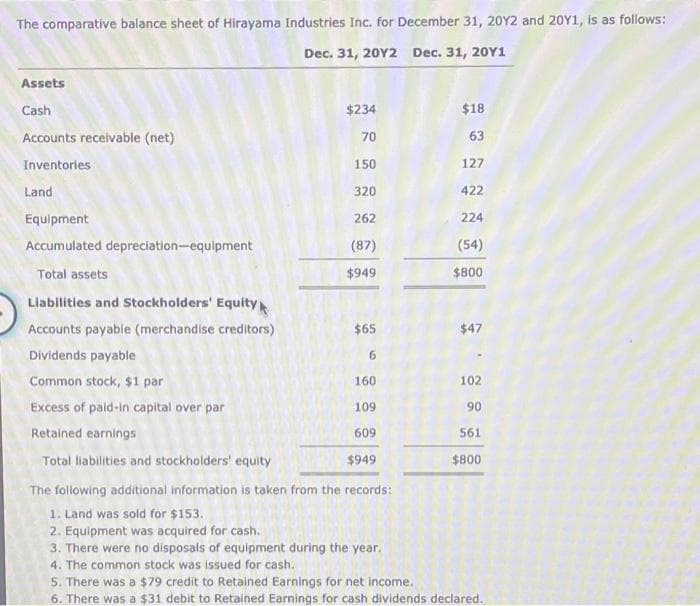

The comparative balance sheet of Hirayama Industries Inc. for December 31, 20Y2 and 20Y1, is as follows: Dec. 31, 20Y2 Dec. 31, 20Y1 Assets Cash $234 $18 Accounts recelvable (net) 70 63 Inventories 150 127 Land 320 422 Equipment 262 224 Accumulated depreciation-equipment (87) (54) Total assets $949 $800 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $65 $47 Dividends payable Common stock, $1 par 160 102 Excess of paid-in capital over par 109 90 Retained earnings 609 561 Total liabilities and stockholders' equity $949 $800 The following additional information is taken from the records: 1. Land was sold for $153. 2. Equipment was acquired for cash. 3. There were no disposals of equipment during the year. 4. The common stock was issued for cash. 5. There was a $79 credit to Retained Earnings for net income. 6. There was a $31 debit to Retained Earnings for cash dividends declared.

The comparative balance sheet of Hirayama Industries Inc. for December 31, 20Y2 and 20Y1, is as follows: Dec. 31, 20Y2 Dec. 31, 20Y1 Assets Cash $234 $18 Accounts recelvable (net) 70 63 Inventories 150 127 Land 320 422 Equipment 262 224 Accumulated depreciation-equipment (87) (54) Total assets $949 $800 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $65 $47 Dividends payable Common stock, $1 par 160 102 Excess of paid-in capital over par 109 90 Retained earnings 609 561 Total liabilities and stockholders' equity $949 $800 The following additional information is taken from the records: 1. Land was sold for $153. 2. Equipment was acquired for cash. 3. There were no disposals of equipment during the year. 4. The common stock was issued for cash. 5. There was a $79 credit to Retained Earnings for net income. 6. There was a $31 debit to Retained Earnings for cash dividends declared.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.4.2MBA: Return on assets The following data (in millions) were adapted from recent financial statements of...

Related questions

Question

Transcribed Image Text:The comparative balance sheet of Hirayama Industries Inc. for December 31, 20Y2 and 20Y1, is as follows:

Dec. 31, 20Y2 Dec. 31, 20Y1

Assets

Cash

$234

$18

Accounts receivable (net)

70

63

Inventories

150

127

Land

320

422

Equipment

262

224

Accumulated depreciation-equipment

(87)

(54)

Total assets

$949

$800

Liabilities and Stockholders' Equity

Accounts payable (merchandise creditors)

$65

$47

Dividends payable

6.

Common stock, $1 par

160

102

Excess of paid-in capital over par

109

90

Retained earnings

609

561

Total liabilities and stockholders' equity

$949

$800

The following additional information is taken from the records:

1. Land was sold for $153.

2. Equipment was acquired for cash.

3. There were no disposals of equipment during the year.

4. The common stock was issued for cash.

5. There was a $79 credit to Retained Earnings for net income.

6. There was a $31 debit to Retained Earnings for cash dividends declared.

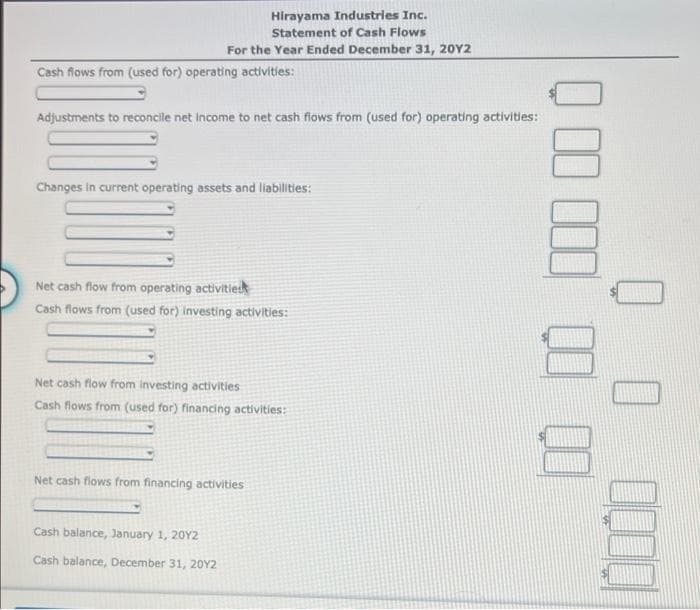

Transcribed Image Text:Hirayama Industries Inc.

Statement of Cash Flows

For the Year Ended December 31, 20Y2

Cash flows from (used for) operating activities:

Adjustments to reconcile net income to net cash flows from (used for) operating activities:

Changes in current operating assets and liabilities:

Net cash flow from operating activitlek

Cash flows from (used for) investing activities:

Net cash flow from investing activities

Cash flows from (used for) financing activities:

Net cash flows from financing activities

Cash balance, January 1, 20Y2

Cash balance, December 31, 20Y2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning