The data needed to determine adjustments are as follows: a. During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3, 2014, transaction at the end of Chapter 3. b. Supplies on hand at July 31 is $275. c. The balance of the prepaid insurance account relates to the July 1, 2014 transaction at the end of Chapter 3. d. Depreciation of the office equipment is $50. e The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3, 2014 transaction at the end of Chapter 3. f. Accrued wages as of July 31, 2014, were $140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated Depreciation-Office Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense

The data needed to determine adjustments are as follows: a. During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3, 2014, transaction at the end of Chapter 3. b. Supplies on hand at July 31 is $275. c. The balance of the prepaid insurance account relates to the July 1, 2014 transaction at the end of Chapter 3. d. Depreciation of the office equipment is $50. e The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3, 2014 transaction at the end of Chapter 3. f. Accrued wages as of July 31, 2014, were $140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated Depreciation-Office Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.23E: Adjustment for depreciation The estimated amount of depredation on equipment for the current year is...

Related questions

Question

Please huhuhu

Transcribed Image Text:Unbilled

b. Depreci

С.

c. Accrue

d. Supplie

Instructio

1. Journal

2. Determi

owner's

each omi

Adjustme

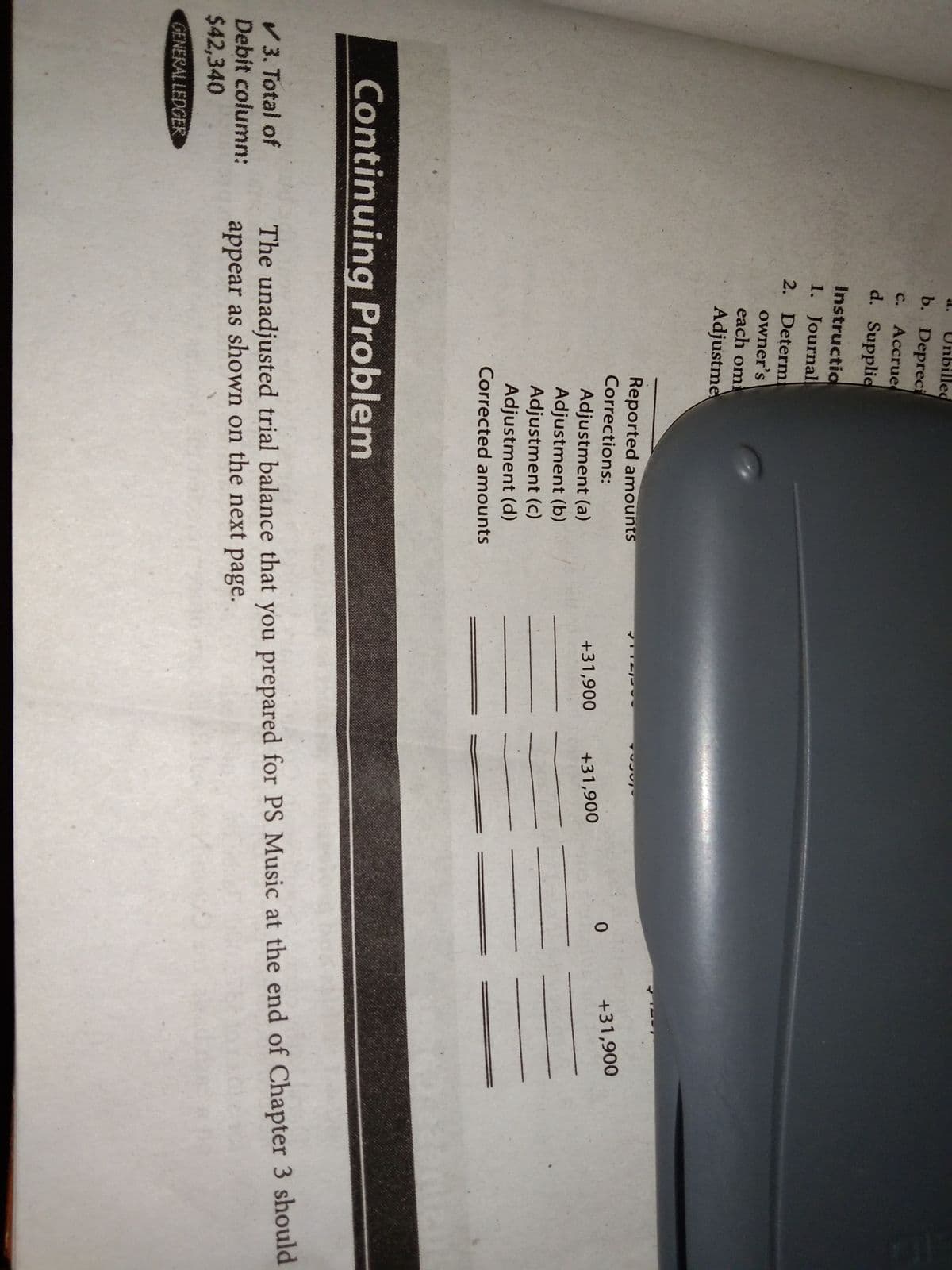

Reported amounts

Corrections:

0.

+31,900

+31,900

+31,900

Adjustment (a)

Adjustment (b)

Adjustment (c)

Adjustment (d)

Corrected amounts

Continuing Problem

V3. Total of

Debit column:

$42,340

The unadjusted trial balance that you prepared for PS Music at the end of Chapter 3 should

appear as shown on the next page.

GENERAL LEDGER

Transcribed Image Text:2. Post the adjusting entries, inserting balances in the accounts affected.

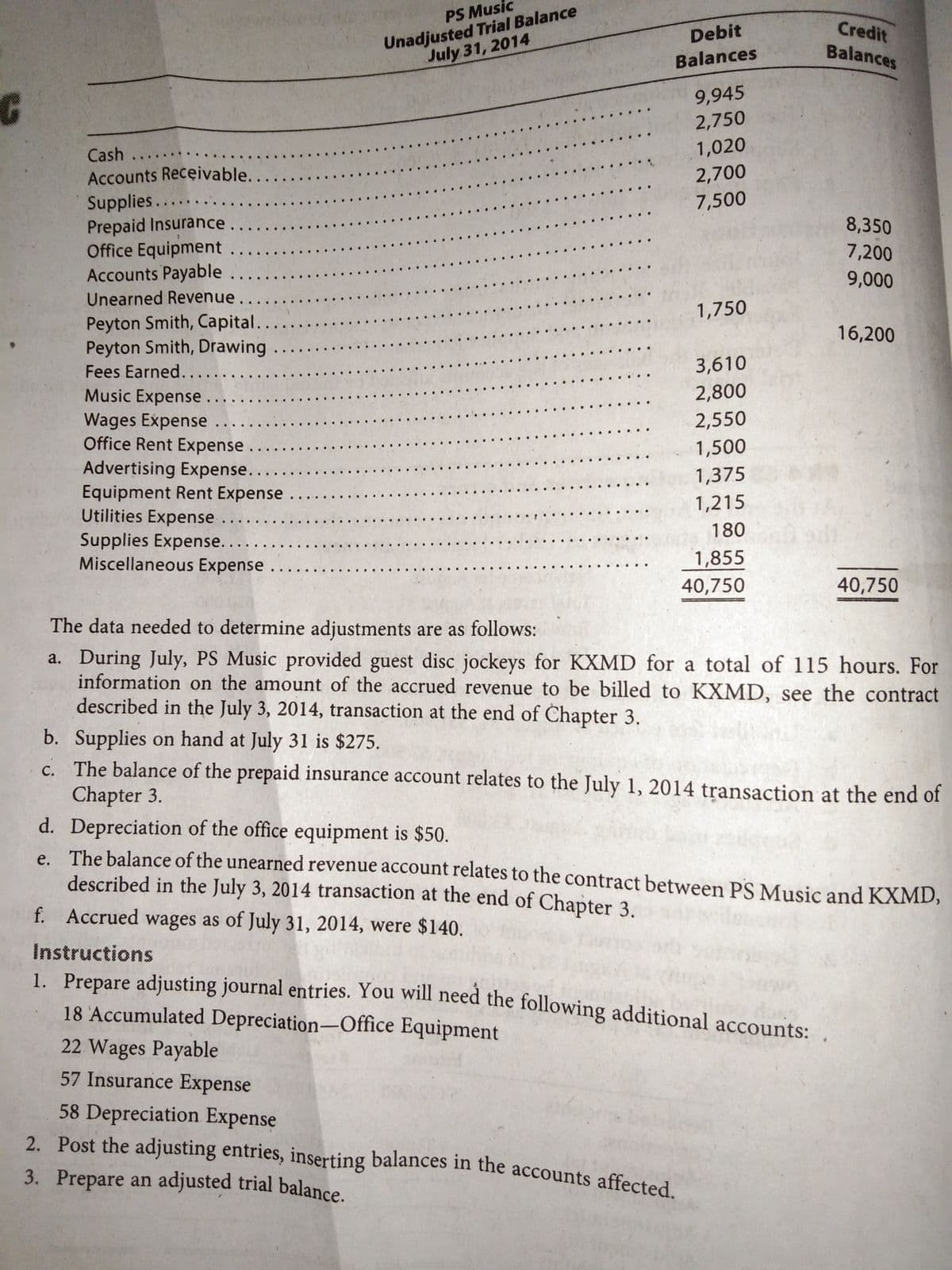

Unadjusted Trial Balance

July 31, 2014

PS Music

Credit

Debit

Balances

Balances

9,945

2,750

Cash ...

1,020

Accounts Receivable.

2,700

Supplies.....

Prepaid Insurance.....

Office Equipment ....

Accounts Payable ......

Unearned Revenue.

7,500

8,350

7,200

9,000

1,750

Peyton Smith, Capital.....

Peyton Smith, Drawing ..

16,200

Fees Earned..

3,610

Music Expense.

2,800

2,550

Wages Expense

Office Rent Expense .

1,500

Advertising Expense..

Equipment Rent Expense.

Utilities Expense ...

Supplies Expense....

Miscellaneous Expense.

1,375

1,215

180

1,855

40,750

40,750

The data needed to determine adjustments are as follows:

a. During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For

information on the amount of the accrued revenue to be billed to KXMD, see the contract

described in the July 3, 2014, transaction at the end of Chapter 3.

b. Supplies on hand at July 31 is $275.

c. The balance of the prepaid insurance account relates to the July 1, 2014 transaction at the end of

Chapter 3.

d. Depreciation of the office equipment is $50.

e The balance of the unearned revenue account relates to the contract between PS Music and KXMD,

described in the July 3, 2014 transaction at the end of Chapter 3.

f. Accrued wages as of July 31, 2014, were $140.

Instructions

1. Prepare adjusting journal entries. You will need the following additional accounts:

18 Accumulated Depreciation-Office Equipment

22 Wages Payable

57 Insurance Expense

58 Depreciation Expense

2. Post the adjusting entries, inserting balances in the accounts affected

3. Prepare an adjusted trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning