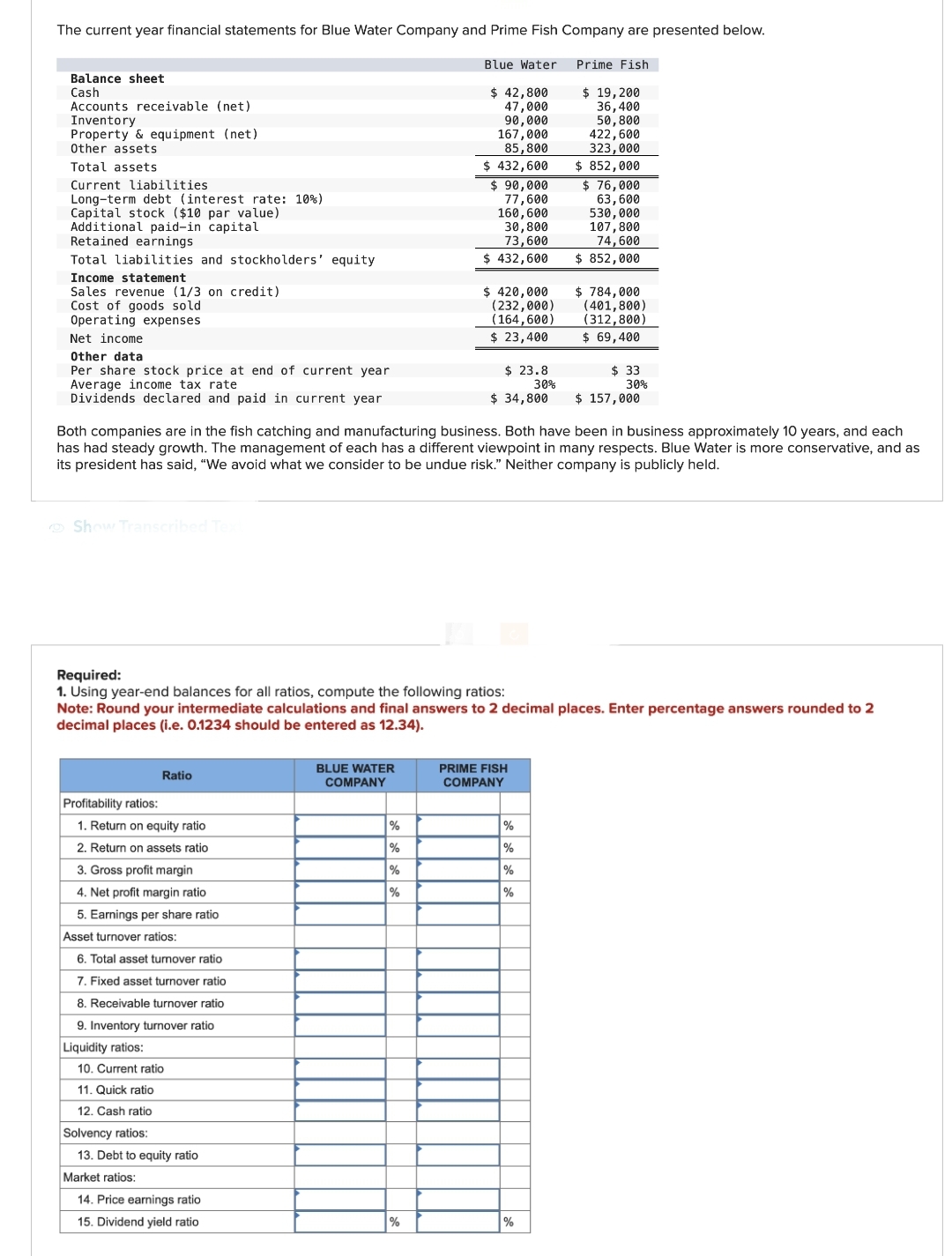

The current year financial statements for Blue Water Company and Prime Fish Company are presented below. Balance sheet Cash Accounts receivable (net) Inventory Property & equipment (net) Other assets Total assets Current liabilities Long-term debt (interest rate: 10 %) Capital stock ($10 par value) Additional paid-in capital Retained earnings Total liabilities and stockholders' equity Income statement Sales revenue (1/3 on credit) Cost of goods sold Operating expenses Net income Other data Per share stock price at end of current year Average income tax rate Dividends declared and paid in current year Blue Water $ 42,800 47,000 90,000 167,000 85,800 $ 432,600 $ 90,000 77,600 160,600 30,800 73,600 $432,600 $ 420,000 (232,000) (164,600) $ 23,400 $23.8 30% $ 34,800 Prime Fish $ 19,200 36,400 50,800 422,600 323,000 $ 852,000 $ 76,000 63,600 530,000 107,800 74,600 $ 852,000 $ 784,000 (401,800) (312,800) $ 69,400 $ 33 30% $ 157,000 Both companies are in the fish catching and manufacturing business. Both have been in business approximately 10 years, and each has had steady growth. The management of each has a different viewpoint in many respects. Blue Water is more conservative, and as ts president has said, "We avoid what we consider to be undue risk." Neither company is publicly held.

The current year financial statements for Blue Water Company and Prime Fish Company are presented below. Balance sheet Cash Accounts receivable (net) Inventory Property & equipment (net) Other assets Total assets Current liabilities Long-term debt (interest rate: 10 %) Capital stock ($10 par value) Additional paid-in capital Retained earnings Total liabilities and stockholders' equity Income statement Sales revenue (1/3 on credit) Cost of goods sold Operating expenses Net income Other data Per share stock price at end of current year Average income tax rate Dividends declared and paid in current year Blue Water $ 42,800 47,000 90,000 167,000 85,800 $ 432,600 $ 90,000 77,600 160,600 30,800 73,600 $432,600 $ 420,000 (232,000) (164,600) $ 23,400 $23.8 30% $ 34,800 Prime Fish $ 19,200 36,400 50,800 422,600 323,000 $ 852,000 $ 76,000 63,600 530,000 107,800 74,600 $ 852,000 $ 784,000 (401,800) (312,800) $ 69,400 $ 33 30% $ 157,000 Both companies are in the fish catching and manufacturing business. Both have been in business approximately 10 years, and each has had steady growth. The management of each has a different viewpoint in many respects. Blue Water is more conservative, and as ts president has said, "We avoid what we consider to be undue risk." Neither company is publicly held.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 20BEA: The income statement, statement of retained earnings, and balance sheet for Somerville Company are...

Related questions

Question

Oo.2.

Subject :- Account

Transcribed Image Text:The current year financial statements for Blue Water Company and Prime Fish Company are presented below.

Balance sheet

Cash

Accounts receivable (net)

Inventory

Property & equipment (net)

Other assets

Total assets

Current liabilities

Long-term debt (interest rate: 10%)

Capital stock ($10 par value)

Additional paid-in capital

Retained earnings

Total liabilities and stockholders' equity

Income statement

Sales revenue (1/3 on credit)

Cost of goods sold.

Operating expenses

Net income

Other data

Per share stock price at end of current year

Average income tax rate

Dividends declared and paid in current year

Show Transcribed Text

Profitability ratios:

1. Return on equity ratio

2. Return on assets ratio

Ratio

3. Gross profit margin

4. Net profit margin ratio

5. Earnings per share ratio

Asset turnover ratios:

6. Total asset turnover ratio

7. Fixed asset turnover ratio

8. Receivable turnover ratio

9. Inventory turnover ratio

Liquidity ratios:

10. Current ratio

11. Quick ratio

12. Cash ratio

Solver ratios:

13. Debt to equity ratio

Market ratios:

14. Price earnings ratio

15. Dividend yield ratio

Both companies are in the fish catching and manufacturing business. Both have been in business approximately 10 years, and each

has had steady growth. The management of each has a different viewpoint in many respects. Blue Water is more conservative, and as

its president has said, "We avoid what we consider to be undue risk." Neither company is publicly held.

BLUE WATER

COMPANY

Blue Water

$ 42,800

47,000

90,000

167,000

85,800

$ 432,600

%

%

%

%

$ 90,000

77,600

160,600

30,800

73,600

$ 432,600

Required:

1. Using year-end balances for all ratios, compute the following ratios:

Note: Round your intermediate calculations and final answers to 2 decimal places. Enter percentage answers rounded to 2

decimal places (i.e. 0.1234 should be entered as 12.34).

%

$ 420,000

(232,000)

(164,600)

$ 23,400

$23.8

30%

$ 34,800

PRIME FISH

COMPANY

Prime Fish

$ 19, 200

36,400

50,800

422, 600

323,000

$ 852,000

%

%

%

%

$ 76,000

63,600

530,000

107,800

74,600

$ 852,000

%

$ 784,000

(401,800)

(312,800)

$ 69,400

$ 33

30%

$ 157,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning