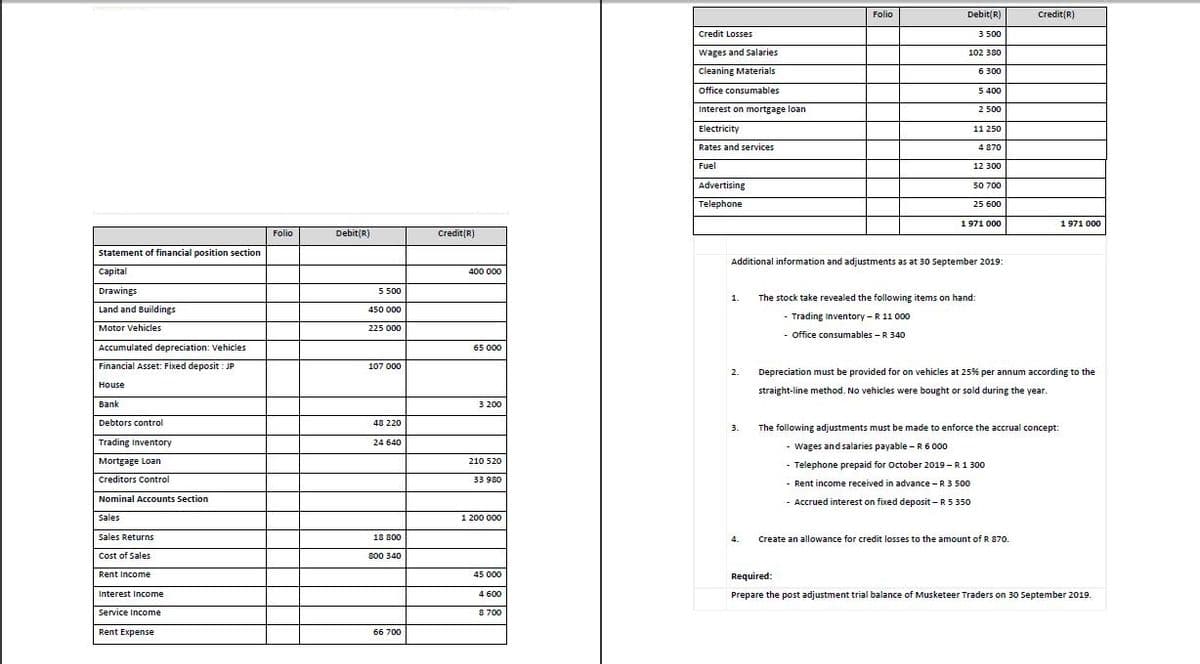

The following pre‐adjustment trial balance appeared in the books of Musketeer Traders at the end of their financial year 30 September 2019. Ignore VAT. Folio Debit(R) Credit(R) Statement of financial position section Capital 400 000 Drawings 5 500 Land and Buildings 450 000 Motor Vehicles 225 000 Accumulated depreciation: Vehicles 65 000 Financial Asset: Fixed deposit : JP House 107 000 Bank 3 200 Debtors control 48 220 Trading Inventory 24 640 Mortgage Loan 210 520 Creditors Control 33 980 Nominal Accounts Section Sales 1 200 000 Sales Returns 18 800 Cost of Sales 800 340 Rent Income 45 000 Interest Income 4 600 Service Income 8 700 Rent Expense 66 700 Folio Debit(R) Credit(R) Credit Losses 3 500 Wages and Salaries 102 380 Cleaning Materials 6 300 Office consumables 5 400 Interest on mortgage loan 2 500 Electricity 11 250 Rates and services 4 870 Fuel 12 300 Advertising 50 700 Telephone 25 600 1 971 000 1 971 000 Additional information and adjustments as at 30 September 2019: 1. The stock take revealed the following items on hand: ‐ Trading Inventory – R 11 000 ‐ Office consumables – R 340 2. Depreciation must be provided for on vehicles at 25% per annum according to the straight‐line method. No vehicles were bought or sold during the year. 3. The following adjustments must be made to enforce the accrual concept: ‐ Wages and salaries payable – R 6 000 ‐ Telephone prepaid for October 2019 – R 1 300 ‐ Rent income received in advance – R 3 500 ‐ Accrued interest on fixed deposit – R 5 350 4. Create an allowance for credit losses to the amount of R 870. Required: Prepare the post adjustment trial balance of Musketeer Traders on 30 September 2019.

The following pre‐adjustment

Traders at the end of their financial year 30 September 2019. Ignore VAT.

Folio Debit(R) Credit(R)

Capital 400 000

Drawings 5 500

Land and Buildings 450 000

Motor Vehicles 225 000

Financial Asset: Fixed deposit : JP

House

107 000

Bank 3 200

Debtors control 48 220

Trading Inventory 24 640

Mortgage Loan 210 520

Creditors Control 33 980

Nominal Accounts Section

Sales 1 200 000

Sales Returns 18 800

Cost of Sales 800 340

Rent Income 45 000

Interest Income 4 600

Service Income 8 700

Rent Expense 66 700

Folio Debit(R) Credit(R)

Credit Losses 3 500

Wages and Salaries 102 380

Cleaning Materials 6 300

Office consumables 5 400

Interest on mortgage loan 2 500

Electricity 11 250

Rates and services 4 870

Fuel 12 300

Advertising 50 700

Telephone 25 600

1 971 000 1 971 000

Additional information and adjustments as at 30 September 2019:

1. The stock take revealed the following items on hand:

‐ Trading Inventory – R 11 000

‐ Office consumables – R 340

2. Depreciation must be provided for on vehicles at 25% per annum according to the

straight‐line method. No vehicles were bought or sold during the year.

3. The following adjustments must be made to enforce the accrual concept:

‐ Wages and salaries payable – R 6 000

‐ Telephone prepaid for October 2019 – R 1 300

‐ Rent income received in advance – R 3 500

‐ Accrued interest on fixed deposit – R 5 350

4. Create an allowance for credit losses to the amount of R 870.

Required:

Prepare the post adjustment trial balance of Musketeer Traders on 30 September 2019.

Step by step

Solved in 2 steps with 3 images