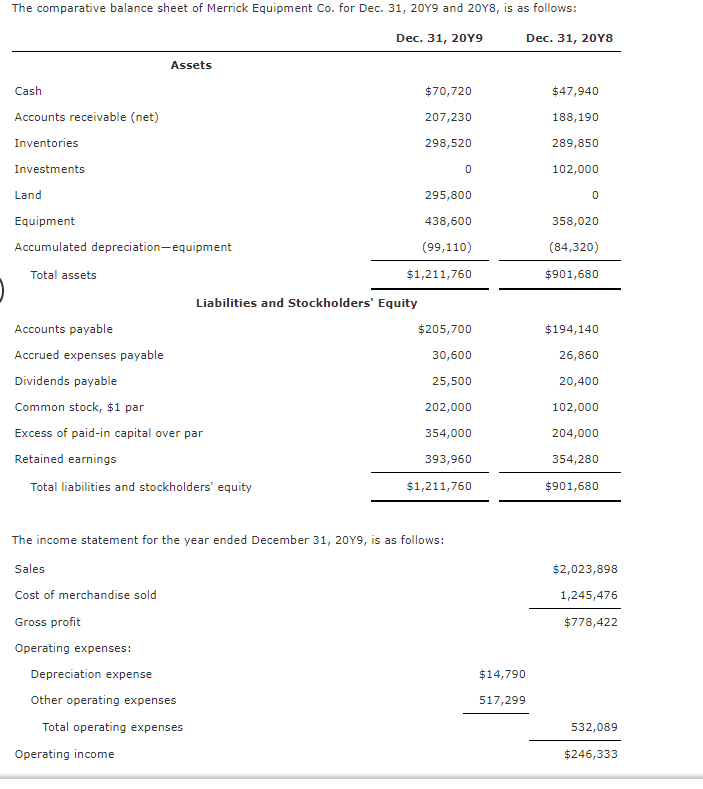

The comparative balance sheet of Merrick Equipment Co. for Dec. 31, 20Y9 and 20Y8, is as follows: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash $70,720 $47,940 Accounts receivable (net) 207,230 188,190 Inventories 298,520 289,850 Investments 102,000 Land 295,800 Equipment 438,600 358,020 Accumulated depreciation-equipment (99,110) (84,320) Total assets $1,211,760 $901,680 Liabilities and Stockholders' Equity Accounts payable $205,700 $194,140 Accrued expenses payable 30,600 26,860 Dividends payable 25,500 20,400 Common stock, $1 par 202,000 102,000 Excess of paid-in capital over par 354,000 204,000 Retained earnings 393,960 354,280 Total liabilities and stockholders' equity $1,211,760 $901,680 The income statement for the year ended December 31, 20Y9, is as follows: Sales $2,023,898 Cost of merchandise sold 1,245,476 Gross profit $778,422 Operating expenses: Depreciation expense $14,790 Other operating expenses 517,299 Total operating expenses 532,089 Operating income $246,333

The comparative balance sheet of Merrick Equipment Co. for Dec. 31, 20Y9 and 20Y8, is as follows: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash $70,720 $47,940 Accounts receivable (net) 207,230 188,190 Inventories 298,520 289,850 Investments 102,000 Land 295,800 Equipment 438,600 358,020 Accumulated depreciation-equipment (99,110) (84,320) Total assets $1,211,760 $901,680 Liabilities and Stockholders' Equity Accounts payable $205,700 $194,140 Accrued expenses payable 30,600 26,860 Dividends payable 25,500 20,400 Common stock, $1 par 202,000 102,000 Excess of paid-in capital over par 354,000 204,000 Retained earnings 393,960 354,280 Total liabilities and stockholders' equity $1,211,760 $901,680 The income statement for the year ended December 31, 20Y9, is as follows: Sales $2,023,898 Cost of merchandise sold 1,245,476 Gross profit $778,422 Operating expenses: Depreciation expense $14,790 Other operating expenses 517,299 Total operating expenses 532,089 Operating income $246,333

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 6MCQ

Related questions

Question

.

Transcribed Image Text:The comparative balance sheet of Merrick Equipment Co. for Dec. 31, 20Y9 and 20Y8, is as follows:

Dec. 31, 20Y9

Dec. 31, 20Y8

Assets

Cash

$70,720

$47,940

Accounts receivable (net)

207,230

188,190

Inventories

298,520

289,850

Investments

102,000

Land

295,800

Equipment

438,600

358,020

Accumulated depreciation-equipment

(99,110)

(84,320)

Total assets

$1,211,760

$901,680

Liabilities and Stockholders' Equity

Accounts payable

$205,700

$194,140

Accrued expenses payable

30,600

26,860

Dividends payable

25,500

20,400

Common stock, $1 par

202,000

102,000

Excess of paid-in capital over par

354,000

204,000

Retained earnings

393,960

354,280

Total liabilities and stockholders' equity

$1,211,760

$901,680

The income statement for the year ended December 31, 20Y9, is as follows:

Sales

$2,023,898

Cost of merchandise sold

1,245,476

Gross profit

$778,422

Operating expenses:

Depreciation expense

$14,790

Other operating expenses

517,299

Total operating expenses

532,089

Operating income

$246,333

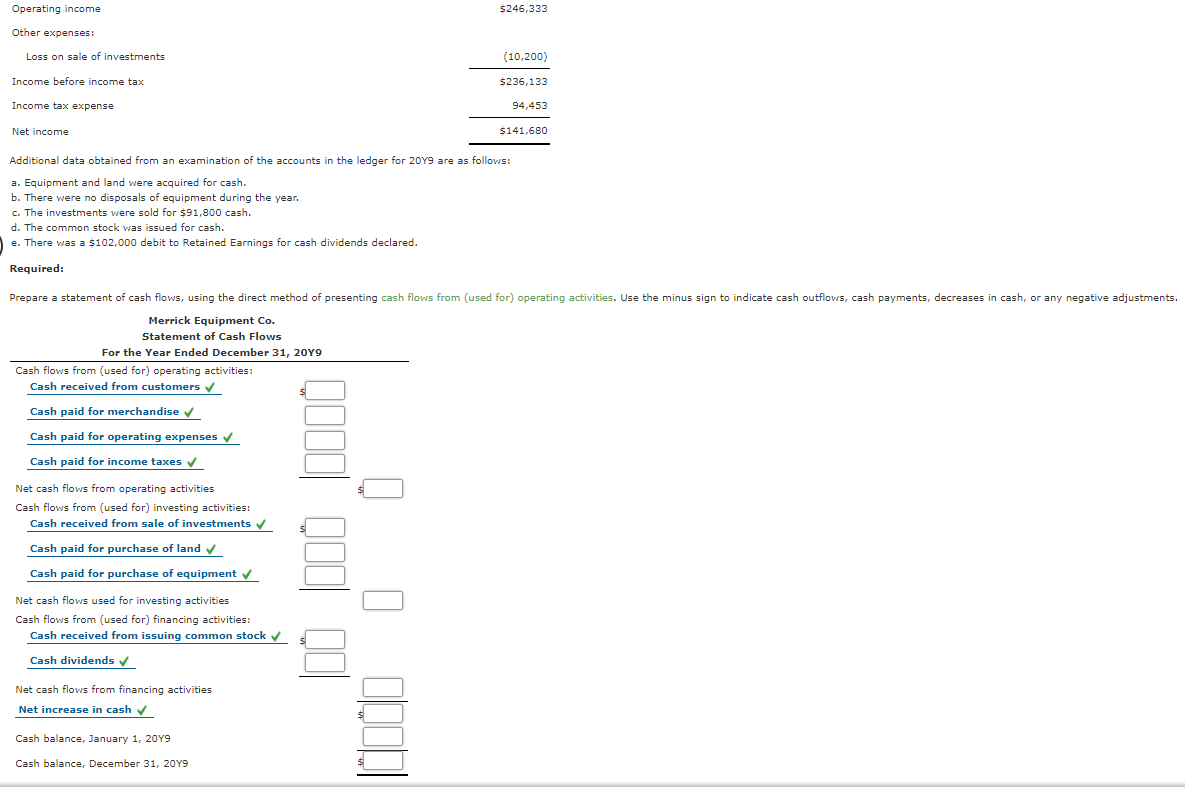

Transcribed Image Text:Operating income

$246,333

Other expenses:

Loss on sale of investments

(10,200)

Income before income tax

$236,133

Income tax expense

94,453

Net income

$141,680

Additional data obtained from an examination of the accounts in the ledger for 20Y9 are as follows:

a. Equipment and land were acquired for cash.

b. There were no disposals of equipment during the year.

c. The investments were sold for $91,800 cash.

d. The common stock was issued for cash.

e. There was a $102,000 debit to Retained Earnings for cash dividends declared.

Required:

Prepare a statement of cash flows, using the direct method of presenting cash flows from (used for) operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.

Merrick Equipment Co.

Statement of Cash Flows

For the Year Ended December 31, 20Y9

Cash flows from (used for) operating activities:

Cash received from customers v

Cash paid for merchandise v

Cash paid for operating expenses v

Cash paid for income taxes v

Net cash flows from operating activities

Cash flows from (used for) investing activities:

Cash received from sale of investments v

Cash paid for purchase of land v

Cash paid for purchase of equipment v

Net cash flows used for investing activities

Cash flows from (used for) financing activities:

Cash received from issuing common stock v

Cash dividends v

Net cash flows from financing activities

Net increase in cash v

Cash balance, January 1, 20Y9

Cash balance, December 31, 20Y9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning