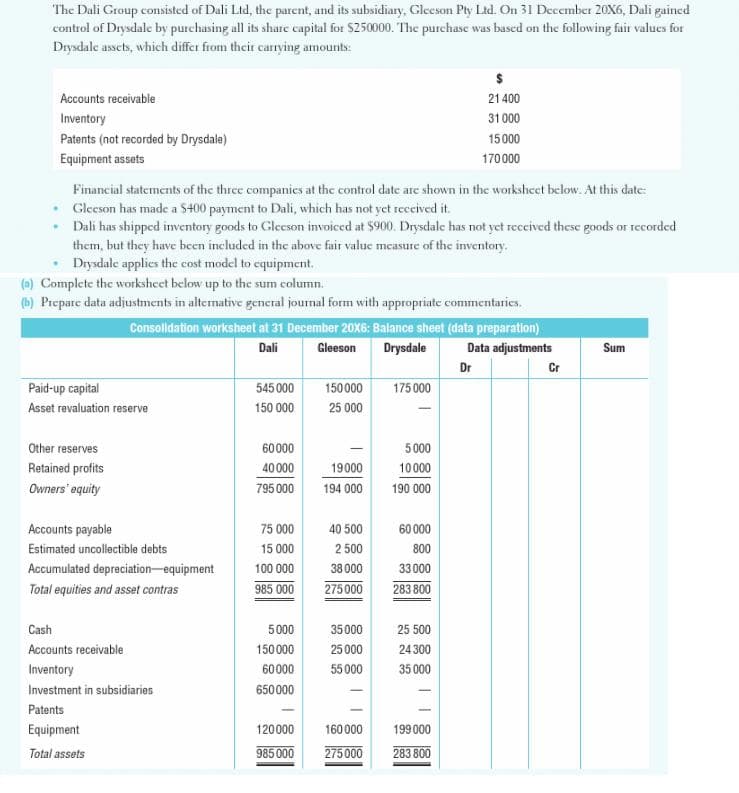

The Dali Group consisted of Dali Ltd, the parent, and its subsidiary, Gleeson Pty Ltd. On 31 December 20X6, Dali gained control of Drysdale by purchasing all its share capital for $250000. The purchase was based on the following fair values for Drysdale assebs, which differ from their carrying amounts:

The Dali Group consisted of Dali Ltd, the parent, and its subsidiary, Gleeson Pty Ltd. On 31 December 20X6, Dali gained control of Drysdale by purchasing all its share capital for $250000. The purchase was based on the following fair values for Drysdale assebs, which differ from their carrying amounts:

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 35P

Related questions

Question

Transcribed Image Text:The Dali Group consisted of Dali Ltd, the parent, and its subsidiary, Gleeson Pty Ltd. On 31 December 20X6, Dali gaincd

control of Drysdale by purchasing all its share capital for $250000. The purchase was based on the following fair values for

Drysdale assets, which differ from their carrying amounts:

Accounts receivable

21 400

Inventory

31000

Patents (not recorded by Drysdale)

15000

Equipment assets

170000

Financial statements of the three companics at the control date are shown in the workshecet below. At this date:

• Gleeson has made a $400 payment to Dali, which has not yet reccived it.

• Dali has shipped inventory goods to Gleeson invoiced at $900. Drysdale has not yet recived these goods or recorded

them, but they have been included in the above fair value measure of the inventory.

Drysdale applies the cost model to equipment.

(e) Complete the worksheet below up to the sum column.

(b) Prepare data adjustments in alternative general journal form with appropriate commentaries.

Consolidation worksheet at 31 December 20X6: Balance sheet (data preparation)

Data adjustments

Dali

Gleeson

Drysdale

Sum

Dr

Cr

Paid-up capital

545 000

150000

175 000

Asset revaluation reserve

150 000

25 000

Other reserves

60000

5 000

Retained profits

40000

19000

10000

Owners' equity

795 000

194 000

190 000

Accounts payable

75 000

40 500

60 000

Estimated uncollectible debts

15 000

2 500

800

Accumulated depreciation-equipment

100 000

38 000

33 000

Total equities and asset contras

985 000

275000

283 800

Cash

5000

35000

25 500

Accounts receivable

150 000

25 000

24 300

Inventory

60000

55 000

35 000

Investment in subsidiaries

650000

Patents

160 000

275 000

Equipment

120000

199000

Total assets

985 000

283 800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you