The Continental Bank made a loan of $20,000 on March 25 to Dr. Hirsch to purchase equipment for her office. The loan was secured by a demand loan (note?) subject to a variable rate of interest that was 7% on March 25. The rate of interest was raised to 8.5% effective July 1 and to 9.5% effective September 1. Dr. Hirsch made partial payments on the loan as follows: $600 on May 5; $800 on June 30; and $400 on October 10. The terms of the note require payment of any accrued interest up to, and including, October 31. How much must Dr. Hirsch pay on October 31? (Use the Declining Balance Method) May 5 Payment Calculate the interest accrued to May 5. Calculate the amount of the payment that can be applied to the principal. Calculate the remaining principal.

The Continental Bank made a loan of $20,000 on March 25 to Dr. Hirsch to purchase equipment for her office. The loan was secured by a demand loan (note?) subject to a variable rate of interest that was 7% on March 25. The rate of interest was raised to 8.5% effective July 1 and to 9.5% effective September 1. Dr. Hirsch made partial payments on the loan as follows: $600 on May 5; $800 on June 30; and $400 on October 10. The terms of the note require payment of any accrued interest up to, and including, October 31. How much must Dr. Hirsch pay on October 31? (Use the Declining Balance Method) May 5 Payment Calculate the interest accrued to May 5. Calculate the amount of the payment that can be applied to the principal. Calculate the remaining principal.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 11EB: Whole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from...

Related questions

Question

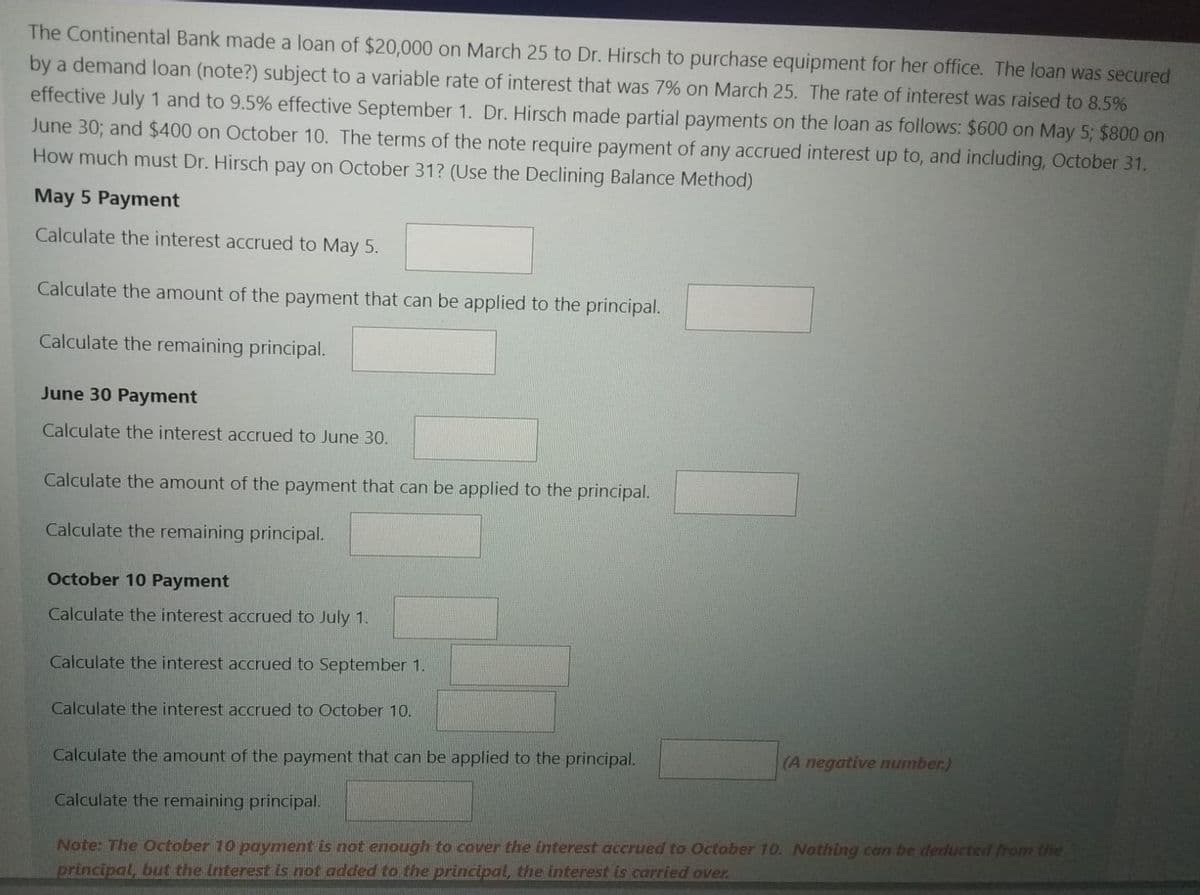

Transcribed Image Text:The Continental Bank made a loan of $20,000 on March 25 to Dr. Hirsch to purchase equipment for her office. The loan was secured

by a demand loan (note?) subject to a variable rate of interest that was 7% on March 25. The rate of interest was raised to 8.5%

effective July 1 and to 9.5% effective September 1. Dr. Hirsch made partial payments on the loan as follows: $600 on May 5; $800 on

June 30; and $400 on October 10. The terms of the note require payment of any accrued interest up to, and including, October 31.

How much must Dr. Hirsch pay on October 31? (Use the Declining Balance Method)

May 5 Payment

Calculate the interest accrued to May 5.

Calculate the amount of the payment that can be applied to the principal.

Calculate the remaining principal.

June 30 Payment

Calculate the interest accrued to June 30.

Calculate the amount of the payment that can be applied to the principal.

Calculate the remaining principal.

October 10 Payment

Calculate the interest accrued to July 1.

Calculate the interest accrued to September 1.

Calculate the interest accrued to October 10.

(A negative number.)

Calculate the amount of the payment that can be applied to the principal.

Calculate the remaining principal.

Note: The October 10 payment is not enough to cover the interest accrued to October 10. Nothing can be deducted from the

principal, but the interest is not added to the principal, the interest is carried over.

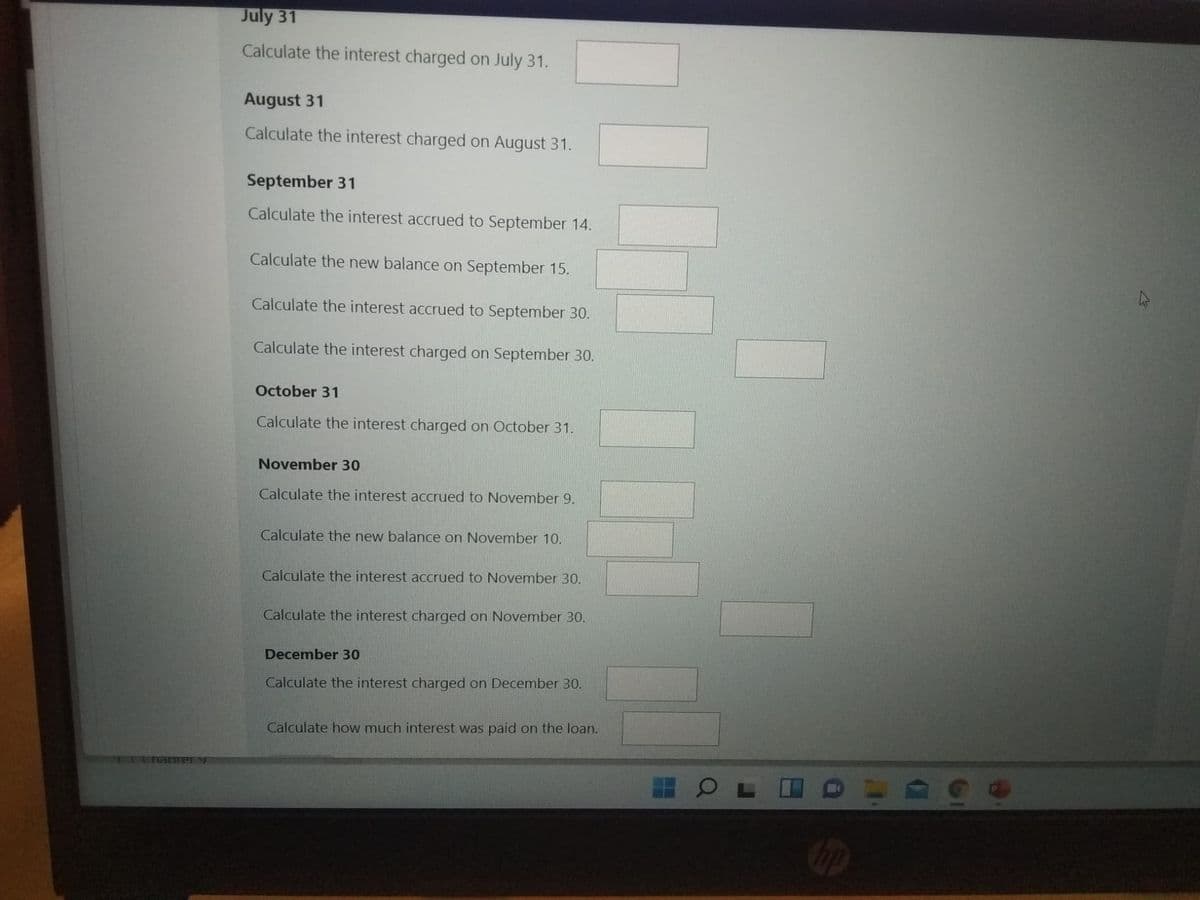

Transcribed Image Text:July 31

Calculate the interest charged on July 31.

August 31

Calculate the interest charged on August 31.

September 31

Calculate the interest accrued to September 14.

Calculate the new balance on September 15.

Calculate the interest accrued to September 30.

Calculate the interest charged on September 30.

October 31

Calculate the interest charged on October 31.

November 30

Calculate the interest accrued to November 9.

Calculate the new balance on November 10.

Calculate the interest accrued to November 30.

Calculate the interest charged on November 30.

December 30

Calculate the interest charged on December 30.

Calculate how much interest was paid on the loan.

Cip

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning