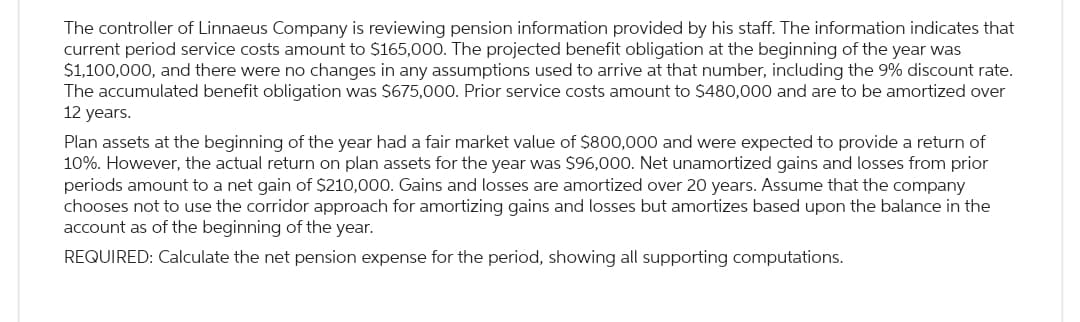

The controller of Linnaeus Company is reviewing pension information provided by his staff. The information indicates that current period service costs amount to $165,000. The projected benefit obligation at the beginning of the year was $1,100,000, and there were no changes in any assumptions used to arrive at that number, including the 9% discount rate. The accumulated benefit obligation was $675,000. Prior service costs amount to $480,000 and are to be amortized over 12 years. Plan assets at the beginning of the year had a fair market value of $800,000 and were expected to provide a return of 10%. However, the actual return on plan assets for the year was $96,000. Net unamortized gains and losses from prior periods amount to a net gain of $210,000. Gains and losses are amortized over 20 years. Assume that the company chooses not to use the corridor approach for amortizing gains and losses but amortizes based upon the balance in the account as of the beginning of the year. REQUIRED: Calculate the net pension expense for the period, showing all supporting computations.

The controller of Linnaeus Company is reviewing pension information provided by his staff. The information indicates that current period service costs amount to $165,000. The projected benefit obligation at the beginning of the year was $1,100,000, and there were no changes in any assumptions used to arrive at that number, including the 9% discount rate. The accumulated benefit obligation was $675,000. Prior service costs amount to $480,000 and are to be amortized over 12 years. Plan assets at the beginning of the year had a fair market value of $800,000 and were expected to provide a return of 10%. However, the actual return on plan assets for the year was $96,000. Net unamortized gains and losses from prior periods amount to a net gain of $210,000. Gains and losses are amortized over 20 years. Assume that the company chooses not to use the corridor approach for amortizing gains and losses but amortizes based upon the balance in the account as of the beginning of the year. REQUIRED: Calculate the net pension expense for the period, showing all supporting computations.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 11E

Related questions

Question

Please do not give image format

Transcribed Image Text:The controller of Linnaeus Company is reviewing pension information provided by his staff. The information indicates that

current period service costs amount to $165,000. The projected benefit obligation at the beginning of the year was

$1,100,000, and there were no changes in any assumptions used to arrive at that number, including the 9% discount rate.

The accumulated benefit obligation was $675,000. Prior service costs amount to $480,000 and are to be amortized over

12 years.

Plan assets at the beginning of the year had a fair market value of $800,000 and were expected to provide a return of

10%. However, the actual return on plan assets for the year was $96,000. Net unamortized gains and losses from prior

periods amount to a net gain of $210,000. Gains and losses are amortized over 20 years. Assume that the company

chooses not to use the corridor approach for amortizing gains and losses but amortizes based upon the balance in the

account as of the beginning of the year.

REQUIRED: Calculate the net pension expense for the period, showing all supporting computations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT