The County of Maxnell decides to create a waste management department and offer ItS services to the public for a fee. As a result, county officials plan to account for this activity as an enterprise fund. Assume the Information is gathered so that the county can prepare fund financial statements. Only entries for the waste management department are required here: January 1 Receive unrestricted funds of $162,800 from the general fund as permanent financing. Febrauary 1 Borrow an additional $128,e00 from a local bank at a 12 percent annual interest rate. March 1 Order a truck at an expected cost of $114,5ee. April 1 Receive the truck and make full payment. The actual cost including transportation was $115,80e. The truck has a 18- year life and no residual value. The county uses straight-line depreciation. May 1 Receive a $23,800 cash grant from the state to help supplement the pay of the department workers. According to the grant, the money must be used for that purpose. June 1 Rent a garage for the truck at a cost of $1,300 per month. The county pays 12 months of rent in advance. The contract has no provisions for extensions or purchases. July 1 Charge citizens $16, 300 for services. Of this amount, $12,400 is collected. August 1 Make a $12,800 cash payment on the 12 percent note of February 1. This payment covers both interest and principal. September 1 Pay salaries of $28, 200 using the grant money received on May 1. October 1 Pay truck maintenance costs of $2, 200. November 1 Pay additional salaries of $18,78e, first using the rest of the grant money received May 1. December 31 Send invoices totaling $24,400 to customers for services during the past six months. Collect $5,5ee of the cash immediately. December 31 A new goverrment landfill opened this year. At the end of the year, it is 12 percent filled. The estimated current cost for the eventual closure of this facility is $2.7 million, although no payments will be made for approximately nine years. Prepare Journal entries for this operation for the followling 2020 transactions. Also prepare any necessary adjusting entries at the end of the year. (If no entry is required for a transaction/event, select "No Journal entry required" In the first account field. Enter your olo do

The County of Maxnell decides to create a waste management department and offer ItS services to the public for a fee. As a result, county officials plan to account for this activity as an enterprise fund. Assume the Information is gathered so that the county can prepare fund financial statements. Only entries for the waste management department are required here: January 1 Receive unrestricted funds of $162,800 from the general fund as permanent financing. Febrauary 1 Borrow an additional $128,e00 from a local bank at a 12 percent annual interest rate. March 1 Order a truck at an expected cost of $114,5ee. April 1 Receive the truck and make full payment. The actual cost including transportation was $115,80e. The truck has a 18- year life and no residual value. The county uses straight-line depreciation. May 1 Receive a $23,800 cash grant from the state to help supplement the pay of the department workers. According to the grant, the money must be used for that purpose. June 1 Rent a garage for the truck at a cost of $1,300 per month. The county pays 12 months of rent in advance. The contract has no provisions for extensions or purchases. July 1 Charge citizens $16, 300 for services. Of this amount, $12,400 is collected. August 1 Make a $12,800 cash payment on the 12 percent note of February 1. This payment covers both interest and principal. September 1 Pay salaries of $28, 200 using the grant money received on May 1. October 1 Pay truck maintenance costs of $2, 200. November 1 Pay additional salaries of $18,78e, first using the rest of the grant money received May 1. December 31 Send invoices totaling $24,400 to customers for services during the past six months. Collect $5,5ee of the cash immediately. December 31 A new goverrment landfill opened this year. At the end of the year, it is 12 percent filled. The estimated current cost for the eventual closure of this facility is $2.7 million, although no payments will be made for approximately nine years. Prepare Journal entries for this operation for the followling 2020 transactions. Also prepare any necessary adjusting entries at the end of the year. (If no entry is required for a transaction/event, select "No Journal entry required" In the first account field. Enter your olo do

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

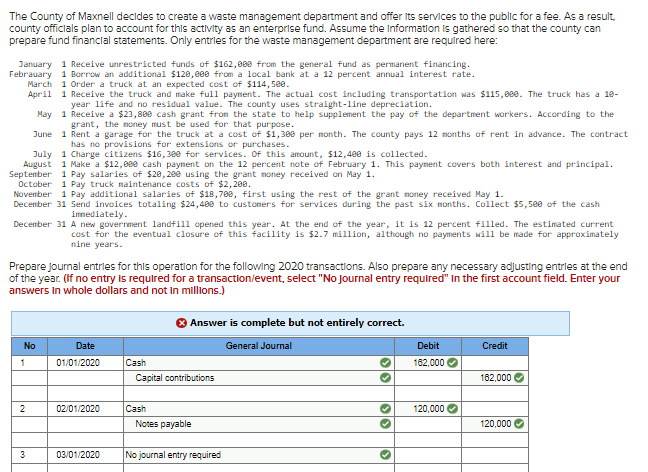

Transcribed Image Text:The County of Maxnell decides to create a waste management department and offer its services to the public for a fee. As a result.

county officlals plan to account for this activity as an enterprise fund. Assume the Information is gathered so that the county can

prepare fund financial statements. Only entries for the waste management department are required here:

January 1 Receive unrestricted funds of $162,800 from the general fund as permanent financing.

Febrauary 1 Borrow an additional $120,e0 from a local bank at a 12 percent annual interest rate.

March 1 Order a truck at an expected cost of $114, 5ee.

April 1 Receive the truck and make full paynent. The actual cost including transportation was $115,000. The truck has a 10-

year life and no residual value. The county uses straight-line depreciation.

May 1 Receive a $23,800 cash grant from the state to help supplement the pay of the department workers. According to the

grant, the money must be used for that purpose.

June 1 Rent a garage for the truck at a cost of $1,300 per nonth. The county pays 12 nonths of rent in advance. The contract

has no provisions for extensions or purchases.

July 1 Charge citizens $16, 300 for services. Of this amount, $12,400 is collected.

August 1 Make a $12,000 cash payment on the 12 percent note of February 1. This paynent covers both interest and principal.

September 1 Pay salaries of $20, 200 using the grant money received on May 1.

October 1 Pay truck maintenance costs of $2, 200.

November 1 Pay additional salaries of $18,78, first using the rest of the grant money received May 1.

December 31 Send invoices totaling $24,400 to custoners for services during the past six nonths. Collect $5,5e0 of the cash

immediately.

December 31 A new goverrment landfill opened this year. At the end of the year, it is 12 percent filled. The estimated current

cost for the eventual closure of this facility is $2.7 million, although no payments will be made for approximately

nine years.

Prepare joumal entries for this operation for the following 2020 transactions. Also prepare any necessary adjusting entries at the end

of the year. (If no entry is required for a transaction/event, select "No Journal entry required" In the first account field. Enter your

answers In whole dollars and not in millions.)

Answer is complete but not entirely correct.

No

Date

General Journal

Debit

Credit

1

01/01/2020

Cash

182,000 O

Capital contributions

182,000

2

02/01/2020

Cash

120,000

Notes payable

120,000

3

03/01/2020

No journal entry required

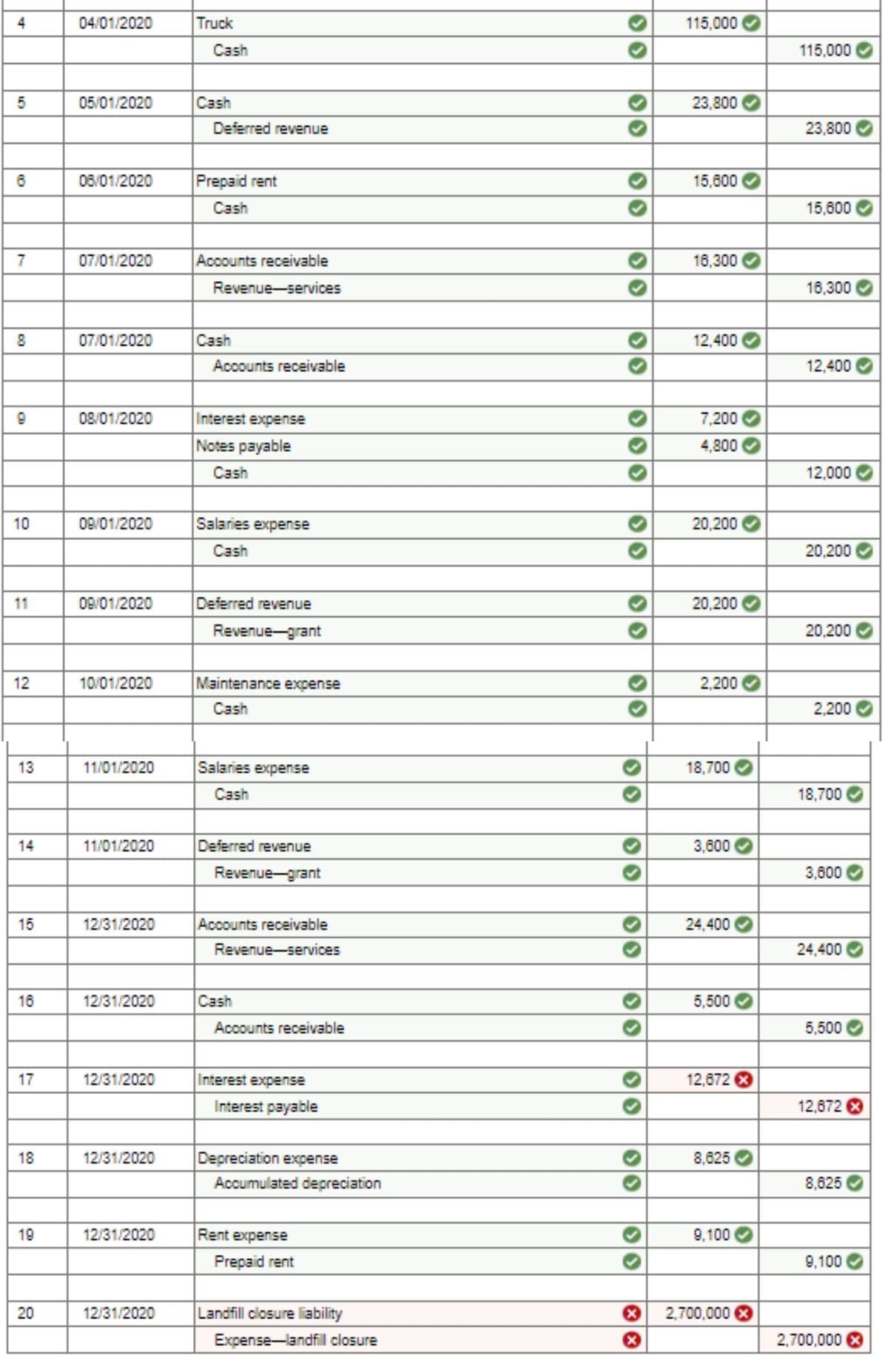

Transcribed Image Text:4

04/01/2020

Truck

115,000

Cash

115,000

5

05/01/2020

Cash

23,800

Deferred revenue

23,800

08/01/2020

Prepaid rent

15,600

Cash

15,600

7

07/01/2020

Accounts receivable

16,300

Revenue-services

16,300

07/01/2020

Cash

12,400

Accounts receivable

12,400

08/01/2020

Interest expense

7,200

Notes payable

4,800

Cash

12,000

10

09/01/2020

Salaries expense

20,200

Cash

20,200

11

09/01/2020

Deferred revenue

20,200

Revenue-grant

20,200

12

10/01/2020

Maintenance expense

2,200

Cash

2,200

13

11/01/2020

Salaries expense

18,700

Cash

18,700

14

11/01/2020

Deferred revenue

3,600

Revenue-grant

3,600

15

12/31/2020

Accounts receivable

24,400

Revenue-services

24,400

16

12/31/2020

Cash

5,500

Accounts receivable

5,500

17

12/31/2020

Interest expense

12,672

Interest payable

12,672 8

18

12/31/2020

Depreciation expense

8,625

Accumulated depreciation

8,625

19

12/31/2020

Rent expense

9,100

Prepaid rent

9,100

12/31/2020

Landfill closure liability

2,700,000

Expense-landfil closure

2,700,000

20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education