The company uses a 10% discount rate and the total-cost approach to capital budgeting analysis. The working capital required under the new system would be released for use elsewhere at the conclusion of the project. Both alternatives are expected to have a useful life of ten years. The net present value of the new system alternative (rounded to the nearest hundred pesos) is: P(758,400) P(552,900) P(987,400) P(862,900)

The company uses a 10% discount rate and the total-cost approach to capital budgeting analysis. The working capital required under the new system would be released for use elsewhere at the conclusion of the project. Both alternatives are expected to have a useful life of ten years. The net present value of the new system alternative (rounded to the nearest hundred pesos) is: P(758,400) P(552,900) P(987,400) P(862,900)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 5C: The following two statements concern depreciation: 1. Because our plant was shut down for part of...

Related questions

Question

The company uses a 10% discount rate and the total-cost approach to capital budgeting analysis. The working capital required under the new system would be released for use elsewhere at the conclusion of the project. Both alternatives are expected to have a useful life of ten years.

The

P(758,400)

P(552,900)

P(987,400)

P(862,900)

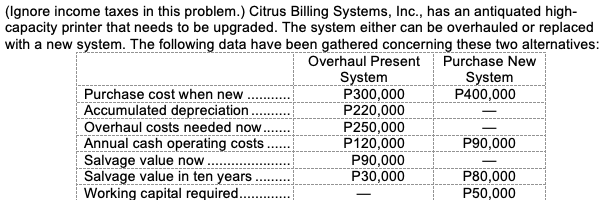

Transcribed Image Text:(Ignore income taxes in this problem.) Citrus Billing Systems, Ic., has an antiquated high-

capacity printer that needs to be upgraded. The system either can be overhauled or replaced

with a new system. The following data have been gathered concerning these two alternatives:

Overhaul Present Purchase New

System

P300,000

P220,000

P250,000

P120,000

P90,000

P30,000

System

P400,000

Purchase cost when new

Accumulated depreciation.

Overhaul costs needed now

Annual cash operating costs

Salvage value now

Salvage value in ten years

Working capital required..

P90,000

P80,000

P50,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning