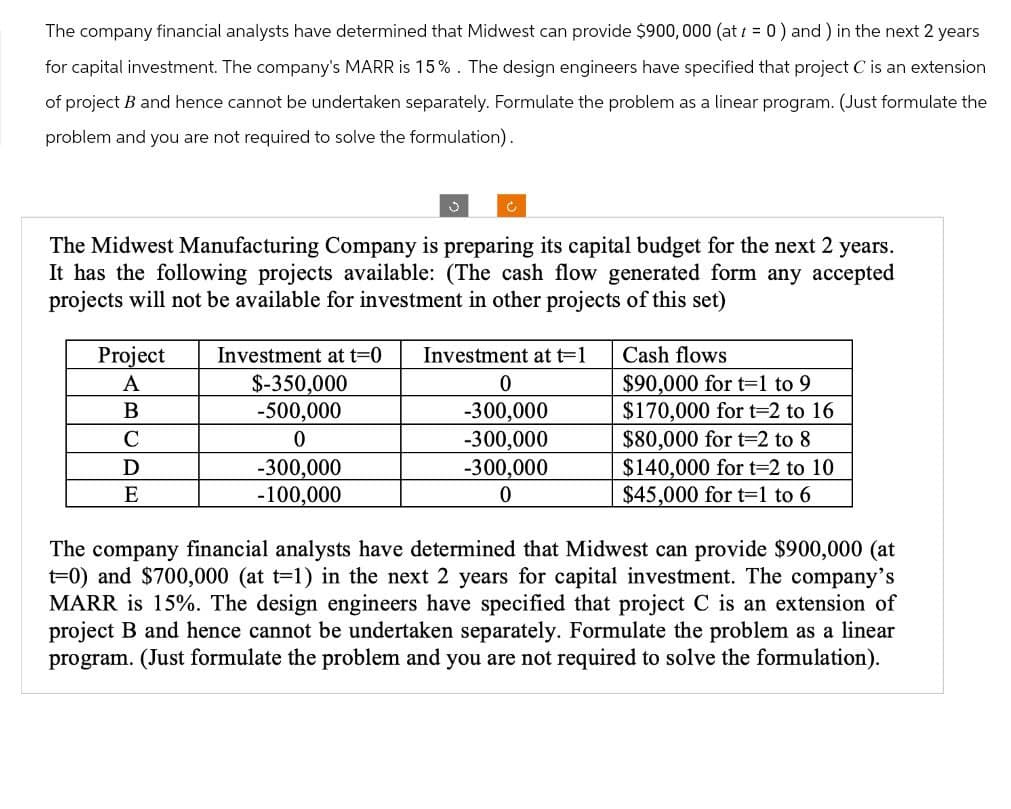

The company financial analysts have determined that Midwest can provide $900,000 (at t = 0) and) in the next 2 years for capital investment. The company's MARR is 15%. The design engineers have specified that project C is an extension of project B and hence cannot be undertaken separately. Formulate the problem as a linear program. (Just formulate the problem and you are not required to solve the formulation). J C The Midwest Manufacturing Company is preparing its capital budget for the next 2 years. It has the following projects available: (The cash flow generated form any accepted projects will not be available for investment in other projects of this set) Investment at t=0 $-350,000 Project A B -500,000 C 0 -300,000 -100,000 Cash flows $90,000 for t=1 to 9 Investment at t=1 0 -300,000 $170,000 for t=2 to 16 -300,000 $80,000 for t-2 to 8 -300,000 0 $140,000 for t=2 to 10 $45,000 for t=1 to 6 D E The company financial analysts have determined that Midwest can provide $900,000 (at t=0) and $700,000 (at t=1) in the next 2 years for capital investment. The company's MARR is 15%. The design engineers have specified that project C is an extension of project B and hence cannot be undertaken separately. Formulate the problem as a linear program. (Just formulate the problem and you are not required to solve the formulation).

The company financial analysts have determined that Midwest can provide $900,000 (at t = 0) and) in the next 2 years for capital investment. The company's MARR is 15%. The design engineers have specified that project C is an extension of project B and hence cannot be undertaken separately. Formulate the problem as a linear program. (Just formulate the problem and you are not required to solve the formulation). J C The Midwest Manufacturing Company is preparing its capital budget for the next 2 years. It has the following projects available: (The cash flow generated form any accepted projects will not be available for investment in other projects of this set) Investment at t=0 $-350,000 Project A B -500,000 C 0 -300,000 -100,000 Cash flows $90,000 for t=1 to 9 Investment at t=1 0 -300,000 $170,000 for t=2 to 16 -300,000 $80,000 for t-2 to 8 -300,000 0 $140,000 for t=2 to 10 $45,000 for t=1 to 6 D E The company financial analysts have determined that Midwest can provide $900,000 (at t=0) and $700,000 (at t=1) in the next 2 years for capital investment. The company's MARR is 15%. The design engineers have specified that project C is an extension of project B and hence cannot be undertaken separately. Formulate the problem as a linear program. (Just formulate the problem and you are not required to solve the formulation).

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 28P: Friedman Company is considering installing a new IT system. The cost of the new system is estimated...

Related questions

Question

None

Transcribed Image Text:The company financial analysts have determined that Midwest can provide $900,000 (at t = 0) and) in the next 2 years

for capital investment. The company's MARR is 15%. The design engineers have specified that project C is an extension

of project B and hence cannot be undertaken separately. Formulate the problem as a linear program. (Just formulate the

problem and you are not required to solve the formulation).

J

C

The Midwest Manufacturing Company is preparing its capital budget for the next 2 years.

It has the following projects available: (The cash flow generated form any accepted

projects will not be available for investment in other projects of this set)

Investment at t=0

$-350,000

Project

A

B

-500,000

C

0

-300,000

-100,000

Cash flows

$90,000 for t=1 to 9

Investment at t=1

0

-300,000

$170,000 for t=2 to 16

-300,000

$80,000 for t-2 to 8

-300,000

0

$140,000 for t=2 to 10

$45,000 for t=1 to 6

D

E

The company financial analysts have determined that Midwest can provide $900,000 (at

t=0) and $700,000 (at t=1) in the next 2 years for capital investment. The company's

MARR is 15%. The design engineers have specified that project C is an extension of

project B and hence cannot be undertaken separately. Formulate the problem as a linear

program. (Just formulate the problem and you are not required to solve the formulation).

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning