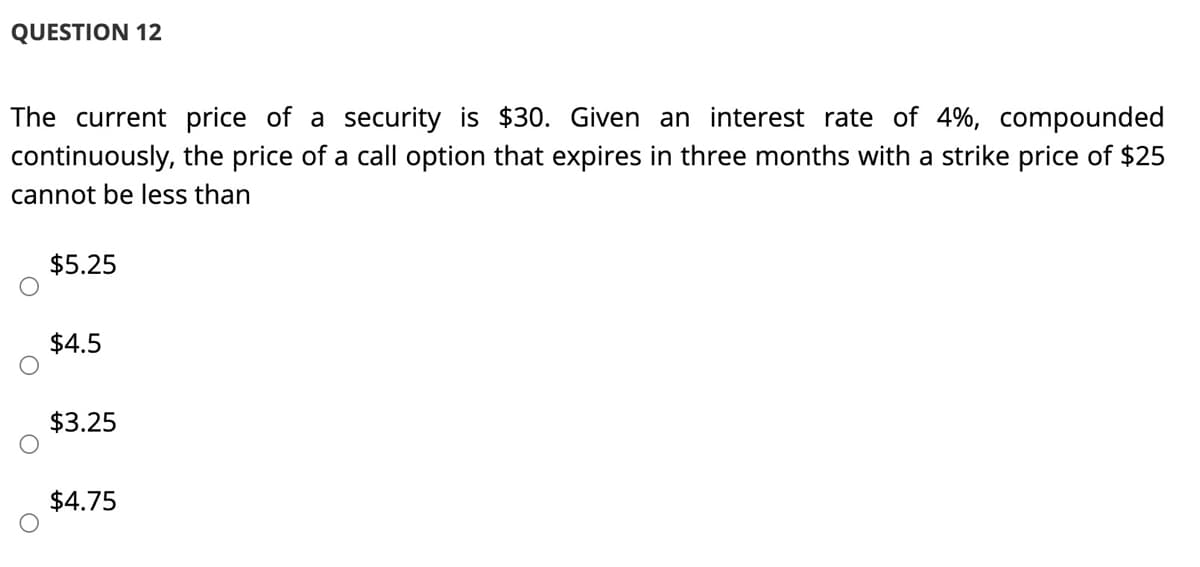

The current price of a security is $30. Given an interest rate of 4 continuously, the price of a call option that expires in three months with a s cannot be less than $5.25 $4.5 $3,25

Q: Today is t=0.5. Compute the present value of the forward contract to purchase a 1.5-year zero coupon…

A: t= 0.5 Today's Present value =94 To compute the present value of the forward contract to purchase a…

Q: Consider a 3-month forward contract on a zero-coupon bond with a face value of $1,000 that is…

A: The provided information are: Spot rate = $1000 Annual risk free rate = 6% = 0.06 Time period =…

Q: A 2-year Treasury security currently earns 1.79 percent. Over the next two years, the real risk-free…

A: Maturity risk premium can be defined as the additional benefit an investor can earn on bonds having…

Q: Consider a 3-month forward contract on a zero-coupon bond with a face value of $1,000 that is…

A: The provided information are: Spot rate = $500 Annual risk free rate = 6% = 0.06 Time period =…

Q: Suppose you purchase a zero coupon bond with face value $1,000, maturing in 25 years, for $180. What…

A: Yield to maturity can be calculated by following function in excel =RATE (nper, pmt, pv, [fv],…

Q: You purchase a bond with a coupon rate of 5.2 percent, a par value $1,000, and a clean price of…

A: The question is based on the concept of Financial Management.

Q: perpetual bondis a bond with no maturity, i.e., it pays a fixed payment at fixed intervals forever.…

A: The given problem relates to perpetuity. Perpetuity means series of uniform cash flows over…

Q: A 2-year Treasury security currently earns 1.77 percent. Over the next two years, the real risk-free…

A: Calculate the maturity risk premium as follows:

Q: What is the present value of a security that will pay $7,000 in 20 years if securities of equal risk…

A: Given: Future value (FV) = 7000 Number of years (n) = 20 Interest rate (r) = 7% = 0.07

Q: Suppose that 6-month, 12-month, 18-month, 24-month, and 30-month aero rates are 4 42 4.4% 4.6, nd…

A: The present discounted value of future cash flows, such as the coupon and maturity values produced…

Q: An investor has two bonds in his portfolio that have a face value of $1,000 and pay a 7% annual…

A: Bond price: Bond price is the current value of the future payments at a given rate of interest.…

Q: You're considering a bond with a maturity of 10 years, face value of 1,000. The surface interest…

A: Using excel PV function to calculate price of the bond

Q: Consider a fixed-payment security that pays P100 at the end of every year fo the three years. If the…

A: Present value of bond can be calculated by using this equation Present value =C1/(1+r) +C2/(1+r)2…

Q: A two-year Treasury security currently earns 1.94%. Over the next two years, the real risk-free rate…

A: Here, 2-year Treasury security yield = 1.94% Real risk-free rate = 1.00% Inflation premium = 0.50%…

Q: An investor has two bonds in his portfolio that have a face value of $1,000 and pay an 11% annual…

A: BOND L Yield to maturity 17 coupon amount (PMT) = 11%*1000 110 Face value (FV) 1000…

Q: Sun Life Financial Trust offers a 360 -day short -term GIC at 0.65 %. It also offers a 120 -day…

A: Given: 360 day GIC rate = 0.65% number of days = 360 120 day short term rate = 0.58% number of days…

Q: What is the present value of a security that will pay $3,000 in 20 years if securities of equal risk…

A: The Formula to Calculate the Present Value =Future Value x 1/(1 + Rate of Interest)^Period (in…

Q: Semiannual compounding, zero coupon bond with 15 years, maturity paying $1,000 at maturity if the:…

A: A financial instrument with a fixed cost that helps a company to raise funds for business operations…

Q: You are buying a bond at a clean price of $1,140. The bond has a face valueof $1,000, an 8 percent…

A: Face Value of Bond = $1,000Coupon Rate = 8% or 0.08Type of Coupon Payment = Semi-annuallyTime for…

Q: If the interest rate is 4 percent, what is the present value of a security that pays you $100 two…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: An insurance firm needs to make a payment of $10000 in 3 years, the market interest rate to discount…

A: Note: This post has multiple questions. The first three questions have been answered below.

Q: Consider a Treasury bond with 8% coupon rate and 4 years to maturity (annual coupons). You enter…

A: Forward price is the price at which the buyer will buy the underlying asseat a future date. This…

Q: What will the value of the Bond L be if the going interest rate is 4%? Round your answer to the…

A: Bonds are primarily the debt instruments using which a company can raise funds. With the given…

Q: A bond has a $1000 par value, 12 years to maturity, a 5% annual coupon and currently sells for $900.…

A: Par value (F) = $1000 Years to maturity (n) = 12 years Coupon (C) = 5% of $1000 = $50 Let r = YTM

Q: An investor has two bonds in his portfolio that have a face value of $1,000 and pay an 11% annual…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: The real risk-free rate is 3.25%, and inflation is expected to be 2.25% for the next 2 years. A…

A: We know that the treasury security yield is determined by the addition of risk-free rate, inflation…

Q: The real risk-free rate is 3.25%, and inflation is expected to be 3.75% for the next 2 years. A…

A: given, rf=3.25%inf2= 3.75%T security yield = 9.25%

Q: A $5,000 face value strip bond has 12 years remaining until maturity. If the market rate of return…

A: A bond is a financial security issued by many business organizations and governments to raise debt…

Q: An investor has two bonds in his portfolio that have a face value of $1,000 and pay an 8% annual…

A: Bonds are loan raised by the company in the stock market. Some bonds are fixed and some are variable…

Q: A bond with a face value of $5,000 pays interest of 8% per year. This bond will be redeemed at par…

A: Information Provided: Face value = $5000 Coupon rate = 8% Term = 20 years Yield = 10%

Q: The real risk-free rate is 3.5% and inflation is expected to be 2.25% for the next 2 years. A 2-year…

A: Maturity Risk relates to risk directly related to term of investments. Maturity Risk Premium(MRP) is…

Q: Assume you will be paying $10,000 per year in tuition expenses at the end of each of the next two…

A: Honor code: As you have posted a question with multiple sub-parts, we will solve the first three…

Q: An investor buys a $10,000 par, 5% coupon (semiannual payments) TIPS security with two years to…

A: A bond is a debt instrument that is issued by the organization to raise the funds from the investor…

Q: Suppose that you bought a 14% Drexler bond with time to maturity of 9 years for $1,379.75…

A: Here, As the Face Value of the Bond is not given in the question, we are assuming it to be $1,000.…

Q: the yield to maturity on a 15— year bond with similar risk will be 8.5%. How much should you be…

A: Annual coupon = (9 / 100) * 1000 = 90 Price after 5 years = Coupon * [1 - 1 / (1 + rate)^periods] /…

Q: A trader, Peter, buys a treasury note with a face value of 1000, which will mature in 180 days.…

A: Treasury notes is a debt financial instrument that offers stable interest rates. It is issued for…

Q: The real risk-free rate is 3.25%, and inflation is expected to be 3.75% for the next 2 years. A…

A: Market risk premium is the interest above the risk fee rate (Rf) and inflation rate(i) offered by…

Q: The price of a stock is currently $200 per share. It'll pay a dividend of $0.85 every 3 months (the…

A:

Q: Which security has a higher effective annual interest rate?a. A 3-month T-bill selling at $97,645…

A: For part (a) Par Value = $100,000 Price of T-bill = $97,645 Time Period = 3 months For part (b)…

Q: An investor has two bonds in his portfolio that have a face value of $1,000 and pay a 6% annual…

A: BOND L Yield to maturity 12 coupon amount (PMT) = 6%*1000 60 Face value (FV) 1000 Yield…

Q: Suppose you purchase a zero coupon bond with a face value of $1000, maturing in 20 years, for…

A: Yield to maturity- It is the internal rate of return required for the present value of all the…

Q: The real risk-free rate is 3%, and inflation is expected to be 4% for the next 2 years. A 2-year…

A: MATURITY risk premium is rate above normal rate of return due to MATURITY of bond.

Q: Suppose that a 5-year 6% bond is purchased between the issuance date and the first coupon date. The…

A: Face value = $1000 Coupon = (6% of $1000) / 4 = $15 r = 4% per annum = 1% per quarter n = 5 years =…

Q: Assume a continuously compounding dollar interest rate of 5%. If you long a 1-year forward contract…

A: Forward price is the price of the underlying asset which needs to be paid on a predetermined date.…

Step by step

Solved in 2 steps

- Question 4 (a) Consider a 3-year forward contract to buy a coupon-bearing bond thatwill mature 3-years from today. The current price of the bond is $120. Suppose that on that bond 3 coupon payments of $10 are expected after 12, 24, and 36 months. We assume that the 12M, 24M, and 36M risk-free interest rates (continuously compounded) are 1.75%, $2.1, and 2.5% per annum, respectively. Determine the strike price, the forward price and the value of the forward contract.(b) 18 months later, the price of the bond is $105 and the risk-free interest rates for maturity 6M and 18M (continuously compounded) are 1.1% and 1.9% per annum, respectively. What are the strike price, the forward price and the value of the forward contract?D4) The investor plans to invest 2000 UAH and chooses between two investment options: one-year bond that pays 12% upon maturity (one-year bond with payment of 5% after redemption) or a high-yield money market account that pays 1% per month with monthly compounding. Which of the options is more profitable? Confirm with calculations (APY and he amount of earned interest accrued at the end of the period)D6 Finance A stock price is currently $30. During each two-month period for the next four months it is expected to increase by 8% or reduce by 6%. The annual risk-free interest rate is 6%. Use a two-step tree to calculate the value of a derivative that pays off Max[(30-Sr),0]^2 where St is the stock price in four months. If the derivative is American-style, should it be exercised early?

- Q.A $35,000, 5% bond that matures in 10 years has interest payable semiannually. If the quoted price is $36,500, what is the yield rate? Cannot use Excel or a financial calculator. Please show step by step work.V7. A stock price is currently $232. It is known that at the end of seven months itwill be either $260 or $210. The risk-free interest rate is 3.5% per annum with continuouscompounding. hat is the value of a seven-month European put option with a strike priceof $240? Use no-arbitrage arguments.a) You've entered into a long forward. The forward has 1.25 years to expiration. The continuouslycompounded risk-free rate of interest is 3.5%. The forward price is $83.50. The underlying assetprice is $81.70. Show whether the forward contract is your asset or liability. b)Suppose that both a call option and a put option have been written on a stock with an exerciseprice of $40. The current stock price is $42, and the call and put premiums are $3 and $0.75,respectively. Draw fully labelled profit diagrams of a long call and a short put. c)For the same call and put options as in question (a), calculate the profit to positions of both theshort call and the long put with an expiration day stock price of $43.

- Q5. Consider a six-month European put option on a non- dividend-paying stock. The current stock price is $100 and the strike price is $105. The risk-free rate is 10% per annum with semiannual compounding. A lower bound for the price of the European put option is $ _ If the put option were an American put option, a lower bound would be $_ Q6. The price of a European call that expires in six months and has a strike price of $50 is $2. The current underlying stock price is $50, and a dividend of $2 is expected in three months from now. The risk-free interest rate is 10% per annum with quarterly compounding. For the same stock, what is the price of a European put option with the same maturity and strike price? $ Q7. Suppose that c1, c2, and c3 are the prices of European call options on a particular stock with strike prices K1, K2, and K3, respectively, and that p1, p2, and p3 are the prices of European put options on the same stock with strike prices K1, K2, and K3, respectively, where K…Question 7 A. What is the basic difference between a forward contract and a futures contract? How important is this difference in determining the contract prices? B. Is the “forward price” the same thing as the “value of the forward contract” Explain. C. A forward contract exists for a unit of two-year government securities with delivery to take place three years from now. Suppose the price of these securities three years from now is uniformly distributed from a low $800 to a high of $1,400. The one-year expected riskless rate of interest is 5 percent for all periods under consideration. (i). If investors are risk neutral, what should be the current forward price? (ii). Suppose now that investors are risk averse and that the forward price is $1,200. What do you know about the relationship between the market value of two-year government securities and overall consumption? (iii). Continue to assume (as in (ii)) that the current forward price (at time 0) is $1,200. One year from now (at…Assume the Eurodollar futures price at time t0 is 93.83 and the contract expires in 3 months time a. Calculate the 3-month forward rate implied by this price. b. Calculate the repayment amount for bonds with maturities of 3, 6, 9 and 12 months if the investor bought $5 million future contracts. no hand written solution plz

- Question 7 You hold an annual coupon bond for 1 year, receiving the 0.14 coupon before selling. When bought it had 6 years to maturity, and the YTM was 0.095. Over the year, interest rates ROSE by 0.002What is the total holding period return for this investment? Group of answer choices 0.0939 0.0856 0.0903 0.0879 0.0820Problem 2: A one-year-long forward contract on a non-dividend-paying stock is entered into when the stock price is $50 and the risk-free interest rate is 5% per annum (continuous compounding). (a) What are the forward price and the initial value of the forward contract? (b) Six months after the signing of the forward contract, the price of the stock is $55 and the risk-free interest rate is still 5%. What is the new market forward price for the same contract (which will now mature in 6 months)? What is the value of the forward contract signed 6 months ago?H5. callable bonds Given an 8% annual coupon and a conversion price of $100the stock sells at $25, and there is a forced conversion if the value is everequal or greater than $1200,the required rate of return is 12% and the bond runs 20 years a) Calculate the minimum price of the bond b) If the stock grows 15% per year into perpetuity How long will it take to reach/exceed the $1200 threshold Show proper calculation