The data in the accompanying table represent the total rates of return (in percentages) for three stock exchanges over the four-year period from 2009 to 2012. Calculate the geometric mean rate of return for each of the three stock exchanges. Click the icon to view data table for total rate of return for stock market indices. i Click the icon to view data table for total rate of return for platinum, gold, and silver. a. Compute the geometric mean rate of return per year for the stock indices from 2009 through 2012.

The data in the accompanying table represent the total rates of return (in percentages) for three stock exchanges over the four-year period from 2009 to 2012. Calculate the geometric mean rate of return for each of the three stock exchanges. Click the icon to view data table for total rate of return for stock market indices. i Click the icon to view data table for total rate of return for platinum, gold, and silver. a. Compute the geometric mean rate of return per year for the stock indices from 2009 through 2012.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.3: Measures Of Spread

Problem 8PPS

Related questions

Question

100%

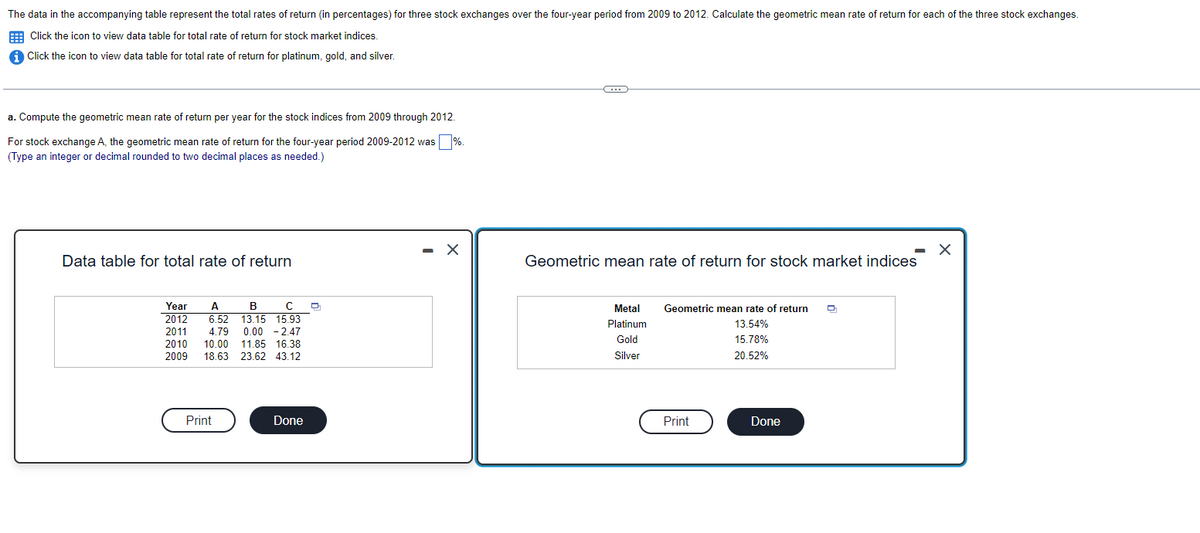

Transcribed Image Text:The data in the accompanying table represent the total rates of return (in percentages) for three stock exchanges over the four-year period from 2009 to 2012. Calculate the geometric mean rate of return for each of the three stock exchanges.

Click the icon to view data table for total rate of return for stock market indices.

Click the icon to view data table for total rate of return for platinum, gold, and silver.

a. Compute the geometric mean rate of return per year for the stock indices from 2009 through 2012.

For stock exchange A, the geometric mean rate of return for the four-year period 2009-2012 was %.

(Type an integer or decimal rounded to two decimal places as needed.)

Data table for total rate of return

Year A B C

2012 6.52 13.15 15.93

2011 4.79 0.00 -2.47

2010 10.00 11.85 16.38

2009 18.63 23.62 43.12

Print

Done

- X

C

Geometric mean rate of return for stock market indices

Metal

Platinum

Gold

Silver

Geometric mean rate of return D

13.54%

15.78%

20.52%

Print

Done

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 16 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt