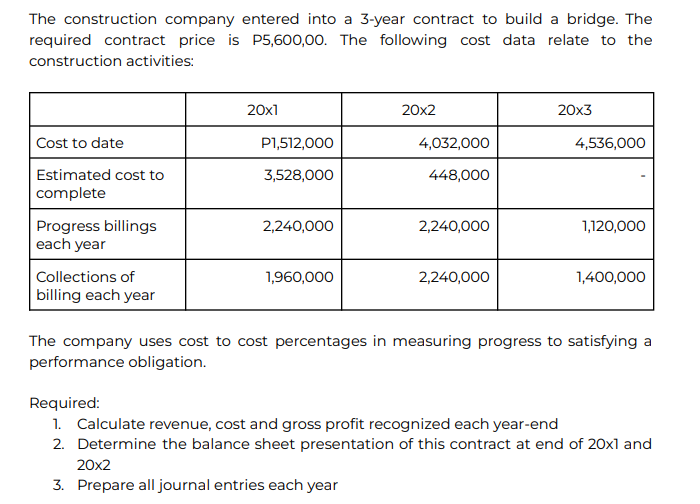

The construction company entered into a 3-year contract to build a bridge. The required contract price is P5,600,00. The following cost data relate to the construction activities: Cost to date Estimated cost to complete Progress billings each year Collections of billing each year 20x1 P1,512,000 3,528,000 2,240,000 1,960,000 20x2 4,032,000 448,000 2,240,000 2,240,000 20x3 4,536,000 1,120,000 1,400,000 The company uses cost to cost percentages in measuring progress to satisfying a performance obligation. Required: 1. Calculate revenue, cost and gross profit recognized each year-end 2. Determine the balance sheet presentation this contract at end of 20x1 and 20x2 3. Prepare all journal entries each year

The construction company entered into a 3-year contract to build a bridge. The required contract price is P5,600,00. The following cost data relate to the construction activities: Cost to date Estimated cost to complete Progress billings each year Collections of billing each year 20x1 P1,512,000 3,528,000 2,240,000 1,960,000 20x2 4,032,000 448,000 2,240,000 2,240,000 20x3 4,536,000 1,120,000 1,400,000 The company uses cost to cost percentages in measuring progress to satisfying a performance obligation. Required: 1. Calculate revenue, cost and gross profit recognized each year-end 2. Determine the balance sheet presentation this contract at end of 20x1 and 20x2 3. Prepare all journal entries each year

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 40P

Related questions

Question

Provide proper solution

Transcribed Image Text:The construction company entered into a 3-year contract to build a bridge. The

required contract price is P5,600,00. The following cost data relate to the

construction activities:

Cost to date

Estimated cost to

complete

Progress billings

each year

Collections of

billing each year

20x1

P1,512,000

3,528,000

2,240,000

1,960,000

20x2

4,032,000

448,000

2,240,000

2,240,000

20x3

4,536,000

1,120,000

1,400,000

The company uses cost to cost percentages in measuring progress to satisfying a

performance obligation.

Required:

1. Calculate revenue, cost and gross profit recognized each year-end

2. Determine the balance sheet presentation of this contract at end of 20x1 and

20x2

3. Prepare all journal entries each year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning