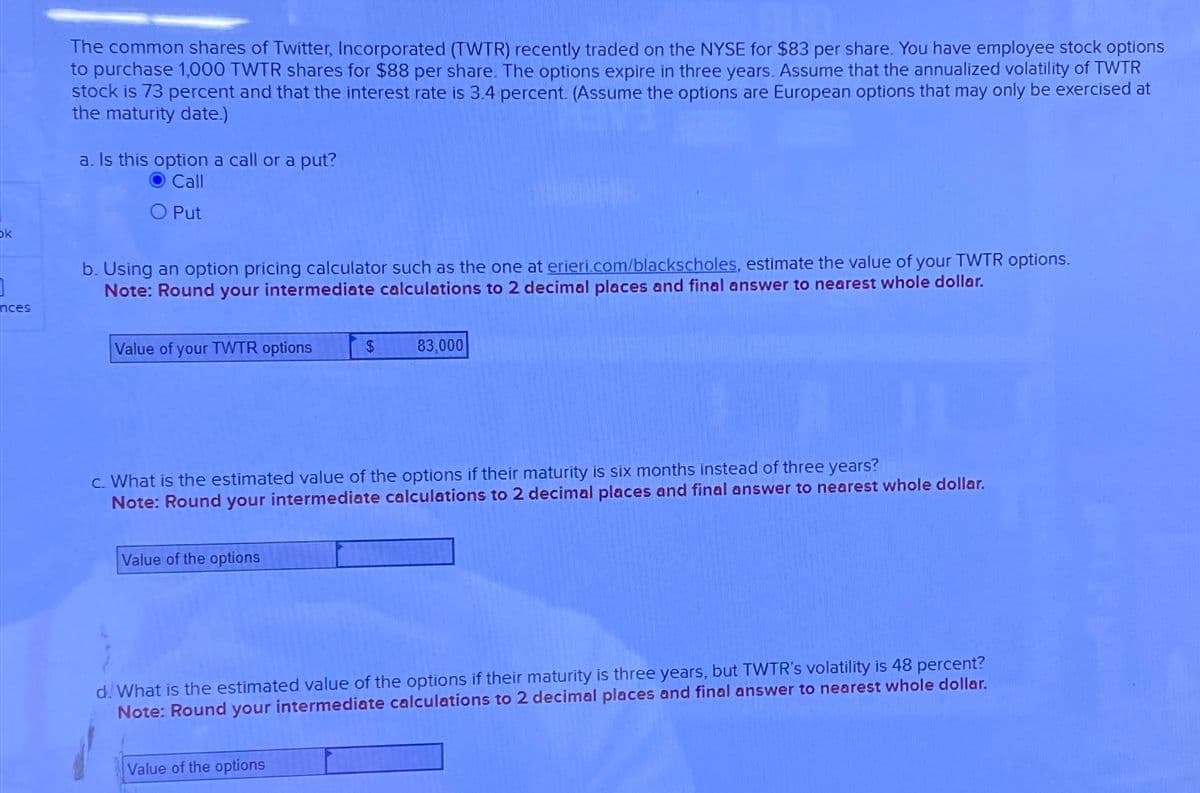

The common shares of Twitter, Incorporated (TWTR) recently traded on the NYSE for $83 per share. You have employee stock options to purchase 1,000 TWTR shares for $88 per share. The options expire in three years. Assume that the annualized volatility of TWTR stock is 73 percent and that the interest rate is 3.4 percent. (Assume the options are European options that may only be exercised at the maturity date.) a. Is this option a call or a put? Call O Put b. Using an option pricing calculator such as the one at erieri.com/blackscholes, estimate the value of your TWTR options. Note: Round your intermediate calculations to 2 decimal places and final answer to nearest whole dollar. Value of your TWTR options $ 83,000 c. What is the estimated value of the options if their maturity is six months instead of three years? Note: Round your intermediate calculations to 2 decimal places and final answer to nearest whole dollar. Value of the options d. What is the estimated value of the options if their maturity is three years, but TWTR's volatility is 48 percent? Note: Round your intermediate calculations to 2 decimal places and final answer to nearest whole dollar. Value of the options

The common shares of Twitter, Incorporated (TWTR) recently traded on the NYSE for $83 per share. You have employee stock options to purchase 1,000 TWTR shares for $88 per share. The options expire in three years. Assume that the annualized volatility of TWTR stock is 73 percent and that the interest rate is 3.4 percent. (Assume the options are European options that may only be exercised at the maturity date.) a. Is this option a call or a put? Call O Put b. Using an option pricing calculator such as the one at erieri.com/blackscholes, estimate the value of your TWTR options. Note: Round your intermediate calculations to 2 decimal places and final answer to nearest whole dollar. Value of your TWTR options $ 83,000 c. What is the estimated value of the options if their maturity is six months instead of three years? Note: Round your intermediate calculations to 2 decimal places and final answer to nearest whole dollar. Value of the options d. What is the estimated value of the options if their maturity is three years, but TWTR's volatility is 48 percent? Note: Round your intermediate calculations to 2 decimal places and final answer to nearest whole dollar. Value of the options

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:k

nces

The common shares of Twitter, Incorporated (TWTR) recently traded on the NYSE for $83 per share. You have employee stock options

to purchase 1,000 TWTR shares for $88 per share. The options expire in three years. Assume that the annualized volatility of TWTR

stock is 73 percent and that the interest rate is 3.4 percent. (Assume the options are European options that may only be exercised at

the maturity date.)

a. Is this option a call or a put?

Call

O Put

b. Using an option pricing calculator such as the one at erieri.com/blackscholes, estimate the value of your TWTR options.

Note: Round your intermediate calculations to 2 decimal places and final answer to nearest whole dollar.

Value of your TWTR options

$

83,000

c. What is the estimated value of the options if their maturity is six months instead of three years?

Note: Round your intermediate calculations to 2 decimal places and final answer to nearest whole dollar.

Value of the options

d. What is the estimated value of the options if their maturity is three years, but TWTR's volatility is 48 percent?

Note: Round your intermediate calculations to 2 decimal places and final answer to nearest whole dollar.

Value of the options

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1: Given information:

VIEWStep 2: b. Calculation of the estimated value of the option if their maturity is 3 years:

VIEWStep 3: c. Calculation of the estimated value of the option if their maturity is 6 months instead of 3 years

VIEWStep 4: d. Calculation of the estimated value of the option if the volatility is 62%:

VIEWSolution

VIEWTrending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning