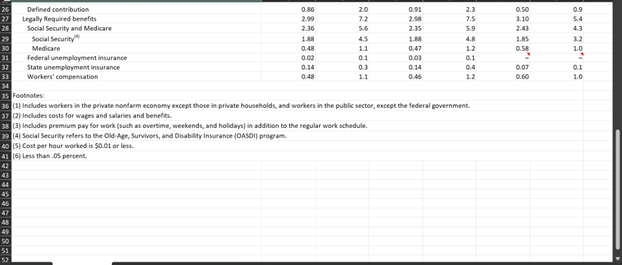

The data you will focus on is for Wages and Salaries (row 8), Paid Leave (row 10), Life Insurance (row 20), Health Insurance (row21), Short-term and Long-term Disability Insurance (rows 22 and 23, respectively), and Retirement and Savings (row 24). These numbers represent the cost per hour worked to the employer for providing workers with particular benefits and are for the third quarter of 2022. For example, the average employer’s cost per hour worked for base wages and salaries equals $28.88 in the third quarter of 2022. It costs employers $3.10 per hour to provide workers with paid leave, etc. Questions: 1. What is the total compensation per hour employers provide to their workers? For this, add up all of the components selected as instructed in the previous paragraph. Do not use the total provided in row 7 of the spreadsheet. 2. Using your answer to question 1, what is the percentage of the total that comes from wages, and what percentage comes from total non-wage benefits? 3. Using your answer to question 1, what is each benefit’s percentage of total compensation? Do these numbers surprise you? Explain why or why not. 4. Would you prefer that the government provide these benefits by instituting a payroll tax on firms and using the tax revenue for the benefits’ provision? Explain why or why not. 5. Draw a graph of the national labor market before employers provide t

The data you will focus on is for Wages and Salaries (row 8), Paid Leave (row 10), Life Insurance (row 20), Health Insurance (row21), Short-term and Long-term Disability Insurance (rows 22 and 23, respectively), and Retirement and Savings (row 24). These numbers represent the cost per hour worked to the employer for providing workers with particular benefits and are for the third quarter of 2022. For example, the average employer’s cost per hour worked for base wages and salaries equals $28.88 in the third quarter of 2022. It costs employers $3.10 per hour to provide workers with paid leave, etc. Questions: 1. What is the total compensation per hour employers provide to their workers? For this, add up all of the components selected as instructed in the previous paragraph. Do not use the total provided in row 7 of the spreadsheet. 2. Using your answer to question 1, what is the percentage of the total that comes from wages, and what percentage comes from total non-wage benefits? 3. Using your answer to question 1, what is each benefit’s percentage of total compensation? Do these numbers surprise you? Explain why or why not. 4. Would you prefer that the government provide these benefits by instituting a payroll tax on firms and using the tax revenue for the benefits’ provision? Explain why or why not. 5. Draw a graph of the national labor market before employers provide t

Chapter12: Labor Markets And Labor Unions

Section: Chapter Questions

Problem 1.3P

Related questions

Question

100%

The data you will focus on is for Wages and Salaries

(row 8), Paid Leave (row 10), Life Insurance (row 20), Health Insurance (row21), Short-term and

Long-term Disability Insurance (rows 22 and 23, respectively), and Retirement and Savings (row

24). These numbers represent the cost per hour worked to the employer for providing workers

with particular benefits and are for the third quarter of 2022. For example, the average

employer’s cost per hour worked for base wages and salaries equals $28.88 in the third quarter of

2022. It costs employers $3.10 per hour to provide workers with paid leave, etc.

Questions:

1. What is the total compensation per hour employers provide to their workers? For this,

add up all of the components selected as instructed in the previous paragraph. Do not use

the total provided in row 7 of the spreadsheet.

2. Using your answer to question 1, what is the percentage of the total that comes from

wages, and what percentage comes from total non-wage benefits?

3. Using your answer to question 1, what is each benefit’s percentage of total

compensation? Do these numbers surprise you? Explain why or why not.

(row 8), Paid Leave (row 10), Life Insurance (row 20), Health Insurance (row21), Short-term and

Long-term Disability Insurance (rows 22 and 23, respectively), and Retirement and Savings (row

24). These numbers represent the cost per hour worked to the employer for providing workers

with particular benefits and are for the third quarter of 2022. For example, the average

employer’s cost per hour worked for base wages and salaries equals $28.88 in the third quarter of

2022. It costs employers $3.10 per hour to provide workers with paid leave, etc.

Questions:

1. What is the total compensation per hour employers provide to their workers? For this,

add up all of the components selected as instructed in the previous paragraph. Do not use

the total provided in row 7 of the spreadsheet.

2. Using your answer to question 1, what is the percentage of the total that comes from

wages, and what percentage comes from total non-wage benefits?

3. Using your answer to question 1, what is each benefit’s percentage of total

compensation? Do these numbers surprise you? Explain why or why not.

4. Would you prefer that the government provide these benefits by instituting a payroll tax

on firms and using the tax revenue for the benefits’ provision? Explain why or why not.

5. Draw a graph of the national labor market before employers provide these benefits to

workers. Add to this graph the changes in supply and demand that would be necessary

for this market to experience no inefficiencies. Make sure to label everything using exact

numbers when appropriate.

6. Major portions of the Patient Protection and Affordable Care Act became effective in

2014. Specifically, the Law required employers that meet particular employment

thresholds to provide health insurance to their employees. Explain how you think this

law affected the total compensation numbers calculated in questions 1, 2, and 3.

on firms and using the tax revenue for the benefits’ provision? Explain why or why not.

5. Draw a graph of the national labor market before employers provide these benefits to

workers. Add to this graph the changes in supply and demand that would be necessary

for this market to experience no inefficiencies. Make sure to label everything using exact

numbers when appropriate.

6. Major portions of the Patient Protection and Affordable Care Act became effective in

2014. Specifically, the Law required employers that meet particular employment

thresholds to provide health insurance to their employees. Explain how you think this

law affected the total compensation numbers calculated in questions 1, 2, and 3.

![|||||

Table 1. Employer Costs for Employee Compensation by ownership

2 (Sept. 2022]

10

11

12

13

17

18

19

20

Personal

15

Supplemental pay

16 Overtime and premium

Shift differentials

Nonproduction bonuses

Insurance

Life

Health

Short-term disability

Long-term disability

Retirement and savings

Defined benefit

21

22

Total compensation

Wages and salaries

Total benefits

Paid leave

24

25

Vacation

Holiday

Sick

Compensation component

Civilian workers

Cost (5)

41.86

28.88

12.98

3.10

1.52

0.92

0.49

0.18

1.30

0.36

0.07

0.87

3.46

0.05

3.28

0.08

0.05

2.13

1.27

Percent of

compensation

100.0

69.0

31.0

7.4

3.6

2.2

1.2

0.4

3.1

0.8

0.2

2.1

8.3

0.1

7.8

0.2

0.1

5.1

3.0

Private industry

workers

Cost (5)

39.61

27.93

11.68

2.94

1.51

0.88

0.40

0.16

1.41

0.37

0.07

0.96

3.00

0.04

2.83

0.08

0.05

1.35

0.44

Percent of

compensation

100.0

70.5

29.5

7.4

3.8

2.2

1.0

0.4

3.6

0.9

0.2

2.4

7.6

0.1

7.1

0.2

0.1

3.4

State and local

government workers

Cost (5)

57.02

35.29

21.73

4.20

1.59

1.20

1.08

0.34

0.57

0.25

0.05

0.26

6.52

0.08

6.35

0.03

0.05

7.34

6.85

Percent of

compensation

100.0

61.9

38.1

7.4

2.8

2.1

1.9

0.6

1.0

0.4

0.1

0.5

11.4

0.1

11.1

0.1

0.1

12.9

12.0](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Ff8d3483e-da63-479d-961b-e8a1bdf58ac4%2F2ffbe8f6-f30a-45f2-a2ea-6eaad2217684%2Fxjtqleo_processed.png&w=3840&q=75)

Transcribed Image Text:|||||

Table 1. Employer Costs for Employee Compensation by ownership

2 (Sept. 2022]

10

11

12

13

17

18

19

20

Personal

15

Supplemental pay

16 Overtime and premium

Shift differentials

Nonproduction bonuses

Insurance

Life

Health

Short-term disability

Long-term disability

Retirement and savings

Defined benefit

21

22

Total compensation

Wages and salaries

Total benefits

Paid leave

24

25

Vacation

Holiday

Sick

Compensation component

Civilian workers

Cost (5)

41.86

28.88

12.98

3.10

1.52

0.92

0.49

0.18

1.30

0.36

0.07

0.87

3.46

0.05

3.28

0.08

0.05

2.13

1.27

Percent of

compensation

100.0

69.0

31.0

7.4

3.6

2.2

1.2

0.4

3.1

0.8

0.2

2.1

8.3

0.1

7.8

0.2

0.1

5.1

3.0

Private industry

workers

Cost (5)

39.61

27.93

11.68

2.94

1.51

0.88

0.40

0.16

1.41

0.37

0.07

0.96

3.00

0.04

2.83

0.08

0.05

1.35

0.44

Percent of

compensation

100.0

70.5

29.5

7.4

3.8

2.2

1.0

0.4

3.6

0.9

0.2

2.4

7.6

0.1

7.1

0.2

0.1

3.4

State and local

government workers

Cost (5)

57.02

35.29

21.73

4.20

1.59

1.20

1.08

0.34

0.57

0.25

0.05

0.26

6.52

0.08

6.35

0.03

0.05

7.34

6.85

Percent of

compensation

100.0

61.9

38.1

7.4

2.8

2.1

1.9

0.6

1.0

0.4

0.1

0.5

11.4

0.1

11.1

0.1

0.1

12.9

12.0

Transcribed Image Text:27

28

29

30

31 Federal unemployment insurance

32

State unemployment insurance

33 Workers' compensation

34

44

45

*28585&S

46

47

48

Defined contribution

Legally Required benefits

Social Security and Medicare

Social Security

Medicare

49

50

51

0.86

2.99

2.36

1.88

0.48

0.02

0.14

0.48

2.0

7.2

5.6

4.5

1.1

0.1

0.3

1.1

0.91

2.98

2.35

0.47

0.03

0.14

0.46

2.3

ERREECCE

35 Footnotes:

36 (1) Includes workers in the private nonfarm economy except those in private households, and workers in the public sector, except the federal government.

37 (2) Includes costs for wages and salaries and benefits.

38 (3) Includes premium pay for work (such as overtime, weekends, and holidays) in addition to the regular work schedule.

39 (4) Social Security refers to the Old-Age, Survivors, and Disability Insurance (OASDI) program

40 (5) Cost per hour worked is $0.01 or less.

41 (6) Less than .05 percent.

7.5

5.9

4.8

1.2

0.1

0.4

1.2

0.50

3.10

2.43

1.85

0.58

0.07

0.60

0.9

5.4

4.3

3.2

1.0

0.1

1.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you