is

composed of two functions: (1) education and (2) parks. The city also utilizes capital projects funds for ongoing construction and an

enterprise fund to account for an art museum. The city also has one discretely presented component unit.

The government-wide financial statements indicate the following Year 4 totals.

Education had net expenses of $614,000.

Parks had net expenses of $108,000.

Art museum had net revenues of $71,750.

General revenues were $855,250. The overall increase in net position for the city was $205,000.

The fund financial statements for Year 4 indicate the following:

The general fund had an increase of $41,250 in its fund balance.

The capital projects fund had an increase of $52,750 in its fund balance.

The enterprise fund had an increase of $72,500 in its net position balance.

Officials for the City of Wolfe define "available" as current financial resources to be paid or collected within 60 days.

The city maintains a landfill and records it within its parks. The landfill generates program revenues of $10,000 in Year 4 and cash

expenses of $37,600. It also pays $7,600 cash for a piece of land. These transactions were recorded as would have been anticipated,

but no other recording was made this year. The city assumes that it will have to pay $370,000 to clean up the landfill when it is closed

in several years. The landfill was 17 percent filled at the end of Year 3 and is 25 percent filled at the end of Year 4. No payments will be

necessary for several more years. For convenience, assume that the entries in all previous years were correctly handled regardless of

the situation.

a. The city believes that the landfill was included appropriately in all previous years as one of the enterprise funds. According to the

information provided, the overall increase in net position was $205,000. What is the correct overall change in the net position in the

government-wide financial statements?

b. The city believes that the landfill was included appropriately in all previous years in one of the enterprise funds. According to the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you