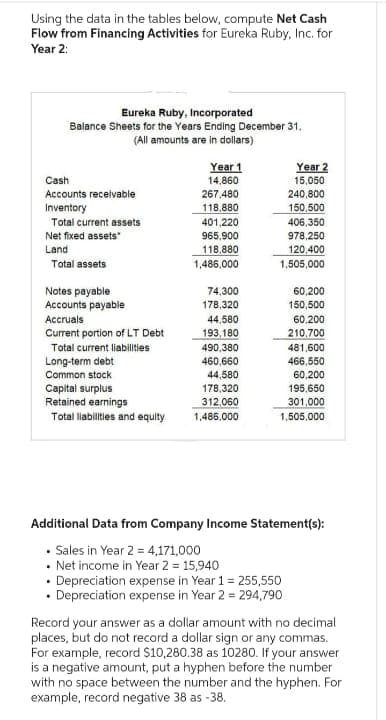

Using the data in the tables below, compute Net Cash Flow from Financing Activities for Eureka Ruby, Inc. for Year 2: Eureka Ruby, Incorporated Balance Sheets for the Years Ending December 31, (All amounts are in dollars) Cash Accounts receivable Inventory Total current assets Net fixed assets" Land Total assets Notes payable Accounts payable Accruals Current portion of LT Debt Total current liabilities Long-term debt Common stock Capital surplus Retained earnings Total liabilities and equity Year 1 14,860 267,480 118,880 401,220 965,900 118,880 1,486,000 74,300 178,320 44,580 193,180 490,380 460,660 44,580 178,320 312,060 1,486.000 Year 2 15,050 240,800 150,500 406,350 978,250 120,400 1,505,000 60,200 150,500 60.200 210,700 481,600 466,550 60,200 195,650 301,000 1,505,000 Additional Data from Company Income Statement(s): • Sales in Year 2 = 4,171,000 • Net income in Year 2 = 15,940 • Depreciation expense in Year 1 = 255,550 • Depreciation expense in Year 2 = 294,790 Record your answer as a dollar amount with no decimal places, but do not record a dollar sign or any commas. For example, record $10,280.38 as 10280. If your answer is a negative amount, put a hyphen before the number with no space between the number and the hyphen. For example, record negative 38 as -38.

Using the data in the tables below, compute Net Cash Flow from Financing Activities for Eureka Ruby, Inc. for Year 2: Eureka Ruby, Incorporated Balance Sheets for the Years Ending December 31, (All amounts are in dollars) Cash Accounts receivable Inventory Total current assets Net fixed assets" Land Total assets Notes payable Accounts payable Accruals Current portion of LT Debt Total current liabilities Long-term debt Common stock Capital surplus Retained earnings Total liabilities and equity Year 1 14,860 267,480 118,880 401,220 965,900 118,880 1,486,000 74,300 178,320 44,580 193,180 490,380 460,660 44,580 178,320 312,060 1,486.000 Year 2 15,050 240,800 150,500 406,350 978,250 120,400 1,505,000 60,200 150,500 60.200 210,700 481,600 466,550 60,200 195,650 301,000 1,505,000 Additional Data from Company Income Statement(s): • Sales in Year 2 = 4,171,000 • Net income in Year 2 = 15,940 • Depreciation expense in Year 1 = 255,550 • Depreciation expense in Year 2 = 294,790 Record your answer as a dollar amount with no decimal places, but do not record a dollar sign or any commas. For example, record $10,280.38 as 10280. If your answer is a negative amount, put a hyphen before the number with no space between the number and the hyphen. For example, record negative 38 as -38.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.24MCE

Related questions

Topic Video

Question

Please do not give solution in image format thanku

Transcribed Image Text:Using the data in the tables below, compute Net Cash

Flow from Financing Activities for Eureka Ruby, Inc. for

Year 2:

Eureka Ruby, Incorporated

Balance Sheets for the Years Ending December 31.

(All amounts are in dollars)

Cash

Accounts receivable

Inventory

Total current assets

Net fixed assets"

Land

Total assets

Notes payable

Accounts payable

Accruals

Current portion of LT Debt

Total current liabilities

Long-term debt

Common stock

Capital surplus

Retained earnings

Total liabilities and equity

Year 1

14,860

267,480

118.880

401,220

965,900

118,880

1,486,000

74,300

178,320

44,580

193,180

490,380

460,660

44,580

178,320

312,060

1,486,000

Year 2

15,050

240,800

150,500

406,350

978,250

120,400

1,505,000

60,200

150,500

60,200

210,700

481,600

466,550

60,200

195,650

301,000

1,505,000

Additional Data from Company Income Statement(s):

• Sales in Year 2 = 4,171,000

• Net income in Year 2 = 15,940

• Depreciation expense in Year 1 = 255,550

• Depreciation expense in Year 2 = 294,790

Record your answer as a dollar amount with no decimal

places, but do not record a dollar sign or any commas.

For example, record $10,280.38 as 10280. If your answer

is a negative amount, put a hyphen before the number

with no space between the number and the hyphen. For

example, record negative 38 as -38.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub