The current PFRSS do not address the aCcounting for revenues from franchise contracts.

The current PFRSS do not address the aCcounting for revenues from franchise contracts.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 5P

Related questions

Question

True or false only under franchise in accounting

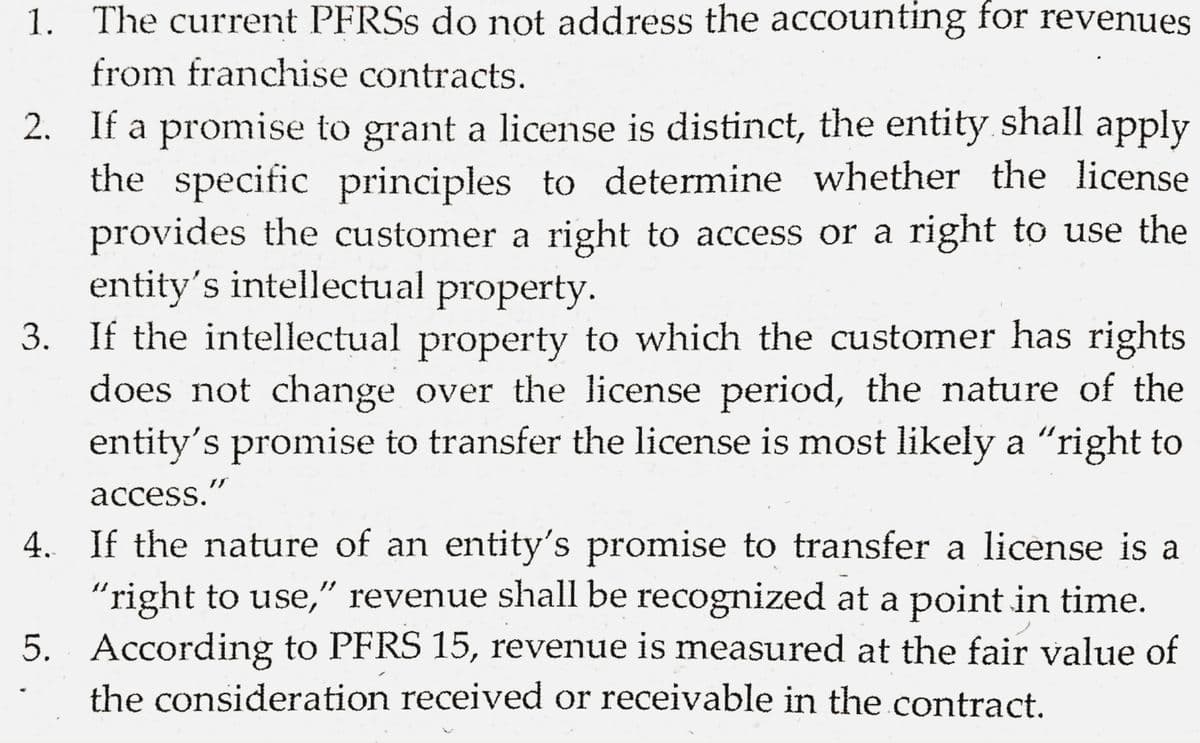

Transcribed Image Text:1. The current PFRSS do not address the accounting for revenues

from franchise contracts.

2. If a promise to grant a license is distinct, the entity shall apply

the specific principles to determine whether the license

provides the customer a right to access or a right to use the

entity's intellectual property.

3. If the intellectual property to which the customer has rights

does not change over the license period, the nature of the

entity's promise to transfer the license is most likely a "right to

access."

4. If the nature of an entity's promise to transfer a license is a

"right to use," revenue shall be recognized at a point in time.

5. According to PFRS 15, revenue is measured at the fair value of

the consideration received or receivable in the contract.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning